Where Has the Past Glory Gone... Overseas Orders Plunge Amid Geopolitical Risks

"Iran, the Golden Goose," Now Faces Uncertainty as Military Conflict Escalates

China Surges, Middle East Closes... Korean Builders in a Dire Predicament

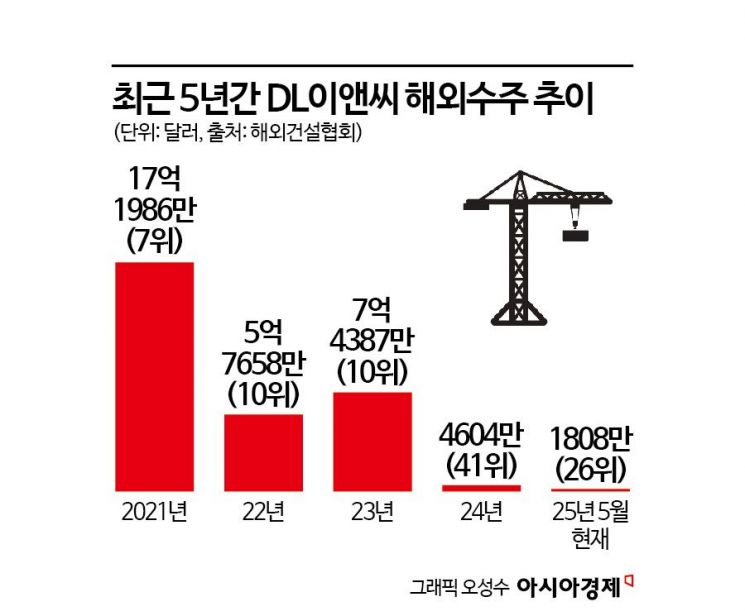

DL E&C's slump in overseas construction orders is turning into a prolonged challenge. Last year, the company relied solely on contract amendments and increases, without securing a single new order. This year, both the total value of overseas orders and the number of new contracts have each remained at only several tens of billions of won and just one new project, respectively. DL E&C, which once maintained a 'top 10' position in order volume by sweeping up multibillion-won projects in the Middle East, including Iran, has long since fallen out of the top ranks. In particular, the possibility of resuming orders in Iran?which was once a 'golden goose' market?has become even more uncertain recently, as the country faces escalating conflict with Israel.

The South Pars gas field in Iran, which was the world's largest gas field development project at the time of construction. DL E&C, GS Construction, Hyundai Construction, and Hyundai Engineering participated in this project. Ministry of Land, Infrastructure and Transport.

The South Pars gas field in Iran, which was the world's largest gas field development project at the time of construction. DL E&C, GS Construction, Hyundai Construction, and Hyundai Engineering participated in this project. Ministry of Land, Infrastructure and Transport.

According to the International Contractors Association of Korea on June 19, DL E&C's overseas construction orders from January to May amounted to only $18.08 million (about 25 billion won), ranking 26th among all construction companies. The only new contract is a $15 million construction management (CM) project for a hydropower plant in Indonesia. Last year, without any new orders, the company recorded $46.04 million (about 63 billion won) solely through contract increases and amendments, ranking 41st overall.

The gap is significant compared to the company’s past performance, when it was consistently among the top 10. Since overseas construction orders have been tracked, DL E&C has accumulated $4.79 billion in orders (as of last year), ranking sixth overall. However, due to the recent two-year slump, its presence is rapidly diminishing.

The reasons for DL E&C’s slump are its profit-focused selective order strategy and geopolitical risks. Iran and Russia, which were once its main overseas markets, are now both effectively 'blocked.' Iran was the first market DL E&C entered among Korean construction companies, right after diplomatic ties were established in 1962. The company secured 22 projects there, including the world’s largest gas field, the South Pars gas field, with total cumulative construction costs reaching about $5.4 billion. Even in Iran, DL E&C was recognized as the Korean construction company with the best local expertise. However, as international sanctions against Iran intensified, new orders have dried up since 2017, and the recent military conflict between Iran and Israel has made the outlook for resuming business even bleaker.

DL E&C still considers Iran a 'strategic market to which it could eventually return.' It is also the only Korean construction company that continues to operate a local office in Iran. A DL E&C representative stated, "The one employee who had been stationed in Iran has now been safely evacuated," adding, "We have maintained a strong relationship of trust with Iran, so if the situation turns around and the market reopens, we will be better positioned than anyone else."

The situation in Russia is not much different. DL E&C has been present in Russia since 2014 and is currently working on part of the 'Baltic Complex Project,' which is worth about 2 trillion won. However, following the war with Ukraine, international sanctions against Russia have intensified, causing construction delays and other impacts. Unless the war ends, it will remain difficult for the company to expand its business in Russia.

The slump in overseas orders is gradually being reflected in DL E&C’s performance. Last year, the company’s overseas sales amounted to 1.1859 trillion won, a 10.4% decrease from 2023 (1.3238 trillion won). The share of overseas sales in total revenue also fell from 16.6% to 14.3%.

DL E&C is seeking a breakthrough by entering markets outside the Middle East. In March, the company signed a contract worth about $15 million to participate in a hydropower plant construction management project in Indonesia. It is also attempting to enter the small modular reactor (SMR) market by investing in shares of the U.S. nuclear company X-energy. However, these projects are still in the early stages, so it will take time before they contribute to the company’s financial results.

Meanwhile, this year, the Korean construction industry as a whole has been struggling overseas. According to the International Contractors Association of Korea, the total value of overseas orders for January to May this year was $11.6 billion, a 14.7% decrease from the same period last year ($13.6 billion). In particular, orders from the Middle East?traditionally a stronghold for Korean companies?plunged by 43.5%. This is attributed to both the economic slowdown in the Middle East and the aggressive entry of Chinese construction companies. Last year, Chinese firms secured $90 billion in orders in the Middle East and North Africa alone, far outpacing Korean companies. Industry observers note that if this trend continues, it will be difficult to achieve the government’s overseas order target of $50 billion for this year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.