Counterarguments Based on "Duty Conflict" Possible in Trials

Management Decisions Such as Paid-in Capital Increase Become Variables

"Company vs. Shareholders" Conflict Could Serve as a Shield for Exemption

On July 2, some experts expressed concerns that the amendment to the Commercial Act, agreed upon by both ruling and opposition parties, may have limitations in strengthening shareholder responsibility. They analyzed that, in situations where the interests of the company and its shareholders are in conflict, management could potentially use the concept of "duty conflict" as a shield to avoid punishment.

According to legal circles, prosecutors who have been in charge of corporate investigations view the amended Commercial Act, which adds a "duty of loyalty to shareholders," from a different perspective than the business community.

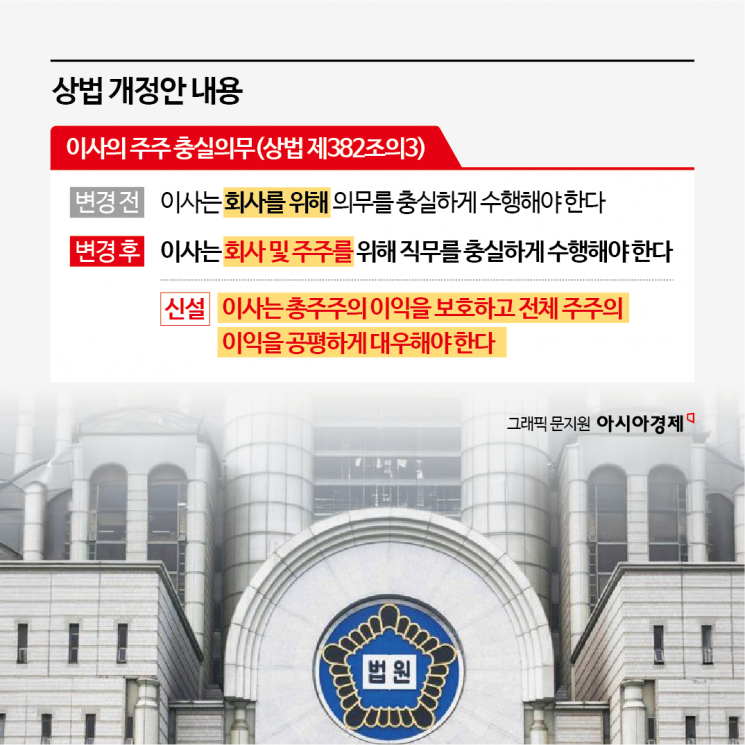

The core of the amendment is to expand the scope of directors' (executives') duty of loyalty from the "company" to include "shareholders." Previously, under the Commercial Act, directors were principally required to fulfill their duty of loyalty as prudent managers for the benefit of the company. The amendment goes a step further by stipulating that the interests of shareholders must also be a key consideration in management decisions.

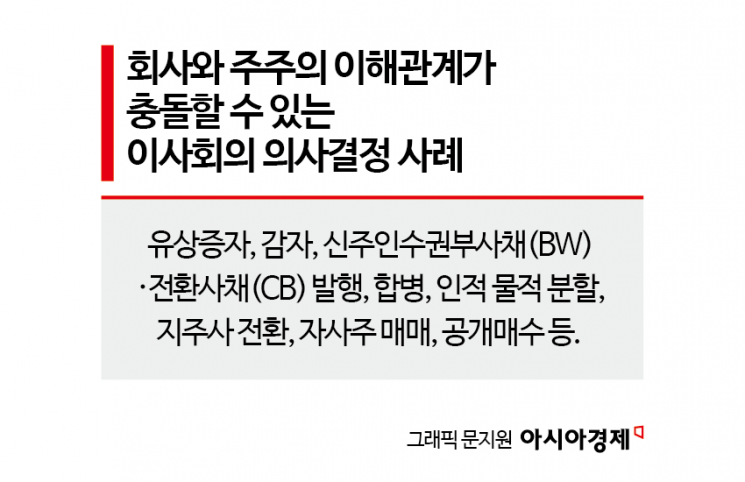

The problem is that, in real management settings, conflicts between the duty to protect the interests of the company and those of shareholders occur frequently. In various management decision situations?such as capital increases, capital reductions, mergers, spin-offs (both physical and legal), conversion to a holding company structure, and the issuance of bonds with warrants (BW)?the interests of the company and its shareholders may not align. A chief prosecutor at the Seoul Southern District Prosecutors' Office stated, "The interests of the company and shareholders especially come into sharp conflict during restructuring phases. In processes such as capital reduction, spin-offs, or capital adjustments, the survival of the company and shareholder value do not necessarily coincide. In these cases, defense attorneys will actively argue that the duties of loyalty conflicted, and will use this logic as a shield to challenge the illegality of breach of trust charges."

Some also argue that, while the amendment was originally intended to enhance transparency in corporate management, its actual effect may be minimal, and it may only complicate courtroom strategies regarding the application of breach of trust charges. They point out that there is a fundamental contradiction in the very structure of the Commercial Act, which places the company and shareholders on equal footing. A chief prosecutor who handled breach of trust cases at the Seoul Central District Prosecutors' Office said, "Even if suspicions are revealed during the investigation stage, if arguments of duty conflict and justifiable grounds for exemption are presented in court, it becomes difficult to respond under the current Criminal Act, and judicial decisions may be inconsistent. Ultimately, the threshold for proving breach of trust will be raised, and there is concern that this could be misused as a shield for management." Contrary to the intention of tightening the net around breach of trust, the logic of exemption could prevail in both investigations and trials. Another chief prosecutor commented, "Confusion will be inevitable until case law is firmly established."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.