Financial Supervisory Service Issues Warning Against Investment Scams

Cautions Investors About Fraudulent IPO Schemes Targeting Unlisted Stocks

As investor sentiment in the domestic stock market has recently shown signs of recovery, the Financial Supervisory Service has issued a warning as investment scams using the imminent listing of unlisted stocks as bait for initial public offering (IPO) investments are becoming rampant.

On June 17, the Financial Supervisory Service issued a consumer alert at the "caution" level, warning that illegal operators impersonating small domestic financial investment firms (asset management, investment advisory, discretionary investment) are targeting investors with IPO-related scams.

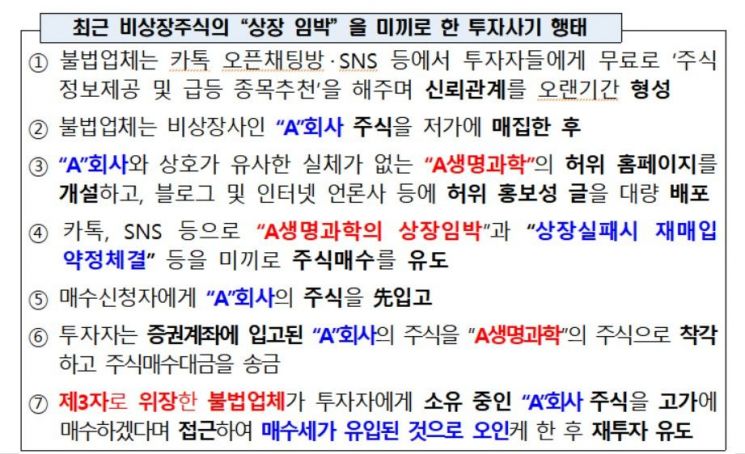

The scammers impersonate small financial investment companies and distribute false information via online channels such as social media and the internet, claiming that non-existent unlisted stocks are about to be listed, and encourage investors to buy these stocks.

They lure general investors with exaggerated business claims that are difficult to verify, such as new technology development, business performance, and investment attraction, as well as false advertisements promising several times the listing profit, and then misappropriate the investment funds.

They attract investors by offering free "stock information and recommendations for rapidly rising stocks" via KakaoTalk or social media. After pre-purchasing unlisted stocks scheduled for listing at a low price, they actually deposit these stocks for free into investors' securities accounts, providing a small-scale investment success experience upon listing and building trust.

Subsequently, after accumulating shares of an unlisted company, Company A, they create a fake website for a similarly named but non-existent company, A Life Science, and post large volumes of fabricated press releases to deceive investors. They then recommend purchasing the soon-to-be-listed stock, and to lure investors, they promise to repurchase the shares through a put-back option (repurchase claim right) in case the listing fails or if the stock price after listing falls short of expected returns.

The Financial Supervisory Service advised that if someone encourages you to buy unlisted stocks by promising high returns with phrases like "imminent listing" or "scheduled listing" on KakaoTalk or social media, you should always suspect a scam.

When a company prepares to go public, it is required to disclose documents such as a securities registration statement. Therefore, if such disclosure documents cannot be found on the DART website, investors should exercise caution. In particular, legitimate financial institutions do not make individual investment solicitations through one-on-one chat rooms, email, or text messages.

The Financial Supervisory Service emphasized, "If you suspect illegal financial investment, you should promptly report it to the Financial Supervisory Service or the police," adding, "Quick reporting can help prevent the concealment of criminal proceeds and additional damage."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.