Bank of Korea: "Economic Impact of Housing Price Polarization"

Housing Price Polarization Widens Perceived Housing Cost Gap

Seoul: 2.29 Million Won vs Jeollanam-do: 490,000 Won

Accumulating Household Debt in Metropolitan Area... Rising Loan Default Risks in Non-Metropolitan Regions

"Housing Cost Stabilization Needed to Alleviate Sluggish Consumption"

The polarization of housing prices between the Seoul metropolitan area and non-metropolitan regions is widening the gap in housing costs, thereby increasing perceived inflation. The Bank of Korea pointed out that while household debt risks are accumulating in the metropolitan area, the risk of loan defaults is rising in non-metropolitan regions, both of which are negatively affecting macroeconomic stability.

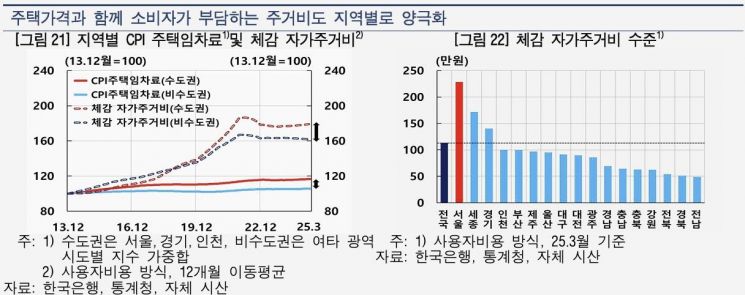

According to the Bank of Korea's report, "Economic Impact of Housing Price Polarization," released on June 18, the gap in the rate of increase in housing rent, as measured by the consumer price index, between the metropolitan and non-metropolitan areas in South Korea has been widening since 2013.

The disparity is even more pronounced when looking at perceived owner-occupied housing costs borne by households owning homes. As of March this year, the Bank of Korea measured perceived owner-occupied housing costs using the user cost method, with Seoul recording the highest at 2.29 million won, and Jeollanam-do the lowest at 490,000 won. The variation is significant: except for Seoul, Sejong, and Gyeonggi, perceived housing costs do not exceed 1 million won in other regions. Perceived owner-occupied housing costs include loan interest and the opportunity cost of equity capital.

The regional gap in inflation rates, including perceived owner-occupied housing costs, also widened considerably from the end of 2019, after the onset of the pandemic, until the middle of 2022. During the period of rising housing prices, this gap reached as much as 1.9 percentage points (in December 2021). The cumulative rate of increase since the pandemic also shows a clear regional disparity.

The Bank of Korea noted that, in the metropolitan area, despite relatively favorable income conditions, the accumulated burden of housing costs is leading to higher perceived inflation. This accumulated perceived inflation burden can act as a factor restricting consumption capacity.

From the perspective of the construction industry, housing price polarization also has negative effects. In non-metropolitan regions, amid population decline and aging, structural sluggishness continues due to oversupply. The number of construction workers?a coincident indicator of the construction economy?in non-metropolitan areas has been decreasing since 2023. Additionally, construction orders?a leading indicator?have seen a sharp drop this year as the downward trend in housing prices continues due to the accumulation of unsold properties.

From a financial stability perspective, both the metropolitan and non-metropolitan regions are negatively affected. In the metropolitan area, the share of household loans in total lending has steadily increased in line with rising housing prices, driving the overall growth of household debt in South Korea. The increase in household debt not only heightens macroprudential risks but also leads to structurally weak consumption, thereby burdening macroeconomic policy management. In contrast, in non-metropolitan regions, the prolonged decline in housing prices has raised the risk of real estate finance defaults. In particular, local banks with a high proportion of loans related to regional housing development projects have seen their non-performing loan ratios rise more rapidly than those of commercial banks, indicating a deterioration in credit quality indicators.

The Bank of Korea emphasized, "Since the accumulated burden of housing costs due to housing price polarization is acting as a factor that reduces actual consumption capacity, stabilizing housing costs is important to alleviate sluggish consumption." The Bank added, "In terms of housing construction, more caution is needed regarding stimulus measures that aim to boost construction investment through non-metropolitan housing construction." The Bank further noted, "The accumulation of household debt in the metropolitan area and the increase in credit risk in non-metropolitan regions indicate the need for regionally differentiated macroprudential management."

Through the report, the Bank of Korea pointed out that both short-term policies and structural reforms must be pursued together to mitigate the problem of housing price polarization. The Bank stated, "In the short term, tailored macroprudential policies such as regionally differentiated loan regulations, improvements to redevelopment project systems to increase supply in the metropolitan area, and the smooth promotion of new town developments are necessary." The Bank also said, "Fundamentally, excessive regional imbalance should be alleviated and the problem of population concentration in the metropolitan area addressed by fostering regional hub cities."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.