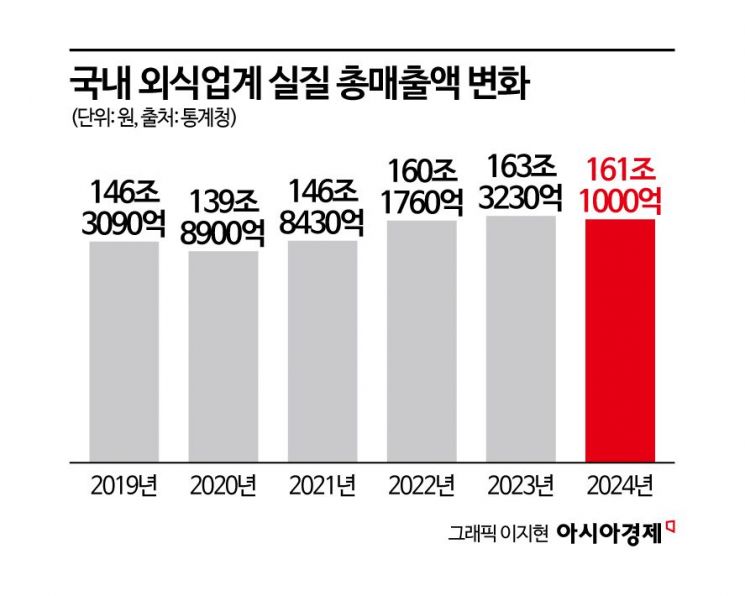

Total Dining-Out Sales in 2024 Drop by 1.4% to 161.1 Trillion Won

Growth of Dining-Out Industry Limited by Weakened Consumer Sentiment

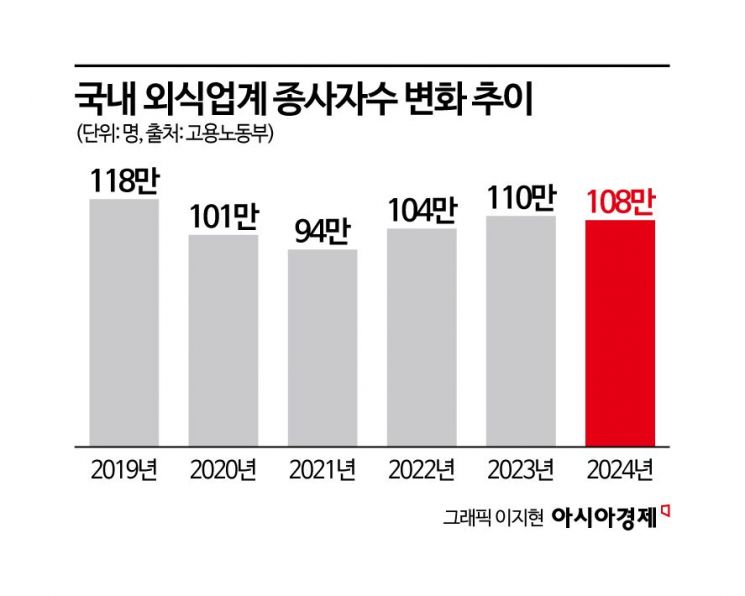

Declining Sales Negatively Impact Job Market

Last year, the domestic dining-out industry saw its sales decline for the first time in four years. The rebound in dining-out demand following the COVID-19 pandemic has once again contracted, due to high inflation and the spread of convenience foods. On top of this, the burden of food ingredient and labor costs has further chilled the overall dining-out industry.

According to Statistics Korea on June 1, the real total sales of domestic restaurants and bars last year were estimated at 161.1 trillion won, a 1.4% decrease compared to the previous year (163.323 trillion won). During the COVID-19 pandemic in 2020, sales hit a low of 139.89 trillion won, but from 2021, the dining-out industry’s sales began to recover. Until 2023, as face-to-face activities increased, the expansion in dining-out demand led to continued growth.

However, recently, rising food ingredient costs, labor costs, and service fees, as well as weakened consumer sentiment due to high inflation and high interest rates, have all acted as constraints on the growth of the dining-out industry, causing it to turn downward for the first time in four years. Furthermore, after COVID-19, consumer culture has shifted from collective event consumption to individual consumption. The increase in single-person households and the persistence of high inflation have expanded the market for convenience foods such as meal kits and convenience store lunch boxes, further aggravating the management difficulties faced by the dining-out industry.

The production index for restaurants and bars (2020=100) also showed a downward trend. It fell from 119 in 2019 to around 100-101 in 2020 and 2021, then rebounded to 117 in 2022 and 2023, but slightly declined to 115 last year. Looking at quarterly figures, the production index for restaurants and bars rose to 103 in the second quarter of 2021 as the impact of COVID-19 partially subsided, and continued to fluctuate upward until the fourth quarter of 2022. However, from the second quarter of 2023, it showed signs of stagnation, and in the first quarter of this year, it declined.

The slump in the dining-out industry has also affected the job market. The number of employees in restaurants and bars had been gradually increasing since reaching 940,000 in 2021, but fell by 1.6% to 1.08 million last year, compared to 1.1 million in 2023. From 2021, when the industry began to recover from the impact of COVID-19, the number of new hires in the dining-out sector started to surpass the number of those leaving, and this trend continued until 2023. However, last year, the number of those leaving slightly exceeded new hires, resulting in a decrease in the number of employees.

Amid management difficulties, dining-out businesses have been trying to endure by increasing their operating hours. In most sectors except for Korean restaurants, the proportion of businesses operating more than 12 hours a day has increased, and the average operating hours have also risen.

As management difficulties intensify in the dining-out industry, a key domestic service sector, there are growing calls for policy support. Specifically, there are calls for the government to take active policy measures to reduce food ingredient costs, alleviate labor shortages and labor cost burdens, and rationalize service fees.

Park Sungjin and Jeon Mugyeong, researchers at the Korea Rural Economic Institute, stated, "To reduce food ingredient costs, it is necessary to streamline the food ingredient distribution structure by securing diverse suppliers, thoroughly managing quality, and improving user awareness. In addition, systematic supply and demand adjustment measures are needed to lower price volatility. Considering the small scale of many dining-out businesses, the government should help ease cost burdens by supporting digital transformation expenses and promote the adoption of food tech, especially for labor-intensive tasks."

They also noted, "Visa application requirements and job scope restrictions are acting as constraints on hiring foreign workers, so it is necessary to consider easing these restrictions. In addition, delivery, unmanned service, and simple payment service fees are emerging as new cost burdens for the dining-out industry, so there needs to be a social consensus on appropriate fee levels, as well as measures to enhance transparency in fee setting."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)