Why Only Casper Is Sold Online: Labor Union Opposition Slows Hyundai Motor's Online Sales

Hyundai and Kia Dominate the Domestic Market, Shaping Sales Trends

Online Car Sales Offer Consumer Benefits by Reducing Middleman Fees

Genesis Tests Online Platforms for Additional Services

Casper's 100% Online Sales Model Succeeds with Digital-Savvy Consumers

Fandom Marketing and Contactless Transactions Drive Casper's Popularity

Hyundai Motor Experiments with Innovative Online Sales on Amazon in the U.S.

Online Sales Expansion in South Korea Depends on Coexistence with Sales Staff and Dealers

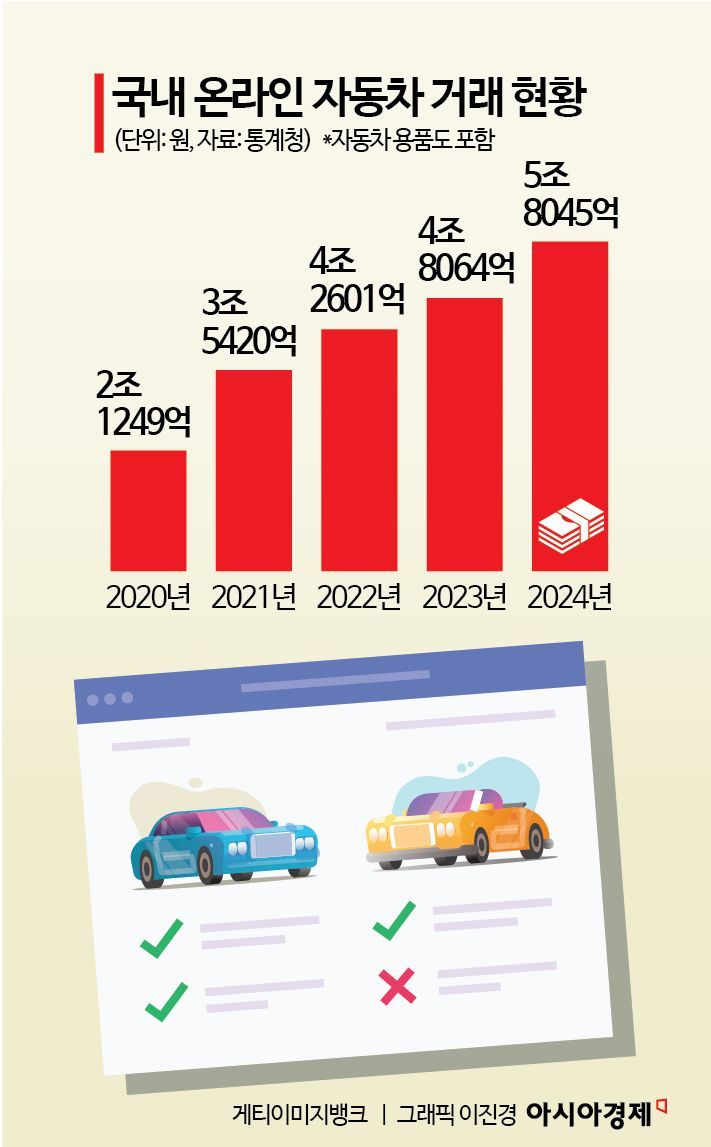

'KRW 450 trillion vs KRW 5.8 trillion.'

This is a comparison of the global and domestic market sizes for online car purchases. According to market research firm Coherent Insights, the global online car purchase market was estimated at $328.9 billion (about KRW 450 trillion) last year. The online sales market is expected to grow at an average annual rate of 12.5%, reaching $751.8 billion (about KRW 1,029 trillion) by 2031.

Let's look at the status of online car sales in South Korea. According to Statistics Korea, the size of the domestic online transaction market for automobiles (including automotive accessories) was KRW 5.8 trillion in 2024. Compared to the KRW 450 trillion global market, this represents only about 1.2%. In terms of total online commerce, South Korea ranks fifth in the world (KRW 240 trillion in 2024), following China, the United States, the United Kingdom, and Japan. However, when narrowing the scope to automobile transactions, the size of the domestic online car sales market remains insignificant. Why is it that, despite South Korea's reputation as an online powerhouse, only the online car sales market is growing so slowly?

Why Casper Is Allowed, but Palisade Is Not

The first cause to examine lies with Hyundai Motor, and more specifically, its labor union. The Hyundai Motor labor union strongly opposes online sales. This is because as online sales, where the manufacturer sells directly to consumers without going through dealerships, increase, the roles and jobs of on-site sales staff could decrease. Hyundai Motor's sales methods must be negotiated with the union according to labor-management agreements. Without union consent, it is difficult to push forward with online sales. The only exception has been the small SUV Casper, which is produced on consignment by Gwangju Global Motors (GGM); despite union opposition, 100% online sales were possible for this model.

As of 2024, Hyundai Motor and Kia hold a 76% share of the domestic market. Based on domestic brands alone, their share exceeds 90%, making them a de facto monopoly. It is no exaggeration to say that Hyundai Motor and Kia's sales policies have an absolute influence on transaction trends and practices in the domestic car market. Industry insiders believe that unless Hyundai Motor and Kia take a proactive approach to online sales, rapid growth in the domestic online car sales market will be difficult.

Another reason is the limitations in consumer trust and purchasing experience in online car transactions. For most households, a car is the second most expensive purchase after a home. People want to touch or test-drive the vehicle and build sufficient trust through face-to-face consultations with salespeople before making such a major decision. Reflecting this market characteristic, the United States, the largest online car transaction market, has developed a hybrid ecosystem combining manufacturers, dealers, and online platforms. For example, consumers can access an online platform, compare inventory, prices, and services at each dealership, and then select the dealer they want. The dealer that matches the consumer's criteria is then connected for one-on-one consultation. The role of the dealer remains, but the market is evolving to enhance the digital experience during the purchase process.

The Trade Secrets of Car Sales

How do car salespeople make a profit? For traditional domestic car dealerships, there are three main sources: sales commissions, insurance and financial brokerage fees, and additional service fees. Sales staff receive a fixed commission for every car sold. At company-owned stores, the base salary is higher but the per-car commission is lower, while at agencies, the base salary is lower but the per-car commission is higher. There are also financial commissions for arranging car insurance, and brokerage fees for guiding customers to specific companies for add-on services such as window tinting or black boxes. Additionally, salespeople can earn brokerage profits by facilitating the sale of a customer's used car.

In other words, if these commissions received by sales staff throughout the process are reduced, the benefits could be passed on to consumers. Of course, salespeople also provide valuable services such as handling offline registration procedures and helping customers navigate the complex options of domestic cars. However, for consumers willing to accept a bit of inconvenience to save on intermediary fees, online sales are much more advantageous.

Hyundai Motor Group has recognized this demand and is partially introducing online platforms for additional services. Genesis, for example, offers a variety of services through its online boutique, including new car window tinting, premium coating and washing, and tire replacement. Consumers can compare brands and service providers online and make their own selections. Services such as window tinting, which used to be arranged through salespeople, have now been moved to the online platform. The industry interprets Hyundai Motor Group's small-scale online sales experiments with Genesis as tests of system stability and consumer response.

Casper Takes the Online Sales Test

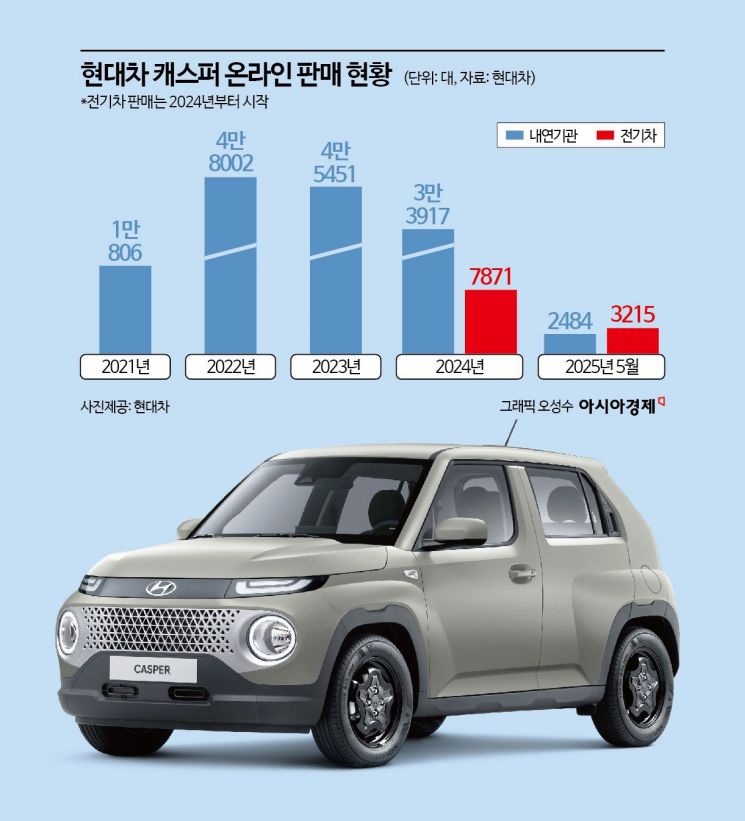

Hyundai Motor opened a new chapter in online sales with the small SUV Casper. Across both Hyundai Motor and Kia, Casper is currently the only model sold 100% online. Casper is produced on consignment at the GGM Gwangju plant. Although the labor union has consistently opposed Casper's online sales, because it is not produced at the Ulsan plant, it was excluded from labor-management negotiations. This made it possible to push forward with online sales. From the manufacturer's perspective, small SUVs are less profitable, so a "low margin, high volume" strategy that minimizes distribution fees was necessary. Casper's lower price and relatively simple options also make it highly accessible online. It is also optimized for online purchase, targeting consumers in their 20s and 30s who are familiar with digital experiences.

The experiment with Casper, launched in September 2021, was a huge success. At the time, the COVID-19 pandemic was at its peak, making contactless transactions a major trend across all industries. Hyundai Motor enabled the entire process?providing vehicle information, combining specifications using 3D modeling, real-time quotes, contracts, payments, and vehicle registration?to be completed online without face-to-face interaction. The contract process also introduced simple authentication methods such as KakaoTalk and joint certificates, and offered one-stop services for contract changes or cancellations, installment limit checks, and issuing dedicated cards.

With the advantage of being able to contract a car with just one click, more than 18,000 pre-orders were received on the first day of Casper's pre-sale alone. This was the highest first-day pre-order figure for any Hyundai Motor internal combustion model at the time. Within two weeks, the pre-orders easily reached the annual production target of 45,000 units. Since then, Casper has maintained strong sales, selling more than 40,000 units annually for three consecutive years.

Another key to Casper's success was "fandom marketing." When a product or brand lacks a strong identity, salespeople need to step in and explain its strengths and advantages over competitors in detail. However, when a brand or model forms its own fandom, consumers seek it out without any prompting from salespeople. Tesla is a prime example. By combining brand philosophy, technological leadership, and CEO storytelling, Tesla has created a unique fandom. From its early models, Tesla has sold all of its cars 100% online. Tesla's contribution was a major factor in the United States becoming the world's leading market for online car purchases.

Hyundai Motor also wanted Casper to build a fandom like Tesla. The company needed an active strategy to attract customers to Casper solely through online marketing, without any sales staff promotion. To overcome the limitations of the online model, Hyundai Motor set up pop-up stores in Seoul, the greater metropolitan area, Busan, Jeju, and other locations. However, there were no dedicated salespeople, and all customer consultations were conducted remotely. Customers could touch and test the vehicle in person, but orders were placed online. Hyundai Motor also launched "Casper TV," a dedicated broadcasting channel for online live streams, where customers could ask questions and get answers in real time via chatbot. Aggressive online advertising was also used. A look at recent advertisements on Hyundai Motor's official Instagram and YouTube accounts shows the significant emphasis placed on Casper.

Another Innovation Experiment: Selling on Amazon in the U.S.

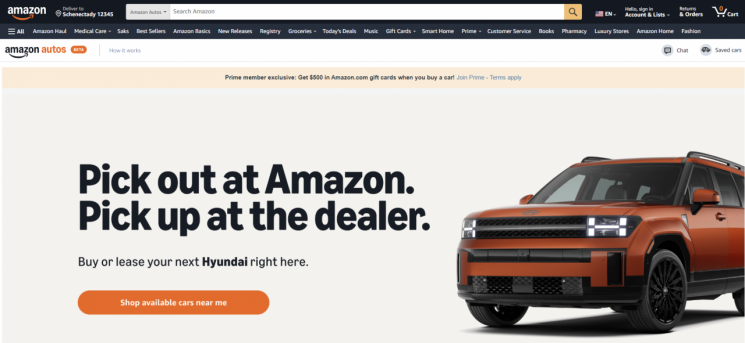

Hyundai Motor is conducting another innovation experiment in the United States, the largest market for online car sales. The company has made it possible to purchase Hyundai vehicles on Amazon, the world's largest e-commerce platform. Hyundai Motor is the first complete car brand to make the entire process?search, purchase, payment, and delivery?possible on Amazon. By entering their zip code and searching for the desired model and specifications on the Amazon site, customers can see the available inventory at the nearest dealership. Consumers can compare prices, options, installment terms, and dealer fees, and make purchases directly. After completing payment and registration, they can pick up the car at a nearby dealership or, if desired, have it delivered to their home.

For Hyundai Motor, this is an opportunity to reach Amazon's vast customer base of over 300 million people. The company can expand its potential customer touchpoints online and raise brand awareness. It can also enhance consumer trust in the purchasing experience by emphasizing transparent pricing, real-time inventory checks, and the convenience of contactless transactions on the Amazon platform. This collaborative model was made possible by finding a way to coexist with dealers. Rather than direct sales by the manufacturer, Hyundai Motor established an online sales model via dealerships for Amazon sales. Dealers list their inventory on the online platform, which matches them with consumers. For dealers, this increases inventory turnover by exposing their stock to more consumers, while consumers can widely compare the conditions of their desired models.

Of course, the situation in South Korea may differ, as the domestic distribution network is primarily based on direct sales by the manufacturer without dealers. However, there is consensus that, ultimately, a solution must be found that allows manufacturers, salespeople, and consumers to coexist through online platforms. If South Korea gradually expands online sales based on realistic compromises, it is only a matter of time before the country emerges as the world's largest market for online car sales.

Hyundai Motor Company and Amazon formed a partnership at the 2023 New York Auto Show to innovate customer experience and transition to the cloud. Jose Munoz, CEO of Hyundai Motor Company, and Mati Malik, Vice President of Global Business Development at Amazon, announced the partnership. Provided by Hyundai Motor Company

Hyundai Motor Company and Amazon formed a partnership at the 2023 New York Auto Show to innovate customer experience and transition to the cloud. Jose Munoz, CEO of Hyundai Motor Company, and Mati Malik, Vice President of Global Business Development at Amazon, announced the partnership. Provided by Hyundai Motor Company

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)