Significant Discrepancy Between External Auditors and Audit Committees

on Internal Accounting Management System Evaluations

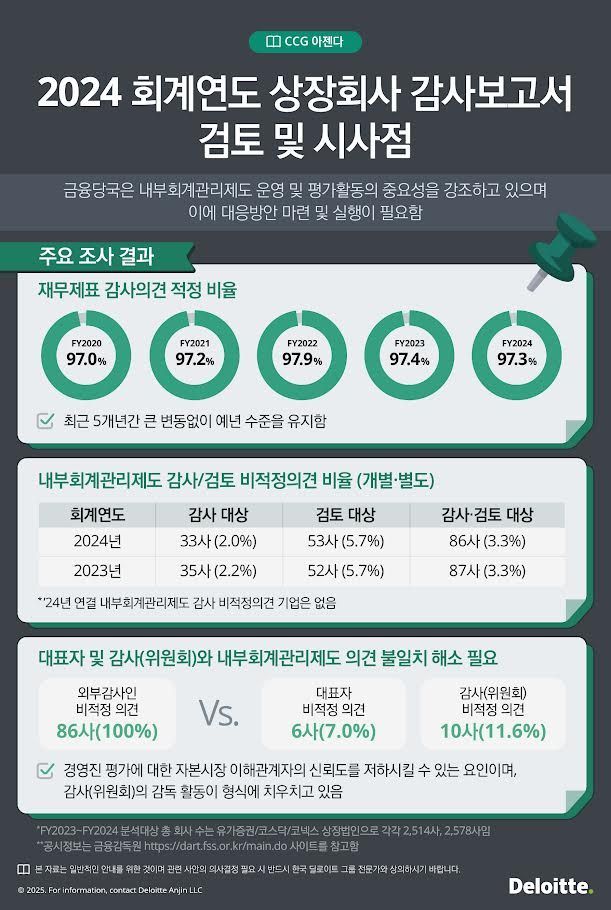

Deloitte Korea Group Analyzes Audit Opinions of 2,578 Listed Companies

There appears to be a significant level of disagreement between external auditors and audit (committees) regarding opinions on the internal accounting management system.

According to the 10th issue of "Corporate Governance Insights" published by Deloitte Korea Group on June 16, among listed companies for the 2024 fiscal year, 88.4% of the 86 companies that received a "qualified" opinion from external auditors regarding their internal accounting management system received an "unqualified" opinion from their audit committees. This indicates a clear discrepancy between internal evaluations and external audits.

This report is the result of a comprehensive analysis of audit opinions on financial statements and audit/review opinions on internal accounting management systems from 2,578 listed companies. Among large listed companies with total assets of 2 trillion won or more, there were no cases of qualified opinions in the second year since the introduction of consolidated internal accounting management system audits last year. Deloitte analyzed that this was due to large companies proactively responding to regulatory changes by establishing dedicated organizations and employing specialized personnel.

Among the 86 companies that received a qualified opinion on their internal accounting management system, a total of 297 reasons for inadequate internal controls were identified. The most frequent reason was "inappropriate conduct by top management" (26.3%), followed by "scope limitation" (19.5%), "lack of accounting expertise" (10.4%), "insufficient disclosure controls" (7.7%), and "insufficient fund controls" (7.1%).

Kim Hanseok, head of the Center for Corporate Governance Development at Deloitte Korea Group, stated, "In order to resolve the inconsistency between the evaluations of audit committees and management and the opinions of external auditors, it is necessary to ensure smooth communication and conduct appropriate evaluation activities."

The report also analyzed the current status of board performance evaluation disclosures at financial companies. The proportion of disclosures that included both "evaluation methods and results" was 97.4%, a 14.9 percentage point increase from the previous year. However, the report pointed out that the results were mostly described in positive terms such as "excellent" or "adequate," highlighting limitations in their practical application.

Deloitte emphasized the need to strengthen audit committee control capabilities using artificial intelligence (AI) in response to digital transformation, as well as to improve governance through the practical use of shareholder proposals. The full report is available on the Deloitte Korea Group website.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.