Global Electric Vehicle Battery Market (Excluding China) from January to April 2025

From January to April of this year, the global electric vehicle battery market, excluding China, grew by 26.8% compared to the same period last year. In contrast to the expanding market share of Chinese companies, the combined market share of the three major Korean battery manufacturers fell by more than 5 percentage points over the past year.

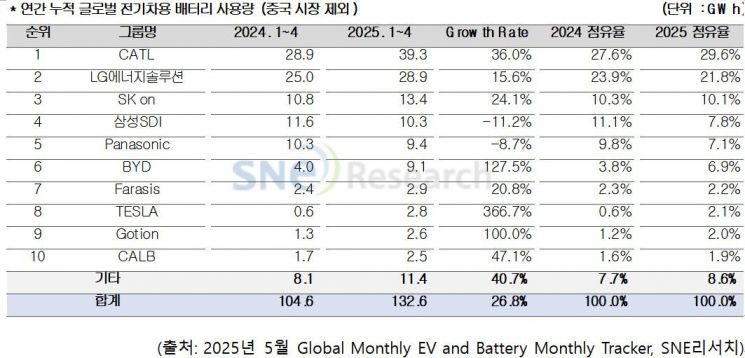

According to SNE Research, an energy sector market research firm, the total battery usage for electric vehicles (including battery electric vehicles, plug-in hybrid vehicles, and hybrid vehicles) sold globally (excluding China) from January to April 2025 was approximately 132.6 gigawatt-hours (GWh), up 26.8% from the same period last year.

During this period, the combined market share of the three major Korean battery companies?LG Energy Solution, SK On, and Samsung SDI?was 39.7%, a decrease of 5.6 percentage points from 45.3% in the same period last year.

LG Energy Solution's electric vehicle battery installations grew by 15.6% (23.9GWh) year-on-year, maintaining second place with a 21.8% market share. SK On recorded a growth rate of 24.1% (13.4GWh), ranking third with a 10.1% market share. Samsung SDI's battery installations decreased by 11.2%, resulting in a 7.8% market share and placing the company fourth.

The decline of Samsung SDI was mainly due to reduced battery demand from major finished vehicle customers in the European and North American markets. SNE Research explained, "While Rivian's R1S and R1T have maintained steady sales in the United States, the launch of the Standard Range trim equipped with another company's lithium iron phosphate (LFP) battery has negatively impacted Samsung SDI's battery usage."

In the global market excluding China, CATL maintained its position as the global leader, growing by 36.0% (39.3GWh) year-on-year. In addition to local Chinese electric vehicle manufacturers, many major global electric vehicle companies are also adopting CATL batteries.

BYD recorded a growth rate of 127.5% (9.1GWh) in markets outside China, ranking sixth. BYD is expanding local production and supply chains to increase its market share abroad, with a particular focus on strengthening its presence in the Korean and European markets.

SNE Research stated, "The aggressive expansion and increased local production investment by Chinese battery companies in Europe are emerging as new challenges for Korean battery companies." The firm added, "Major Chinese companies such as CATL and BYD are strengthening partnerships with local finished vehicle customers by leveraging price competitiveness and production speed, and this is acting as a factor threatening the market share of Korean companies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.