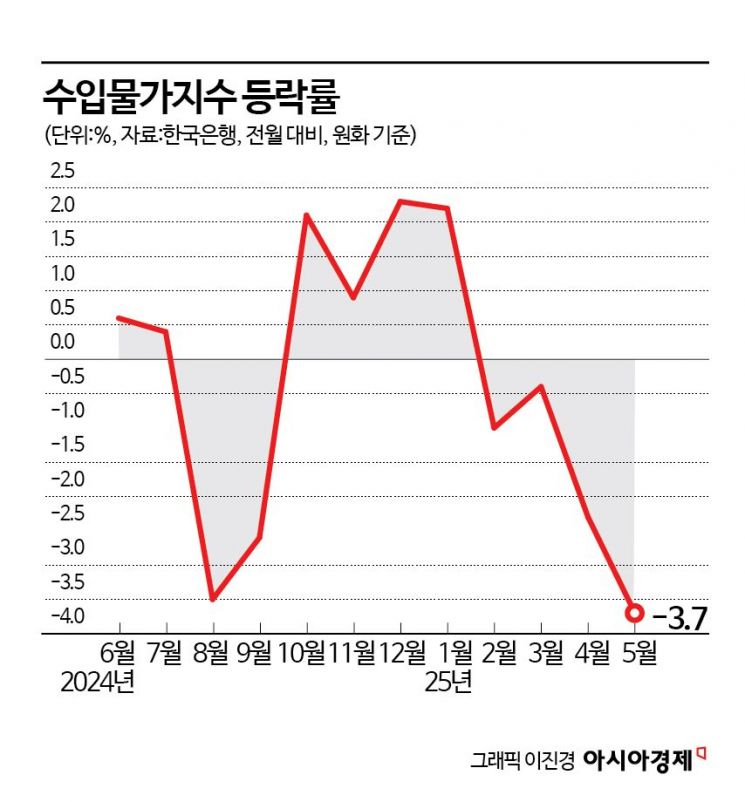

Import Prices Fell 3.7% Last Month from April

Raw Materials, Including Crude Oil and Mineral Products, Down 5.5%

This Month, Oil Prices Rebound and Middle East Risks Need Close Monitoring

Last month, import prices declined for the fourth consecutive month. With the continued decline in international oil prices and the won-dollar exchange rate, import prices saw their largest drop in a year and a half. However, it remains uncertain whether this downward trend will continue this month, given the high level of domestic and international uncertainty, including the armed conflict between Israel and Iran.

According to the "Export and Import Price Index and Trade Index (Preliminary) for May 2025" released by the Bank of Korea on the 17th, import prices (based on the Korean won) fell by 3.7% in May compared to the previous month. This is the largest monthly decline since November 2023 (-4.3%), marking a one-and-a-half-year record. Compared to the same month last year, import prices also dropped by 5.0%. The simultaneous decrease in international oil prices and the won-dollar exchange rate led to a decline centered on mineral products such as crude oil.

Last month, the average monthly price of Dubai crude oil fell to $63.73 per barrel, a 5.9% decrease from $67.74 in April. Compared to the same month last year, it dropped by 24.2%. The average won-dollar exchange rate last month was 1,394.49 won, down 3.4% from 1,444.31 won in April.

By usage, raw materials, mainly mineral products such as crude oil, fell by 5.5% compared to the previous month. Intermediate goods, including chemical products and coal and petroleum products, dropped by 3.2% month-on-month. Capital goods declined by 2.7%, and consumer goods fell by 2.3%. Excluding the exchange rate effect, import prices based on contract currency also fell by 0.6% compared to the previous month and by 7.5% compared to the same month last year.

However, it is still uncertain whether the downward trend will continue this month. Lee Moonhee, head of the Price Statistics Team 1 at the Economic Statistics Department of the Bank of Korea, explained, "Import prices are heavily influenced by fluctuations in international oil prices and the won-dollar exchange rate. From the beginning of this month through the 13th, the average international oil price (Dubai crude) rose by 3.8% compared to the previous month's average, while the average won-dollar exchange rate fell by 2% through the 16th." He added, "Since these factors are moving in opposite directions, and given the significant uncertainty in the Middle East, we need to monitor the trend for the time being."

Last month, export prices fell by 3.4% compared to the previous month, as the won-dollar exchange rate declined and international oil prices dropped, leading to decreases in chemical products, coal, and petroleum products. Compared to the same month last year, export prices fell by 2.4%, mainly due to declines in coal and petroleum products. By item, agricultural, forestry, and fishery products fell by 0.8% from the previous month. Manufactured goods, especially chemical products, coal, and petroleum products, dropped by 3.4% month-on-month. Export prices based on contract currency fell by 0.1% compared to the previous month and by 4.8% compared to the same month last year.

The export volume index, which shows changes in export and import activity, rose by 2.5% in May compared to the same month last year, mainly due to increases in computers, electronic, and optical devices. The export value index fell by 1.9% during the same period. The import volume index rose by 1.3% as computers, electronic and optical devices, and mineral products increased. The import value index dropped by 6.3%.

In May, the net barter terms of trade index rose by 3.4% year-on-year, as import prices (-7.5%)?mainly for mineral products such as crude oil, natural gas, and bituminous coal?fell more sharply than export prices (-4.3%). The income terms of trade index increased by 6.0%, as both the net barter terms of trade index (3.4%) and the export volume index (2.5%) rose.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)