On June 5, KB Securities released a report titled "Thirty Years of Nuclear Power Dominance Explained Through Microeconomics," predicting that nuclear power will dominate the next 30 years due to a surge in electricity demand driven by the emergence of artificial intelligence (AI) and deglobalization caused by major powers' prioritization of their own national interests, rather than renewable energy sources.

As is well known, the first industrial revolution was driven by "coal," as high-density energy was needed to power steam engines. The second industrial revolution, led by internal combustion engines, was dominated by "oil." This was not simply an energy substitution; it was because the countries that secured oil gained global hegemony. Now, with the advent of the third industrial revolution, a third energy transition is underway. The core of this third energy transition has been eco-friendliness, and the main player in eco-friendly energy has been renewables.

However, an unexpected obstacle has recently emerged and is changing the situation: deglobalization.

Microeconomics teaches that "if public goods are left to market choices, 'market failure (the tragedy of the commons)' occurs." Therefore, government intervention is needed to prevent market failure, with penalties and subsidies being the main tools. Since 2000, large-scale subsidies and international cooperation have been implemented worldwide to promote the adoption of renewable energy.

However, deglobalization has changed everything. Both penalties and subsidies are rapidly disappearing. In the era of deglobalization, it has become impossible for China, the United States, Europe, and others to cooperate and take joint action. With the disappearance of penalties through collective action, the result is market failure (free riding). In addition, rising national debt and interest rates are making it difficult for governments to even pay interest. Furthermore, increases in defense spending are just beginning. As a result, there is no room left for eco-friendly subsidies.

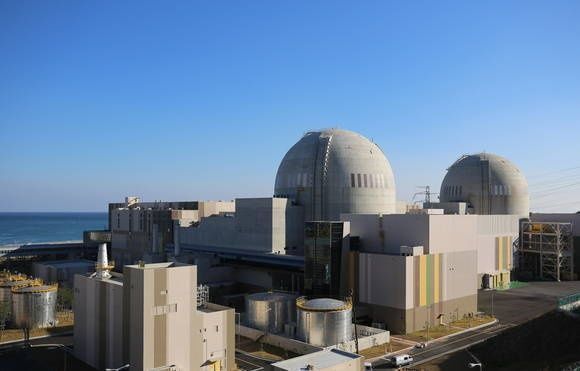

Ultimately, deglobalization has unintentionally brought about a change in the main player. To make matters worse, the recent emergence of AI is expected to once again increase demand for high-density energy. This means a retreat for renewables and a rise for nuclear power. In fact, the stock prices of "renewable ETFs" and "nuclear ETFs" are perfectly symmetrical. The rise in the stock prices of nuclear-related companies, especially those involved in SMRs, is similar to the pattern seen in renewable-related stocks in the 2000s. Even though there is barely any increase in orders, let alone profits, stock prices are reflecting expectations for a change in the main player of the third energy transition.

Lee Euntaek, a strategist at KB Securities, explained, "If you see the rise in nuclear-related stocks not just as a result of 'surging AI demand,' but as a replacement of 'renewable energy,' the current stock price increase may appear in a new light."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.