Despite Base Rate Cut, Mortgage Loan Rates Rise Instead

Deposit Rates Drop Rapidly... Loan-Deposit Rate Gap Hits Record High

Despite the Bank of Korea's cut in the base interest rate, a phenomenon of 'reverse rate movement' is occurring, with mortgage loan rates at major commercial banks rising instead. This is due to an increase in the benchmark interest rate used for rate calculation, and as housing prices?especially in Seoul?show a clear upward trend, banks are independently raising loan rates to control demand. In contrast, deposit and savings rates are being lowered, causing the gap between loan and deposit rates to reach its highest level since disclosure began.

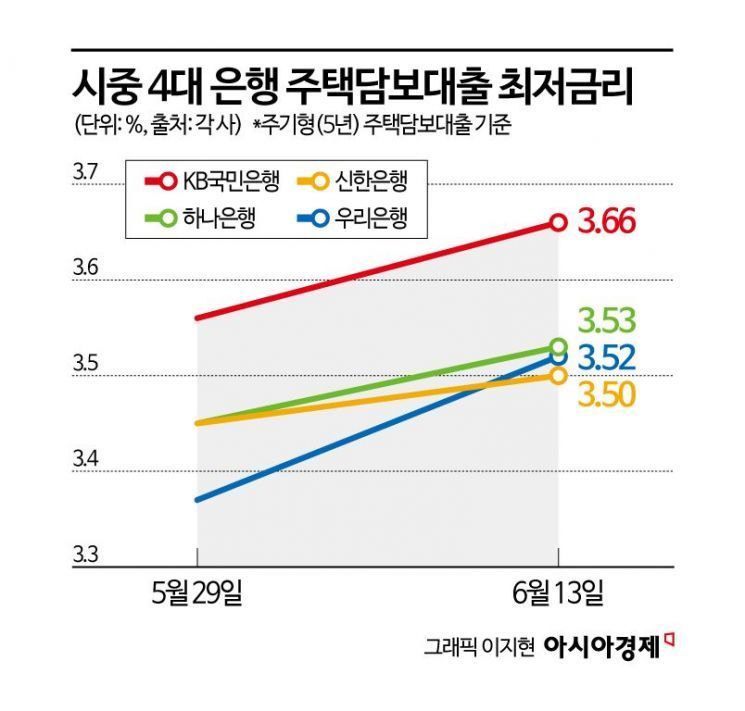

According to the financial sector on the 16th, major commercial banks have been raising mortgage loan rates one after another since the beginning of this month. In the two weeks since the Bank of Korea lowered the base rate on May 29, Woori Bank raised its rates by 0.15 percentage points, and KB Kookmin Bank increased the rates of its major non-face-to-face mortgage products by 0.26 percentage points compared to the previous month. K Bank also raised the additional rate for apartment mortgage loans by 0.29 percentage points on June 2. SC First Bank will reduce the preferential rate for mortgage loans at branches by 0.15 percentage points starting June 18. Reducing the preferential rate effectively increases the actual loan rate.

The reason why mortgage loan rates at commercial banks are rising despite the Bank of Korea's base rate cut is that the benchmark rate (bank bond yield) used for rate calculation is increasing. Bank lending rates are calculated by adding a margin to market rates such as bank bonds and COFIX (Cost of Funds Index). According to the Korea Financial Investment Association, as of June 13, the average rate for five-year bank bonds (unsecured, AAA) was 2.883%, up 0.198 percentage points from 2.685% on May 7?a one-month increase. Due to the rise in the benchmark rate, even if the margin is lowered, the final rate can still increase. For example, Shinhan Bank lowered its margin on June 2, reducing the minimum rate for periodic mortgage loans from 3.45% to 3.41% per annum, but as of June 10, the minimum rate had risen again to 3.5% per annum.

Additionally, with housing prices overheating?especially in Seoul?loan demand has increased, prompting banks to manage total loan volume independently. According to financial authorities, as of May, household loans across all financial sectors, including banks, increased by 6 trillion won compared to the previous month. This is the largest increase in eight months since September last year. The rise in household loans is due to increased demand for home purchases following the lifting of Land Transaction Permission Zones (Toheoguyeok) in February, as well as a rush of last-minute demand ahead of the implementation of the third phase of the Debt Service Ratio (DSR) regulation in July.

With expectations that the trend of increasing household loans will continue for the time being, mortgage loan rates are also likely to remain at a high level. This is because the Bank of Korea may continue to lower the base rate due to concerns over domestic economic stagnation and low growth, and government bond yields are also expected to remain elevated.

In contrast, deposit rates are falling rapidly in response to the Bank of Korea's base rate cut. Since June 9, KB Kookmin Bank has lowered the base rates of three time deposit products by 0.10 to 0.25 percentage points depending on the product. IBK Industrial Bank of Korea (up to 0.25 percentage points), SC First Bank (up to 0.20 percentage points), and NH Nonghyup Bank (up to 0.30 percentage points) have also reduced deposit product rates in succession. According to the Korea Federation of Banks, the base rate (simple interest) for some banks' one-year deposits has dropped to the 1% range. As of June 15, the base rates for 'Sh First Meeting Preferential Deposit' at Sh Suhyup Bank stood at 1.85%, 'iM Main Transaction Preferential Deposit' at iM Bank at 1.99%, 'The Special Time Deposit' at BNK Busan Bank at 1.90%, 'LIVE Time Deposit' at 1.95%, and 'Smile Dream Time Deposit' at Jeju Bank at 1.90%.

The gap between loan and deposit rates has widened to its highest level since records began. According to the Korea Federation of Banks, as of April, the gap between loan and deposit rates for household loans (excluding policy finance) at the five major commercial banks (Kookmin, Shinhan, Hana, Woori, Nonghyup) stood at 1.35 to 1.51 percentage points. By bank, Shinhan had the largest gap at 1.51 percentage points, followed by Kookmin (1.42 percentage points), Nonghyup (1.38 percentage points), Hana (1.37 percentage points), and Woori (1.35 percentage points), with an average of 1.41 percentage points. Both Shinhan (1.51 percentage points) and Hana (1.43 percentage points) recorded their largest gaps since the second half of 2022, when disclosures began in March 2023.

An official at a major commercial bank said, "Financial authorities are ordering banks to manage household loans autonomously, but apart from adjusting interest rates, there are few options banks can use at their discretion," adding, "With the third phase of the DSR regulation approaching, lowering loan rates could further increase loan demand, putting us in a difficult position."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)