Anonymous Transactions Outside Exchanges

Many Deals for Money Laundering and Concealment

Rising Concerns Over Secondary Damages Such as 'Exit Scams'

"Tether purchase fee 4%."

This is a post by an over-the-counter (OTC) cryptocurrency dealer on Telegram, offering to buy the stablecoin 'Tether' (a cryptocurrency pegged to the US dollar or other fiat currencies) with cash. The dealer requested "advance cryptocurrency transfer via wallet." The transaction method is non-face-to-face. When the reporter asked, "Can I really trust you?" the dealer provided detailed records of previous transactions. The records included screenshots of customer reviews such as "As expected, brother," and "Since this is not a scam, I will sell 20 million KRW worth of Tether next time."

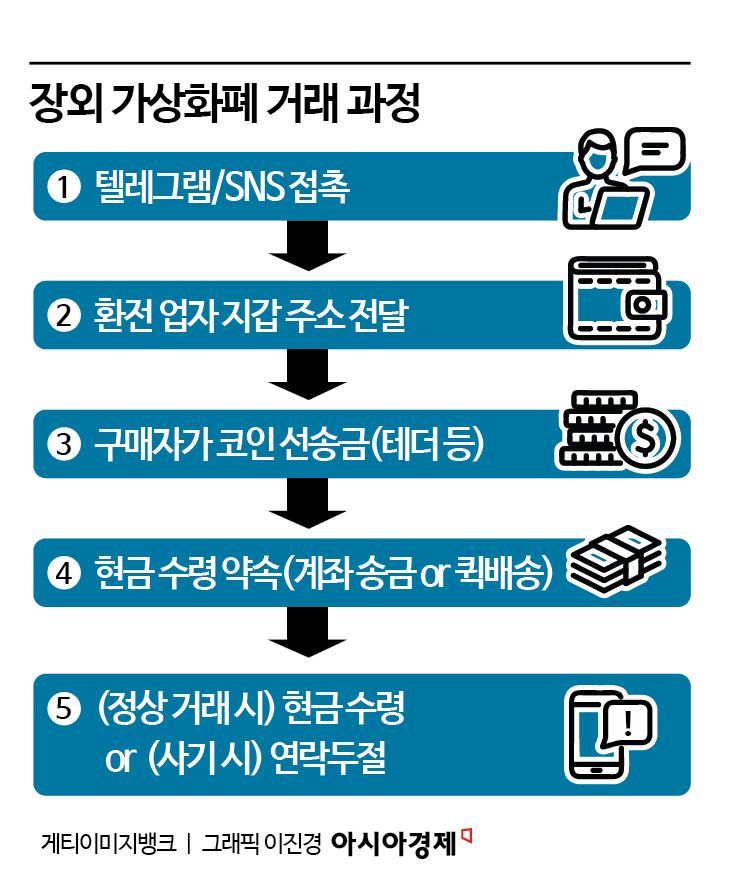

There is a growing trend of individuals buying and selling cryptocurrencies directly with each other, bypassing exchanges. Among these transactions, some are conducted for the purpose of money laundering, which can lead to secondary damages such as fraud.

On June 5, when searching for related keywords such as 'coin trading' and 'sondaeson' (a slang term for direct cryptocurrency trading) in KakaoTalk open chat rooms, several large chat rooms with over 1,000 participants appeared. In these rooms, participants advertise the buying and selling of cryptocurrencies, instructing others to "contact via Telegram for more details."

OTC trading refers to buying and selling cryptocurrencies through wallets without going through a virtual asset exchange. Transactions via wallets do not incur official exchange fees (typically 0.05~0.25%). However, it is suspected that a significant portion of these transactions are used for laundering illicit funds from sources such as drugs, voice phishing, and overseas gambling sites. Unlike exchanges, which leave real-name information and account histories, wallet transactions are guaranteed anonymity through the blockchain.

In fact, some OTC cryptocurrency dealers demand transaction fees dozens or even hundreds of times higher than exchange fees. One dealer contacted via Telegram requested a fee as high as 10%, stating, "I don't ask or care about the story behind the coin."

The most widely used cryptocurrency in OTC trading is Tether. As a stablecoin pegged to the US dollar, it has low price volatility and can be used in most wallets worldwide. Since US President Donald Trump announced that he would support stablecoins as a policy, Tether has effectively emerged as the standard for OTC trading.

The most common secondary damage arising from such OTC transactions is non-face-to-face 'exit scams.' On anonymous platforms such as Telegram, scammers lure victims by offering more favorable terms than the market rate to induce advance cryptocurrency deposits, then disappear. Yoon (27), who has been a victim of such fraud, said, "The dealer seemed relaxed, saying 'I'm not forcing you,' so I trusted him and sent Tether, but I never received the money." There are many similar cases reported on Telegram, open chat rooms, and other platforms.

In face-to-face transactions, theft crimes are occurring. In February, a group was arrested by police in Seocho-gu, Seoul after fleeing without paying for Tether worth 500 million KRW during a transaction. A month earlier in Jeju, a group of Chinese nationals was arrested for defrauding approximately 840 million KRW worth of cryptocurrency by promising to pay 1 billion KRW in cash upon receiving the cryptocurrency. Criminals typically suggest meeting in places with few CCTV cameras or where there are few people, and then flee immediately after confirming the cryptocurrency transfer.

The police estimate that there are far more unreported crimes of this nature. A police official stated, "Victims are often reluctant to report to the police because they may have been trading for money laundering purposes themselves, and scammers exploit this vulnerability."

Experts warn that while OTC trading itself is not illegal under current law, individuals who habitually engage in such transactions could face penalties. Attorney Jin Hyunsoo said, "Under current law, anyone engaging in the business of buying or exchanging virtual assets must report to the Financial Intelligence Unit," adding, "Cryptocurrency exchangers often conduct transactions worth hundreds of millions of KRW, but operating unregistered private OTCs is problematic."

Kim Hyungjoong, a special professor at Korea University's Graduate School of Information Security, said, "If your purpose is simply to trade, you should use an exchange whenever possible," and added, "If you suffer financial damage through OTC trading, it is difficult to receive compensation because transaction records are unclear."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)