Strengthening the Lineup of Long-Term Insurance Products

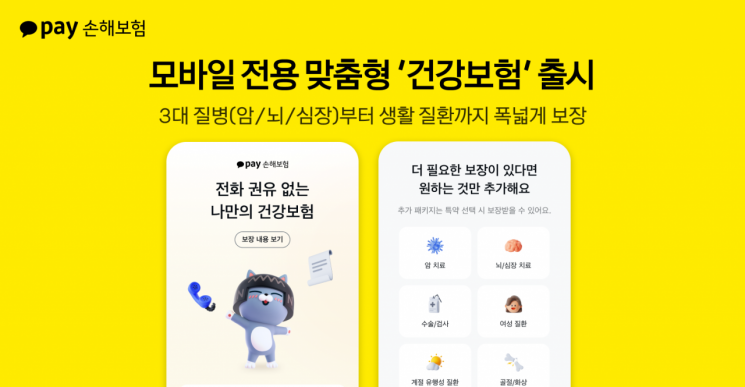

The basic coverage of the health insurance focuses on diagnosis benefits for the three major diseases: cancer, cerebrovascular disease, and heart disease. It provides five types of coverage: cancer diagnosis benefit (excluding minor cancers, 90-day waiting period, same hereafter), minor cancer diagnosis benefit, cerebrovascular disease diagnosis benefit, ischemic heart disease diagnosis benefit, and emergency room visit treatment benefit (emergency cases, same hereafter). Users can choose between the Standard Plan and the Enhanced Plan based on the scope of coverage.

The Standard Plan allows users to prepare for medical expenses with relatively affordable premiums, while the Enhanced Plan strengthens coverage by also considering income loss due to long-term treatment. The Standard Plan covers 20 million KRW for cancer diagnosis, 4 million KRW for minor cancer diagnosis, 10 million KRW each for cerebrovascular and ischemic heart disease diagnosis, and 30,000 KRW for emergency room visit treatment. In contrast, the Enhanced Plan raises the coverage to 50 million KRW for cancer diagnosis, 10 million KRW for minor cancer diagnosis, 20 million KRW each for cerebrovascular and ischemic heart disease diagnosis, and 50,000 KRW for emergency room visit treatment.

Users can add up to eight additional packages to the basic coverage, taking into account their health status and lifestyle habits.

This health insurance can be easily purchased via KakaoTalk. The underwriting process consists of only four health-related questions, such as whether the applicant has been hospitalized or undergone surgery in the past five years. Users can design and purchase the insurance directly on mobile without the need for phone consultations or face-to-face solicitation.

The eligible age for enrollment is from 19 to 49 years old, and the policy term can be set to mature from age 60 up to a maximum of 80 years old.

Jang Younggeun, CEO of Kakao Pay Insurance, said, "This health insurance product is designed to help users easily prepare for the diseases they are most concerned about through mobile channels," adding, "A key differentiator is that it streamlines the complex screening and consultation process of existing health insurance products such as cancer insurance, and allows customers to directly select the coverage they need."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)