Yoon Donghan Files Lawsuit Against Vice Chairman Yoon Sanghyun for Return of Shares

Yoon Sanghyun's Side: "Not a Conditional Gift...Agreement Details Are Different"

Yoon Yeowon’s Side: "Context of Agreement Matters, Everything Will Be Revealed in Court"

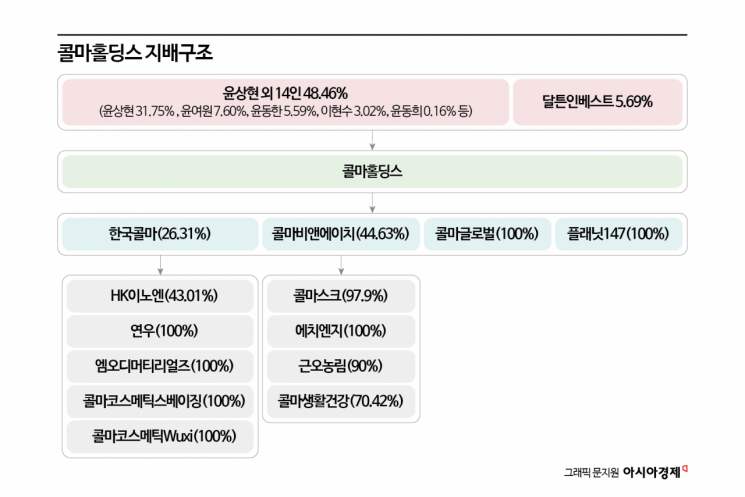

The management rights dispute between the second-generation heirs of Kolmar Group has escalated into a legal battle. Yoon Donghan, founder and Chairman of Korea Kolmar, has filed a lawsuit to reclaim shares he had gifted to his eldest son, citing a "breach of management agreement" after aligning with his eldest daughter. If the father and daughter win this lawsuit, they could become the largest shareholders of Kolmar Holdings, the group's holding company, making a change in control possible. However, the eldest son does not acknowledge the management agreement, citing the "gift contract" he signed with his father, turning the dispute over management rights into a battle of truth.

According to industry sources on June 19, Sanghyun Yoon, Vice Chairman of Kolmar Holdings and the eldest son, received the complaint for the share return lawsuit filed by Chairman Yoon Donghan the previous day. Previously, on May 30, Chairman Yoon had filed a share return lawsuit against Vice Chairman Yoon at the Seoul Central District Court, as stated by Yeowon Yoon, CEO of Kolmar BNH and the chairman’s eldest daughter.

This lawsuit began after Kolmar Holdings, led by the eldest son, demanded an extraordinary shareholders’ meeting on May 2 to replace the board of Kolmar BNH. Chairman Yoon reportedly filed the lawsuit on the grounds that Vice Chairman Yoon’s attempt to dismiss his younger sister, CEO Yoon, constituted a breach of the "three-party management agreement" signed in September 2018 between Chairman Yoon and his two children regarding the group's governance structure.

According to Kolmar BNH, the management agreement stipulated that "Vice Chairman Yoon would be responsible for operating the group through Kolmar Holdings and Korea Kolmar, and as a shareholder and executive of Kolmar Holdings, he must, within legal boundaries, support and cooperate to ensure that CEO Yoon can exercise independent and autonomous management rights over Kolmar BNH, which operates the health and functional foods business."

In contrast, Vice Chairman Yoon’s side argues that the three-party management agreement was drafted when Chairman Yoon gifted Kolmar BNH shares to CEO Yoon in August 2018, and that the subsequent transfer of Kolmar Holdings shares to Vice Chairman Yoon the following year was not a "conditional gift" based on this management agreement.

In 2019, after public criticism arose over Chairman Yoon screening a controversial video by a conservative YouTuber at a Korea Kolmar monthly meeting, he stepped down from management and gifted 2.3 million Kolmar Holdings shares (now 4.6 million shares, or 12.82%, due to a bonus issue) to Vice Chairman Yoon. A Kolmar Holdings representative stated, "The share transfer was for management stability and unrelated to the previously signed three-party management agreement," adding, "There is a separate share transfer contract, and the claim that the management agreement included a commitment to support Kolmar BNH’s independent management is not true."

However, Kolmar BNH issued a rebuttal, stating, "It was indeed a conditional gift, and the details will be clarified in court," further arguing, "Although the phrase guaranteeing independent and autonomous management rights is not explicitly stated, the context shows that Kolmar Holdings breached the agreement."

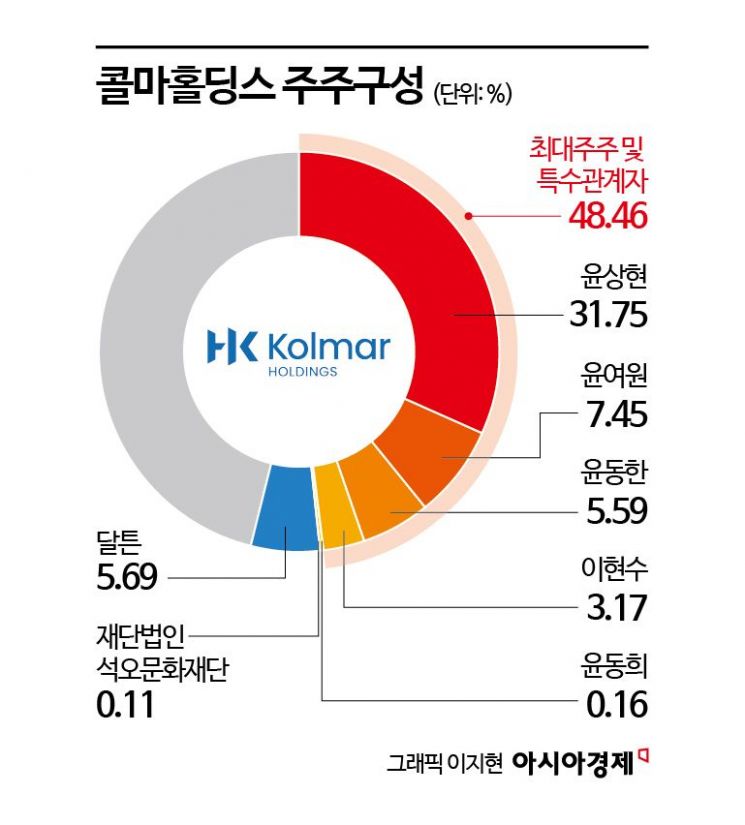

Currently, Kolmar Holdings’ largest shareholder is Vice Chairman Yoon with 31.75%, followed by CEO Yoon with 7.6%, Chairman Yoon with 5.99%, Dalton Invest with 5.69%, CEO Yoon’s husband Hyunsoo Lee with 3.02%, Vice Chairman Yoon’s eldest son Donghee Yoon with 0.16%, the Seokoh Cultural Foundation with 0.11%, and CEO Yoon’s sons Minseok Lee and Youngseok Lee with 0.06% each.

If Chairman Yoon wins the share return lawsuit, the gap in shareholding among the family will narrow, potentially affecting control over the entire Kolmar Group. Dalton Invest, the second-largest shareholder, is considered an ally of Vice Chairman Yoon. Currently, Vice Chairman Yoon’s allied shares amount to 37.6%, but if the shares are returned, his side’s stake would drop to 24.61%, while the father-daughter alliance’s share would rise to 29.6%, reversing the balance. The votes of minority shareholders, who hold about 38%, are expected to be decisive.

As a result, Kolmar Holdings’ stock price surged over 29% to hit the upper limit the previous day, and continued to post double-digit gains in early trading today.

Meanwhile, the previous day at the Daejeon District Court, a hearing was held on Kolmar Holdings’ request to convene an extraordinary shareholders’ meeting for Kolmar BNH. As the starting point of this dispute, Vice Chairman Yoon applied for permission to convene an extraordinary shareholders’ meeting to appoint himself and Seunghwa Lee, former Vice President of CJ CheilJedang, as new inside directors. The reason cited was the need to replace management due to Kolmar BNH’s prolonged poor performance and stagnant stock price.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.