KOSPI Surpasses 2,900 for the First Time in 3 Years and 5 Months

President Lee Visits Korea Exchange, Reaffirms Commitment to "KOSPI 5000"

External Risks Remain, Market Watches for Tariff Negotiation Breakthrough

The KOSPI is attempting to shed its long-held reputation as the "perpetual boxpi." With three key factors?expectations for the new administration, inflows of foreign capital, and the strength of the semiconductor sector?all aligning, there is a growing perception in the market that "this time is different." However, excessive expectations for a sustained rally are being flagged as a risk factor, as it is still difficult to say that tariff uncertainties have been fully resolved.

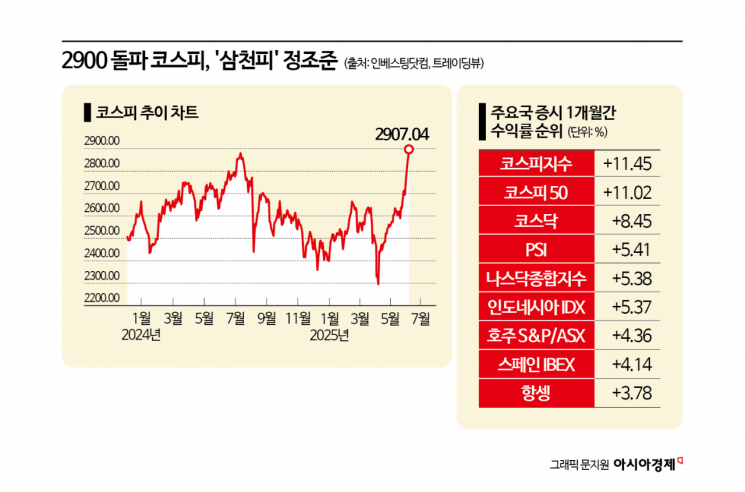

According to the Korea Exchange on June 12, the previous day the KOSPI closed at 2,907.04, up 1.23%. This is the first time the KOSPI has surpassed the 2,900 mark in about three years and five months, since January 18, 2022. On the same day, President Lee Jaemyung visited the Korea Exchange and expressed his commitment to restoring fairness in the capital market and ushering in the KOSPI 5000 era, which is seen as having ignited investor sentiment.

With political instability having been resolved, the KOSPI has risen more than 20% compared to the beginning of the year. Over the past month, the KOSPI and KOSDAQ have surged by 11.45% and 8.45%, respectively, placing them among the top performers of major global indices.

Kim Jaeseung, a researcher at Hyundai Motor Securities, pointed out that the current bull market is being driven by three key factors: expectations for the new administration, net buying by foreign investors, and the strength of the semiconductor sector. He noted that the perception among investors that "this time is different" is spreading. He also assessed that if investor confidence in the Korean stock market is restored in line with President Lee's declaration to resolve the Korea Discount (undervaluation of the Korean stock market), achieving "Samcheonpi" (KOSPI 3,000) within the year would not be out of reach.

President Lee, who has repeatedly pledged to usher in the "KOSPI 5000" era since his candidacy, also visited the Korea Exchange Market Surveillance Committee on this day, signaling a firm stance against disruptive activities in the financial markets. The ruling party has also reaffirmed that the stock market is a top policy priority for the Lee Jaemyung administration by once again pushing for a revision of the Commercial Act to expand directors' fiduciary duties from the current "company" to "company and shareholders." In addition, foreigners have led the market by making net purchases of nearly 4 trillion won in KOSPI stocks so far this month. They have most heavily bought the two leading semiconductor stocks, SK Hynix and Samsung Electronics.

However, experts are warning of the possibility of a correction following the recent rapid rise, as well as tariff risks stemming from the United States. There is speculation that a resolution of tariff negotiations between the U.S. and major countries before July will be the first key hurdle determining whether the "honeymoon rally" can continue.

Lee Euntaek, a researcher at KB Securities, stated, "U.S. President Donald Trump has consistently employed a negotiation strategy of lulling the market into optimism (or complacency) before striking back. If there are no results from (tariff) negotiations at the upcoming G7 and NATO summits, the market will be concerned about July 9, when the '90-day grace period' expires."

Lee Hayoung, head of research at KB Asset Management, commented, "In the short term, various factors such as political events, policy directions, and the global trade environment can affect the market, but in the long term, the global macro environment is likely to continue to drive market trends."

Kim Hyungrae, head of global macro strategy at Samsung Asset Management, said, "Policies to revitalize the stock market are likely to continue, but excessive expectations for such policies should be approached with caution. Once external uncertainties are resolved, sectors with solid earnings fundamentals are expected to stand out."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.