Down 0.2 Percentage Points Year-on-Year to 1.51%

Jeonbuk Bank Records Highest at 6.18%

Deposit and Savings Rates Falling in Line with Base Rate

Lending Rates Rising Amid Increasing Household Loans

President Lee Jae Myung's Pledge: "Easing Household Burden"

Efforts Expected to Lower Lending Rates

Although the base interest rate is being lowered, banks are actually raising lending rates, increasing the likelihood that the gap between deposit and lending rates?which narrowed last year?will widen again. While the loan-to-deposit interest rate spread (LDIR spread) decreased slightly last year, it is expected to be difficult to narrow this year due to rising household loan demand and anticipated regulatory measures by financial authorities. As President Lee Jae Myung has pledged to ease the financial burden on households, there is growing attention on whether institutional reforms to lower lending rates will follow.

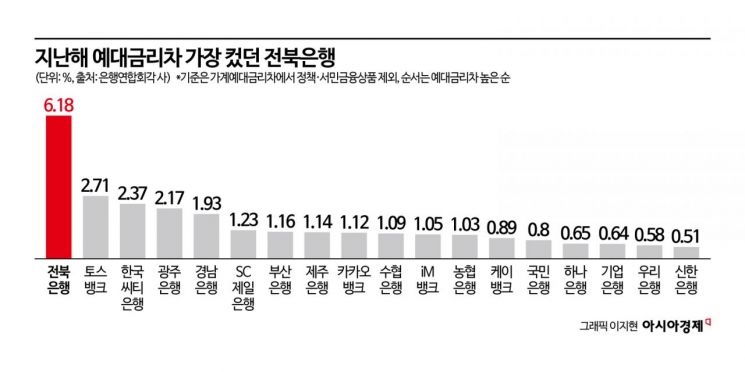

According to the annual management report on banks released by the Korea Federation of Banks on June 5, the average LDIR spread for 18 banks, based on new transactions last year, was 1.51%. This marks a decrease of 0.2 percentage points from 1.71% in 2023. The LDIR spread here excludes policy and inclusive finance products from the household LDIR spread. The 18 banks are Kyongnam, Gwangju, Kookmin, IBK, Nonghyup, Busan, Suhyup, Shinhan, iM Bank, SC First, Woori, Jeonbuk, Jeju, KakaoBank, K Bank, Toss Bank, Hana, and Citibank Korea.

The LDIR spread refers to the difference between the lending rate banks charge borrowers and the deposit rate they pay to depositors. It is a key source of bank profits; the larger the spread, the greater the bank’s earnings. Conversely, companies and consumers using banks may be disadvantaged if banks set higher lending rates and lower deposit rates, as this increases their interest burden.

President Lee Jae Myung delivers the inauguration speech of the 21st president at the National Assembly in Yeouido, Seoul on June 4, 2025. Photo by Kim Hyun Min

President Lee Jae Myung delivers the inauguration speech of the 21st president at the National Assembly in Yeouido, Seoul on June 4, 2025. Photo by Kim Hyun Min

Among the 18 banks, Jeonbuk Bank recorded the highest LDIR spread. Jeonbuk Bank, which also had the highest spread in 2023 at 5.6%, posted a 6.18% gap between household lending and deposit rates last year. Toss Bank followed with a spread of 2.71%. Toss Bank was also second in 2023 with 3.79%. The gap between Jeonbuk Bank and Toss Bank widened compared to 2023; the difference between the top two banks increased from 1.81 percentage points in 2023 to 3.47 percentage points last year. Jeonbuk Bank explained, "The income level of credit loan customers in the Jeonbuk region is the lowest nationwide, and the proportion of multi-debt holders among our customers is 14%, which puts us in a challenging environment. However, since more than 70% of our household loans are extended to financially marginalized groups such as mid- to low-credit borrowers and foreign workers, the LDIR spread may appear relatively high." The bank with the smallest LDIR spread was Shinhan Bank at 0.51%. Shinhan Bank stated, "This is because we continued policies to ease the burden on household borrowers until the implementation of the second phase of the stress-based DSR (Debt Service Ratio) in September last year."

Although the LDIR spread narrowed last year, it remains uncertain whether the gap will continue to shrink this year. While deposit and savings rates have declined in line with the Bank of Korea's base rate cuts, banks?mindful of financial authorities amid a surge in household loans?are instead raising lending rates. According to the Bank of Korea’s Economic Statistics System, the deposit rate for new transactions at deposit banks fell from 3.4% in October last year to 3.37%, and continued to decline for seven consecutive months through April. During this period, the Bank of Korea lowered the base rate three times.

Household loans, which had stabilized and even decreased in January, began to increase more rapidly from April. The change in household loans at the five major banks (Kookmin, Shinhan, Hana, Woori, Nonghyup) was a decrease of 476.2 billion won in January. However, the monthly increase was 3.0931 trillion won in February, 1.7992 trillion won in March, and then surged to 4.5337 trillion won in April?2.5 times higher than the previous month. Last month, the increase reached nearly 5 trillion won at 4.9964 trillion won. Industry analysts attribute this to a rush in demand for mortgage loans ahead of the implementation of the third phase of the stress-based DSR in July. As a result, some banks are raising mortgage rates. On June 2, Woori Bank set its variable-rate mortgage at 4.01?5.51% per annum, up 0.06 percentage points from the last business day of the previous month. K Bank also raised the additional rate for all types of mortgages by 0.3 percentage points, while Kookmin Bank decided to increase its non-face-to-face mortgage rate by 0.17 percentage points starting from June 4.

Given that President Lee Jae Myung, who pledged to ease the financial burden on households, has been elected, measures to lower lending rates are expected. According to the Democratic Party’s presidential campaign pledges, President Lee promised to amend the Banking Act to prevent various statutory costs, such as contributions, from being unfairly passed on to financial consumers when calculating additional interest rates. He also stated that the structure of education tax burdens on financial institutions would be reformed to alleviate the interest burden on financial consumers.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)