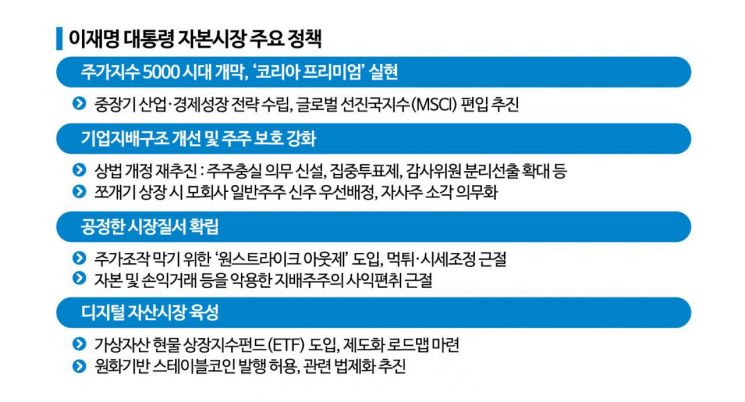

According to the presidential campaign policy book of the Democratic Party of Korea on June 4, President Lee Jaemyung announced his intention to push forward once again with an amendment to the Commercial Act. This amendment would expand the fiduciary duty of directors to include "shareholders" in order to protect the rights and interests of general shareholders by improving corporate governance structures. Previously, an amendment to the Commercial Act, led by the opposition party, passed the National Assembly but was ultimately scrapped after strong opposition from the business community and the government’s exercise of its right to request reconsideration (veto), followed by a re-vote in the National Assembly.

The administration also plans to mandate that companies above a certain size appoint a minimum percentage of independent directors who can provide effective oversight independent from management. The separate election of audit committee members in large listed companies will be gradually expanded, and the cumulative voting system in such companies will also be promoted.

President Lee has repeatedly emphasized the need to eradicate controlling shareholders’ pursuit of private interests by abusing capital or profit-and-loss transactions. In so-called "split-off listings," a certain portion of new shares will be preferentially allocated to general shareholders of the parent company, and the institutionalization of the principle of mandatory cancellation of treasury shares in listed companies will also be pursued. The administration plans to introduce a mandatory tender offer system to ensure that minority shareholders have an opportunity to exit and share in the management control premium when a company is acquired.

President Lee has consistently stated in public that, to achieve KOSPI 5000, Korea’s capital market system must shift from quantitative policies focused on increasing the number of listed companies to qualitative policies aimed at improving the market’s fundamentals. The "one-strike-out rule," which would permanently ban anyone who participates even once in stock price manipulation from re-entering the stock market, is also included in his campaign pledges.

The separate taxation of dividend income, which was proposed as a campaign pledge by Kim Moonsoo, the People Power Party’s presidential candidate and a rival in the presidential race, was not included in President Lee’s campaign pledges. However, ahead of the election, Democratic Party lawmaker Lee Soyoung proposed an amendment to the Income Tax Act to allow separate taxation of dividend income for listed companies with a dividend payout ratio of 35% or higher. As a result, there is growing analysis that the Lee Jaemyung administration is likely to pursue separate taxation.

Lee Sunghoon, a researcher at Kiwoom Securities, commented, "To resolve the Korea Discount (the undervaluation of Korean equities) through governance improvement, conflicts of interest between controlling and general shareholders must be mitigated. To achieve this, amendments to the Commercial Act and tax reforms should be pursued simultaneously."

The development of digital assets is also expected to gain momentum. President Lee pledged to permit the issuance, listing, and trading of spot ETFs based on assets such as Bitcoin. The administration also plans to establish measures for the issuance and distribution of won-based stablecoins and to promote the use of stablecoins.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.