Cumulative Corporate Tax Reaches 35.8 Trillion Won as of April

Income Tax Rises 9.8% to 48.8 Trillion Won

From January to April this year, national tax revenue increased by 16.6 trillion won compared to the same period last year. Following March, corporate tax in April also rose by 57% due to improved corporate performance, driving the overall increase in tax revenue. However, due to sluggish economic conditions and the impact of U.S. tariffs, the outlook for future tax revenue remains uncertain.

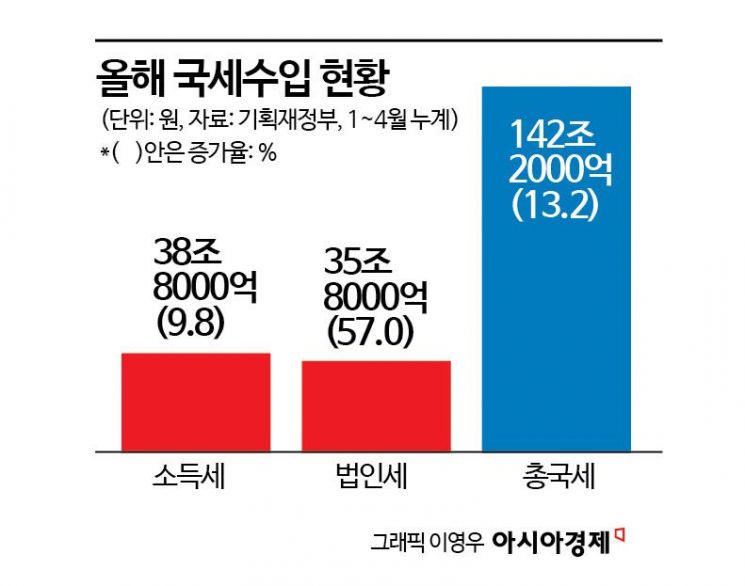

According to the “National Tax Revenue Status for April 2025” released by the Ministry of Economy and Finance on May 30, national tax revenue last month amounted to 48.9 trillion won, up 8.2 trillion won (20.2%) from the same month last year. Cumulative revenue from January to April increased by 16.6 trillion won (13.2%) to reach 142.2 trillion won. As of last month, the progress rate against the main budget was 37.2%, higher than last year’s 34.2%. However, it was lower than the five-year average progress rate based on final accounts (38.3%).

The increase in cumulative national tax revenue through April was largely driven by corporate tax. As of last month, cumulative corporate tax revenue reached 35.8 trillion won, an increase of 13 trillion won (57.0%). This was due to improved corporate performance, with the operating profit of KOSPI-listed companies last year rising by 174.4% year-on-year, as well as increases in corporate interest and dividend income. However, the progress rate against the main budget was 40.6%, lower than the recent five-year average of 42.0%.

Cho Moonkyun, Director of Tax Analysis at the Ministry of Economy and Finance, said, “In March, the amount of installment payments increased due to a rise in general corporate tax filings, and in April, the amount paid increased due to a rise in consolidated corporate tax filings.” However, he added, “Since the third quarter of last year, the semiconductor industry has deteriorated, resulting in corporate performance falling short of initial projections. As a result, the progress rate for corporate tax is lagging behind the historical average, which means there is downside risk.” He continued, “Corporate performance increased in the first quarter of this year, and if this trend continues through the second quarter, and first-half performance rises, we may see an increase in advance payments in August and September, so we need to keep an eye on the situation.”

Among the three major tax items along with corporate tax, income tax recorded 38.8 trillion won as of the cumulative total for April, up 3.5 trillion won (9.8%). An increase in performance bonuses and the number of employees led to a 3.2 trillion won (15.1%) rise in earned income tax (24.5 trillion won), which had a significant impact. Another major tax item, value-added tax, fell by 600 billion won (1.6%) to 39.7 trillion won as of the cumulative total for April, mainly due to an increase in refunds.

Securities transaction tax plummeted by 800 billion won (44.6%) to 1.1 trillion won as of the cumulative total for April, due to a decrease in securities transaction volume. The transportation, energy, and environment tax increased by 500 billion won (14.7%) to 4.1 trillion won, influenced by the partial restoration of the flexible fuel tax rate.

The outlook for future tax revenue remains uncertain. This is due to worsening economic conditions and the potential impact of increased uncertainty in U.S. trade policy. The government plans to continuously monitor economic conditions and monthly payment trends.

Director Cho said, “The overall tax revenue progress rate is 1.1 percentage points lower than the five-year average, and corporate tax performance is also somewhat weak. In addition, the uncertainty surrounding Trump’s tariff policy continues to grow, so we need to keep a close watch on the situation.” He added, “Value-added tax appears to be affected by U.S. tariffs, while corporate tax and others are based on last year’s performance and have not yet reflected these changes. We will need to monitor developments through the second half of the year.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)