Trump Revives Section 232 of the Trade Expansion Act

Steel Pipe Exports Hit Hard, Domino Effect on Prices Unavoidable

Government and Industry Mobilize Full Response... Considering Diplomatic Solutions

U.S. President Donald Trump announced in a speech over the weekend that, starting from the 4th, his administration will impose tariffs of up to 50% on imported steel and aluminum. This has put the domestic steel industry on high alert. The Ministry of Trade, Industry and Energy held an emergency meeting with key trade officials from major domestic steel companies to begin formulating countermeasures.

According to industry sources on June 2, the Ministry of Trade, Industry and Energy convened an emergency review meeting with the steel and non-ferrous metals industries at the Korea Iron & Steel Association in Songpa-gu, Seoul, earlier that morning. The meeting was held to assess the impact of the U.S. steel tariff hike on major exporting companies and to discuss possible responses. Representatives from POSCO, Hyundai Steel, Dongkuk Steel, and SeAH Steel, among others, reportedly attended the meeting to share their opinions.

On May 30 (local time), President Trump declared during a speech at the US Steel plant in Pittsburgh, Pennsylvania, that tariffs on steel and aluminum products would be raised from 25% to 50%. Since March 12, a 25% tariff had been imposed on foreign steel products under Section 232 of the Trade Expansion Act, and now the tariff rate is being doubled.

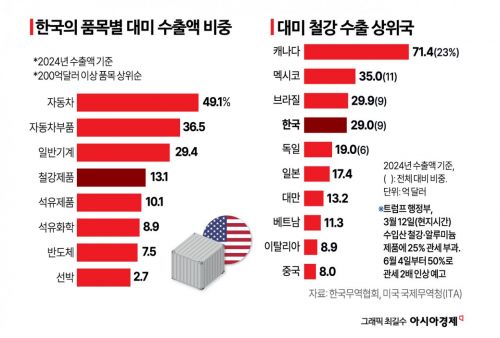

As of 2024, Korea exported $2.9 billion (approximately 3.9927 trillion won) worth of steel to the United States, ranking fourth among U.S. steel import sources. About 13% of Korea's total steel exports are concentrated in the U.S. market. In particular, companies specializing in steel pipes, such as SeAH Steel, Husteel, and Nexteel, have a high proportion of exports to the U.S., making them especially vulnerable to the new tariffs. A SeAH Steel official stated, "We export a significant amount of steel pipe products for the energy sector to the U.S. Since this situation developed in just a day or two, we are currently reviewing the situation through internal response meetings."

POSCO and Hyundai Steel do not have a large share of exports to the U.S. for high-grade steel sheets used in automobiles. However, they believe that if U.S. regulations are prolonged, there could be changes in the supply strategies of global automakers. In particular, if there are changes in Hyundai Motor Group's North American strategy, Hyundai Steel's exports of high-grade steel sheets could also be affected. An industry official commented, "If U.S. import restrictions expand, foreign products from countries like China and Vietnam may be rerouted to Southeast Asia and Europe, which could intensify global oversupply. This structure would also put pressure on domestic steel prices."

Since the 25% tariff was imposed in March, Korea's steel exports have shown a clear downward trend. According to the Ministry of Trade, Industry and Energy and the Korea International Trade Association, Korea's total steel exports last month stood at $2.56 billion, down 12.4% from the same month last year. In particular, steel exports to the U.S. dropped sharply by 20.6% to $220 million during the same period. The cumulative steel exports to the U.S. from January to April this year also fell by 10.2% year-on-year to $1.384 billion. Since the 25% tariff imposed in March has already had a visible impact on exports, most observers believe that a further increase to 50% will inevitably result in short-term damage.

Tariffs by product category are being used as a key negotiating tool by the Trump administration. By imposing high tariffs on major export items, the U.S. can use partial relaxations or exemptions as bargaining chips in trade negotiations with other countries. Given that Korea relies heavily on U.S. imports for many products, there are concerns that not only steel but also automobiles (49.1%), auto parts (36.5%), and semiconductors (7.5%) could become targets of U.S. pressure.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)