Precautionary Loans Down 68%, Normal Loans Up 48%

Distressed Assets Sold, Performing Loans Extended

Household Lending Stagnant... "Urgent Need to Strengthen Credit Evaluation"

Eighteen major savings banks with assets exceeding 2 trillion won have halved their non-performing real estate project financing (PF) loans over the past year. This is the result of efforts to resolve non-performing loans (NPLs) despite a sluggish real estate market. However, as delinquency rates still approach 10%, there are calls to accelerate the sale of non-performing loans and to increase household lending in order to reduce reliance on real estate PF loans.

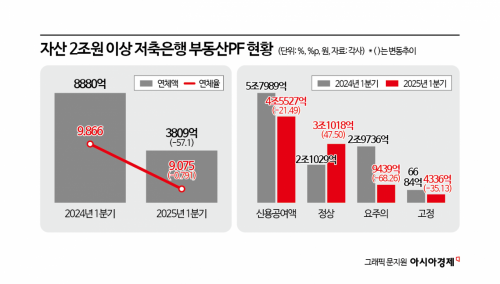

According to a comprehensive analysis by Asia Economy on June 2, the amount of delinquent real estate PF loans at the 18 major savings banks decreased by 57.1%, from 888 billion won at the end of the first quarter last year to 380.9 billion won at the end of the first quarter this year. During the same period, the delinquency rate dropped by 0.79 percentage points, from 9.87% to 9.08%.

The soundness classification for real estate PF loan receivables consists of five stages: normal, precautionary, substandard, doubtful, and estimated loss. The Financial Supervisory Service (FSS) PF project evaluation system uses four stages: good, average, caution, and concern for insolvency. In this system, precautionary loans correspond to "average," while substandard and below loans are classified as "insolvent" (caution and concern for insolvency) assets.

As of the end of the first quarter, the amount of precautionary loans at the 18 savings banks was 943.9 billion won, a 68.3% decrease from 2.9736 trillion won a year earlier. Substandard loans decreased by 35.1%, from 668.4 billion won to 433.6 billion won during the same period. In contrast, normal loans increased by 47.5%, from 2.1029 trillion won to 3.1018 trillion won.

By savings bank, the reduction rates for precautionary loans were as follows: Daol Savings Bank (-86.2%), Moa Savings Bank (-85.1%), Shinhan Savings Bank (-80%), OK Savings Bank (-77.4%), NH Savings Bank (-77.2%), and SBI Savings Bank (-75.1%). For substandard loans, the highest reduction rates were recorded by KB Savings Bank (-91.8%), Moa Savings Bank (-79%), Shinhan Savings Bank (-77.7%), Welcome Savings Bank (-69.2%), and NH Savings Bank (-64.9%).

The highest growth rates in normal loans were seen at OK Savings Bank (188.7%), Aequon Savings Bank (126%), Baro Savings Bank (115.1%), KB Savings Bank (98%), and Moa Savings Bank (85.9%).

The industry sees some progress in the sale of distressed real estate PF assets. Although the overall industry delinquency rate remains high at 9%, the fact that the delinquency rate at major savings banks has fallen by about 1 percentage point over the past year, along with an increase in normal loan performance, is viewed positively.

However, there are concerns that even major savings banks in Seoul and the greater metropolitan area (Incheon and Gyeonggi), which are advantageous for loan business, have struggled to increase household lending. Savings banks are often criticized for having a relatively high proportion of corporate loans compared to first-tier banks. Corporate loans carry a higher delinquency risk than household loans because the borrowers' capital strength can deteriorate rapidly depending on economic conditions.

At the end of the first quarter, household loans at the 18 savings banks totaled 30.8998 trillion won, up 7.2% from 28.8282 trillion won a year earlier. However, household loans at some major savings banks actually shrank: Daishin Savings Bank (-40.5%), Moa Savings Bank (-33.5%), Pepper Savings Bank (-27.4%), KB Savings Bank (-7.3%), and OK Savings Bank (-3.8%).

Pepper Savings Bank, in particular, saw its normal PF loan performance plummet by 76.5%, resulting in 26.8 billion won in delinquent loans and a delinquency rate of 30.9%, indicating poor asset quality. As a result, the industry believes that negotiations over the merger and acquisition (M&A) price with OK Savings Bank have stalled. This situation is seen as not only a problem of Pepper Savings Bank's asset quality management, but also as something that undermines the vitality of the entire sector.

Industry insiders emphasize that revitalizing both the sale of distressed PF assets and the household lending business at savings banks is critical to restoring trust in the sector. The NPL management company under the Korea Federation of Savings Banks is expected to play a significant role in the sale of distressed PF assets. Until now, buyers of NPLs have mainly been NPL investment companies affiliated with financial holding groups, such as Hana F&I and Woori F&I, as well as subsidiaries of mutual finance institutions like the National Credit Union Federation of Korea and the National Agricultural Cooperative Federation. The Korea Federation of Savings Banks' subsidiary is also set to join the sale of distressed PF assets in the second half of the year. According to the FSS, savings banks account for 4% of the total PF exposure across all financial sectors.

To increase household lending at savings banks, there is a growing call to enhance customer evaluation systems for borrowers with low credit scores and limited financial history. There are also calls to accelerate the development of a standard credit scoring system (CSS) for the industry and to promote collaboration on AI-powered mid- to low-credit loans with the recently launched online investment-linked finance sector.

Financial authorities have also stressed the need to upgrade credit evaluation systems for mid- to low-credit borrowers to enhance both the effectiveness of financial support policies for ordinary citizens and the profitability of savings banks. In March, Financial Services Commission Chairman Kim Byounghwan stated when announcing the "Plan to Strengthen the Role of Savings Banks," "To reinforce the fundamental role of savings banks, it is essential to strengthen the industry's own credit evaluation capabilities above all else," adding, "The Korea Federation of Savings Banks should continue to advance the evaluation system for mid- to low-credit borrowers."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.