Net Buying of U.S. Stocks Resumes on June 13

Record-High Holdings Surpass $120 Billion

Shifting from Long-Term Bonds to Leveraged ETFs

Retail investors in Korea, often referred to as "Seohak Ants," are once again turning their attention to the U.S. stock market. After having taken a defensive stance last month by increasing their holdings in long-term U.S. Treasury bonds, they are now making aggressive bets by adding leveraged products to their portfolios.

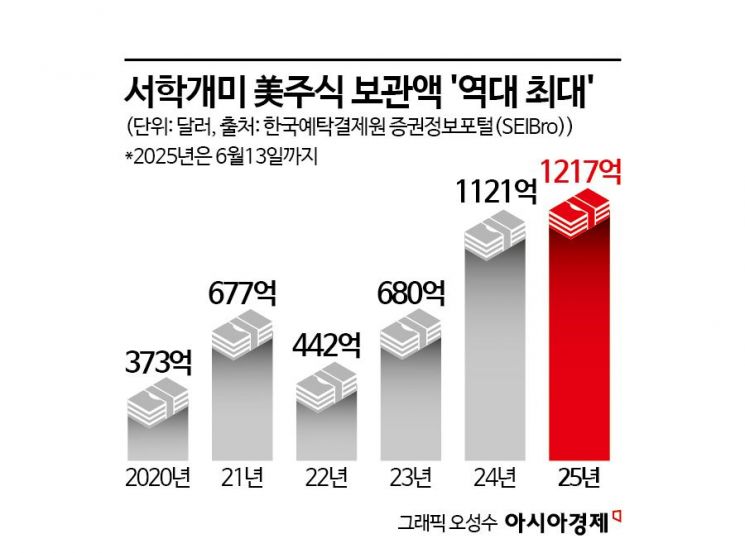

According to the Korea Securities Depository's SEIBro portal on June 17, as of June 13, domestic individual investors made net purchases of $523,498 worth of U.S. stocks, marking their first net buying for this month. The total value of U.S. stocks held by Korean investors also surpassed $121.736 billion (approximately 16.6 trillion KRW), breaking the previous record of $119.32254 billion set last month.

Previously, Seohak Ants had maintained a net buying streak in the U.S. stock market for six consecutive months, from November last year?when Donald Trump secured the U.S. presidential election?through April this year. However, last month, when the S&P 500 posted its highest monthly gain in 35 years, they shifted to net selling as they took profits. With optimism over U.S.-China trade negotiations rising this month and a relief rally underway, they have returned to net buying after about 40 days.

Their optimism about the U.S. market is also evident in the stocks they are purchasing. Until last month, they had built a defensive portfolio by buying over $300 million worth of U.S. long-term Treasury bond ETFs with maturities of 20 years or more, such as TLT and TMF. However, this month, they have shifted to aggressive bets by buying leveraged ETFs, including TSLL?which tracks twice the daily return of Tesla stock and is the top net purchase?and SOXS, which delivers three times the inverse daily return of the U.S. ICE Semiconductor Index and ranks third in net purchases. During this period, Circle, the issuer of the stablecoin USDC, also saw net purchases of about $118 million, ranking second.

An official from a securities firm commented, "The fact that retail investors, who did not join the recent rally toward 'Samcheonpi' (KOSPI 3000), are increasing their exposure to U.S. stocks suggests that they have not completely shaken off doubts about 'Boxpi' (the phenomenon of the KOSPI moving within a box range). If the market rebounds after a correction and tests the 3000 level, their outlook may change." In fact, from June 4, when the new government took office, to June 13, while foreigners bought more than 4 trillion KRW worth of KOSPI stocks, the most purchased stock by individuals was "KODEX 200 Futures Inverse 2X" (approximately 279.6 billion KRW in net purchases), which bets on a decline in the KOSPI.

With the escalation of geopolitical risks originating from the Middle East, it is expected that not only the domestic stock market but also the accounts of Seohak Ants will inevitably be affected. However, analysts warn against hasty responses. Han Ji-young, a researcher at Kiwoom Securities, said, "While the likelihood of a quick resolution to the Israel-Iran military conflict is low, the potential for it to escalate into a major negative event that disrupts the existing upward trend in stock prices is limited. Except for full-scale crises such as the oil shock, the Gulf War, and the Russia-Ukraine war, most geopolitical shocks have been short-term events for stock prices. Therefore, even if short-term volatility increases, it is advisable to refrain from expanding short positions as a response."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.