2025 BOK International Conference Day 2

"Need to Consider the Tradeoff Between Curbing Inflation Caused by the Green Transition and Achieving Potential Growth"

"In order to curb inflation resulting from the imposition of a carbon tax, a significant economic contraction would be necessary. That is the cost that must be borne."

Marco Del Negro, Economic Research Advisor at the Federal Reserve Bank of New York, emphasized this point during a session titled "Does the Green Transition Cause Inflation?" on the second day of the "2025 BOK International Conference," held at the Bank of Korea in Jung-gu, Seoul, on June 3. He explained that while transition policies to mitigate climate change, such as carbon taxes, do not necessarily cause inflation, they can create a tradeoff between controlling inflation and achieving potential growth rates. He argued that the speed of price adjustments (price stickiness) varies between carbon-intensive industries and other sectors in response to external shocks, which can intensify this tradeoff.

Lee Changyong, Governor of the Bank of Korea (third from the left in the front row), and Christopher Waller, Member of the Board of Governors of the U.S. Federal Reserve (Fed), among others, are taking a commemorative photo on the 2nd at the Bank of Korea annex in Jung-gu, Seoul, during the 2025 BOK International Conference. Photo by Yonhap News

Lee Changyong, Governor of the Bank of Korea (third from the left in the front row), and Christopher Waller, Member of the Board of Governors of the U.S. Federal Reserve (Fed), among others, are taking a commemorative photo on the 2nd at the Bank of Korea annex in Jung-gu, Seoul, during the 2025 BOK International Conference. Photo by Yonhap News

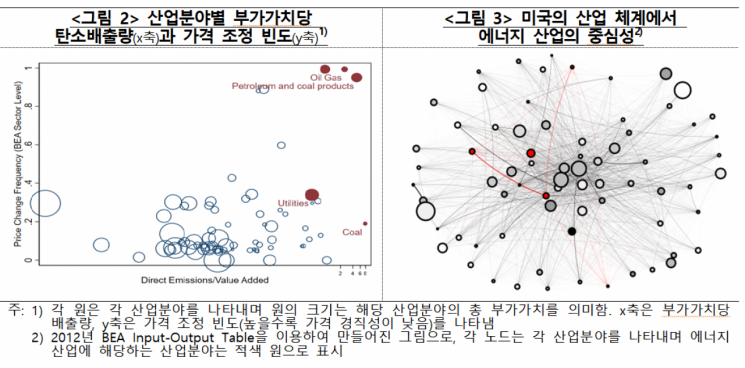

Del Negro stated, "Most previous studies have concluded that the green transition has only a limited impact on inflation, but our research arrives at a different result. When considering the difference in price stickiness between carbon-intensive industries and other sectors, as well as the interdependence among industries revealed in input-output tables, we find that the impact on inflation is substantial."

He explained, "According to our model analysis, if price stickiness in carbon-intensive industries is low, the central bank may have to tolerate higher inflation in order to achieve its potential growth target when a carbon tax is introduced. On the other hand, if the central bank aims to keep inflation at its target level, it would have to accept an economic slowdown to suppress price increases in other sectors, where price stickiness is higher." When the output of carbon-intensive industries is used as intermediate goods in other sectors, the rise in intermediate goods prices due to the carbon tax can lead to changes in the prices of final consumer goods, resulting in more pronounced shifts in overall price trends across the economy.

He continued, "We simulated a scenario in which a carbon tax is gradually increased from $0 to $100 over 100 months in the U.S. economy, and the central bank seeks to achieve potential growth. The results showed that the core inflation rate would likely remain about 50 to 100 basis points (1bp = 0.01 percentage points) above the target inflation rate for roughly 10 years."

The reason carbon taxes cause inflation, he explained, is that prices in carbon-intensive industries are relatively flexible, and the energy sector?a representative carbon-intensive industry?holds a central position in the U.S. industrial structure. He pointed out, "Even in industries with high price stickiness that are not directly subject to the carbon tax, their use of outputs from carbon-intensive industries as intermediate goods means that, when considering input-output analysis, the tradeoff between inflation control and achieving potential growth is significant."

He stressed, "Central bank policymakers need to consider the tradeoff between controlling inflation and achieving potential growth that is triggered by the green transition. While the green transition does not necessarily cause inflation, suppressing inflation during the transition would require accepting a short-term economic downturn."

The session featured lively debate and a Q&A session. When asked, "Even if carbon taxes cause short-term inflation, wouldn't companies find alternatives as the government pushes the green transition, potentially leading to price declines through technological advances? Considering this 'productivity dynamic,' isn't it difficult to say the green transition will cause long-term inflation?" Del Negro replied, "The essence of a tax is to bring about changes in production, and as you pointed out, technological progress can be a catalyst for such change. Situations where innovation occurs and technology transforms the landscape are difficult to quantify, so we were unable to incorporate them into this study."

When asked whether, in a situation where the green transition is necessary despite causing inflation, the central bank could shift its long-term inflation target from 2.0% to 2.5% or 3.0% for about 10 years, he responded, "An increase of 0.5 percentage points over 10 years may not be a major issue. Ultimately, I think that is a decision for the central bank to make."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)