If the Additional Interest Rate Is Lowered, Lending Rates Could Drop by 0.1 to 0.2 Percentage Points

As Lending Rates Decrease, Banks' Net Interest Margin and Pre-Tax Profits May Fall by Up to 10%

President Lee Jae-myung is having a conversation with Woo Won-sik, Speaker of the National Assembly, and other party leaders before having lunch at Sarangjae in the National Assembly on June 4, 2025. Photo by Kim Hyunmin

President Lee Jae-myung is having a conversation with Woo Won-sik, Speaker of the National Assembly, and other party leaders before having lunch at Sarangjae in the National Assembly on June 4, 2025. Photo by Kim Hyunmin

There are projections that if the Lee Jae-myung administration amends the Banking Act as promised and lowers the additional interest rates (spread) applied by commercial banks, lending rates will decrease slightly, but the reduction in bank profits could be greater than expected. There are also concerns that banks, worried about profit declines, may hesitate to lower lending rates or may pass costs on to financial consumers, highlighting the need for more sophisticated policy design.

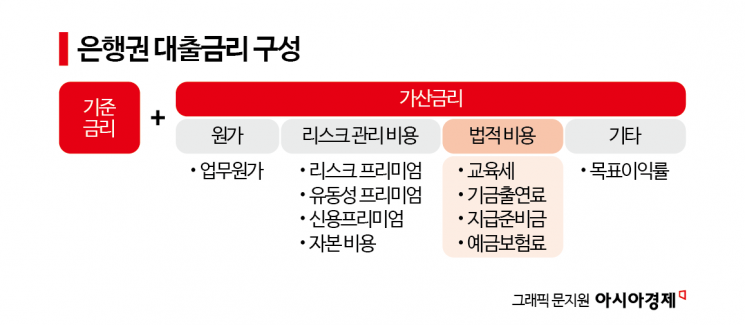

According to the financial sector on June 10, the new administration plans to adjust banks' additional interest rates to reduce the loan interest burden on households and small business owners. The additional interest rate refers to the risk-weighted rate that banks add to the benchmark interest rate when determining lending rates. The Democratic Party of Korea is expected to push for an amendment to the Banking Act to prevent banks from passing on various statutory costs?such as education taxes, fund contributions, reserve requirements, and deposit insurance premiums?when calculating the additional interest rate.

Min Byung-deok, a member of the Democratic Party, and others specified in the amendment to the Banking Act proposed at the end of last year that items such as reserve requirements, insurance premiums under the Depositor Protection Act, and contributions to the Korea Inclusive Finance Agency, Korea Technology Finance Corporation, Korea Agro-Fisheries & Food Trade Corporation, and Korea Credit Guarantee Fund cannot be reflected in lending rates.

If, as per government and political plans, the additional interest rate included in bank lending rates is lowered, borrowers' interest burdens will also decrease. Both financial authorities and the industry estimate that if the additional interest rate is reduced as the government expects, the average lending rate could fall by 0.15 to 0.2 percentage points.

The issue is whether banks will actively participate in the government's policy to lower lending rates. If the additional interest rate is reduced and lending rates fall immediately, there are projections that the net interest margin (NIM) of the banking sector will drop, and pre-tax profits could decrease by up to 10%.

Jeon Bae-seung, a researcher at LS Securities, analyzed, "Assuming that 10% to 30% of statutory costs such as deposit insurance premiums and fund contributions are included in lending rates, the amendment could reduce banks' pre-tax profits by at least 5% and up to about 10%. Unlike mutual growth finance, regulation of the additional interest rate could serve as a continuous margin pressure factor for banks." Choi Jung-wook, a researcher at Hana Securities, estimated, "If contributions to the Korea Credit Guarantee Fund and education taxes are excluded from the additional interest rate, there could theoretically be an approximately 0.1 percentage point decrease in NIM."

Another concern is that banks' capacity to further lower the additional interest rate is not as great as in the past. According to the Korea Federation of Banks, the additional interest rate on new household loans in April was 1.66%, which is not significantly different from the monthly average of 1.67% since 2010. Researcher Jeon pointed out, "The current level of the additional interest rate is not historically high. In the future, it may not be easy for banks to secure sufficient additional interest rates."

As banks' participation in government policy becomes more active, their profitability will inevitably decline, which is expected to increase concerns within the banking sector. Since each bank calculates the additional interest rate differently and it constitutes a trade secret, there are concerns that banks could circumvent regulations and pass costs on to financial consumers. A source in the financial sector commented, "Since this is the early stage of the new administration, it is unlikely that banks will oppose or go against the policy. However, for the policy to be effective, it needs to be designed more precisely."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.