Hanwha Aerospace, Hyundai Rotem, LIG Nex1, and Korea Aerospace Industries Reach Record Highs

Hanwha Aerospace Touches 980,000 Won Intraday... Emperor Stock Status Within Reach

As geopolitical issues originating from the Middle East intensified, defense stocks surged, repeatedly breaking all-time highs. Hanwha Aerospace moved one step closer to becoming an “Emperor Stock.”

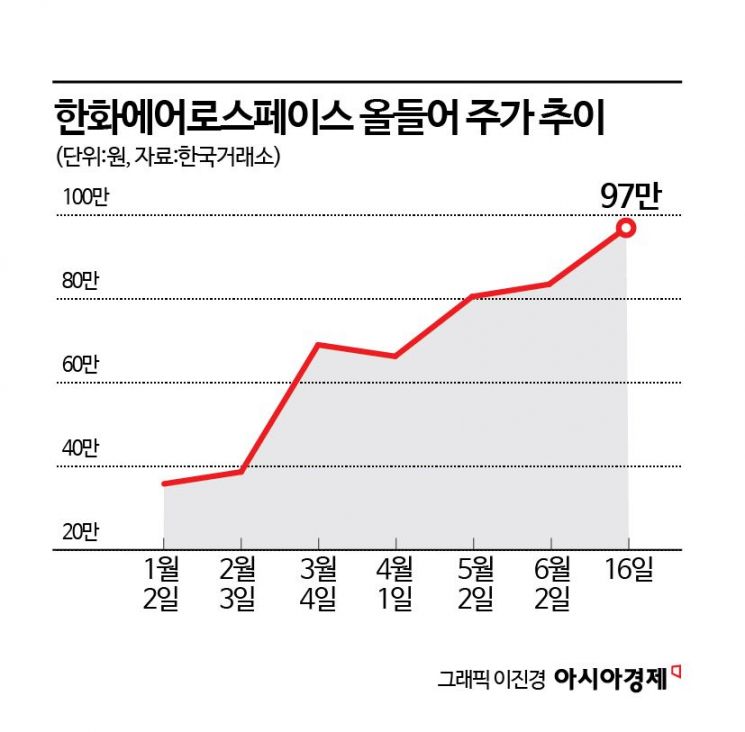

According to the Korea Exchange on June 17, defense stocks collectively set new record highs the previous day. Hanwha Aerospace climbed to 987,000 won during intraday trading, marking a new all-time high. The stock closed at 970,000 won, up 2.65% for the day. Hyundai Rotem also reached an intraday high of 198,650 won, again setting a record. Hyundai Rotem rose more than 6% on the day, extending its winning streak to five consecutive sessions. LIG Nex1, which advanced over 5%, reached an intraday high of 557,000 won, also breaking its previous record, while Korea Aerospace Industries hit a new all-time high of 101,800 won.

This strong performance was driven by expectations of increased weapons demand as the Middle East war crisis escalates. Jung Dongik, a researcher at KB Securities, commented, “While civilian casualties resulting from the war are deeply tragic, from an economic perspective, this situation could present opportunities for Korean defense companies. Israel is one of the world’s major arms exporters, but due to the current crisis, it will likely have to restrict overseas sales of stockpiled or newly produced weapons for a considerable period to prioritize its own defense. In particular, even after the war with Iran ends, Israel will need to stockpile a significant portion of its air defense missiles domestically for some time.” He added, “It is also important to consider that anti-Israel sentiment may intensify among Islamic countries in the Middle East and North Africa. As a result, export opportunities for Korean-made weapons such as air defense missiles, main battle tanks, self-propelled artillery, drones, and related components are expected to increase.”

With positive conditions for defense stocks continuing, Hanwha Aerospace appears to be on the verge of joining the ranks of Emperor Stocks. Hanwha Aerospace shares have risen more than 200% so far this year. Securities firms have already set their target prices at Emperor Stock levels. Korea Investment & Securities set a target price of 1.3 million won for Hanwha Aerospace, while Mirae Asset Securities suggested 1.2 million won. Hanwha Investment & Securities, Kiwoom Securities, and Kyobo Securities each set targets at 1.1 million won, and NH Investment & Securities, Hyundai Motor Securities, Eugene Investment & Securities, and DB Financial Investment each set targets at 1 million won.

Expectations of continued strong earnings in the second quarter are also supporting the stock price. According to financial data provider FnGuide, the consensus forecast for Hanwha Aerospace’s second-quarter results (the average of securities firms’ estimates) is sales of 6.2618 trillion won, up 124.76% year-on-year, and operating profit of 696.3 billion won, up 94.06%. Bae Sungjo, a researcher at Hanwha Investment & Securities, stated, “Hanwha Aerospace’s second-quarter sales are expected to reach 6.3979 trillion won, with operating profit at 733 billion won, exceeding market expectations for operating profit. The main factors driving this outperformance are the steady delivery of K9 and Cheonmu systems to Poland and productivity improvements from repeated production.” He added, “For the second quarter, we estimate ground defense sales at 1.6396 trillion won, up 23.3% year-on-year, and operating profit at 397.9 billion won, up 53.0%. Although the foreign exchange effect will be less significant than in the past two quarters, increased exports of ground defense products, particularly to Poland, will drive overall company performance.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.