Banks are raising the bar for loan approvals. This move is interpreted as a response to the financial authorities' call for tighter management of household lending.

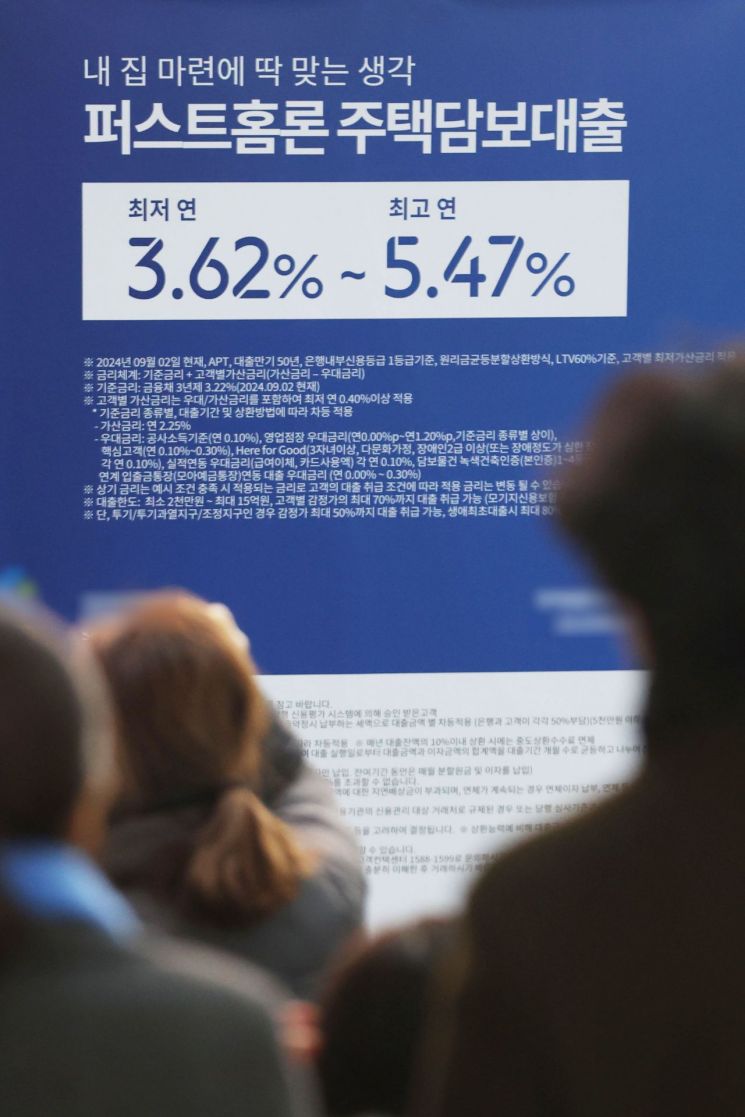

Starting June 18, SC First Bank will shorten the maximum maturity for mortgage loans from the current 50 years to 30 years. When the maturity period for mortgages is reduced, the annual principal and interest repayment burden increases in the calculation of the Debt Service Ratio (DSR), resulting in a lower loan limit. The preferential interest rate for branch manager approval will also be reduced by 0.25 percentage points. Reducing the preferential rate effectively raises the interest rate on loans.

NH Nonghyup Bank will also strengthen its preferential rate conditions starting June 18. For existing face-to-face mortgage loan products (fixed and variable types), the preferential rate of 0.2 percentage points, previously offered when the Loan-to-Value (LTV) ratio was 40% or less, will now only apply when the LTV is 30% or less. The 0.1 percentage point preferential rate for All One Bank subscribers and the 0.1 percentage point special support program benefit will be removed, while a new 0.2 percentage point preferential rate for households with three or more children will be added.

As housing prices in Seoul have recently risen and household lending has increased, the financial authorities have instructed banks to strengthen their loan management. On June 16, the Financial Supervisory Service convened deputy presidents in charge of household lending at banks and asked those offering mortgage products with maturities of 40 and 50 years to check whether they are increasing loan limits by circumventing the DSR.

For banks such as Nonghyup Bank and SC First Bank, which have significantly increased household lending, the authorities also urged compliance with previously submitted targets.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.