China dominates over 80% of the global separator market

Toray's withdrawal presents new opportunities for Korean companies

SKIET poised to fill the gap with advanced technology

US countervailing duties on Chinese products may benefit Korean firms

China has been found to account for more than 80% of the global lithium-ion battery separator market. While Korean and Japanese separator companies are struggling due to China's overproduction, some analysts believe that the withdrawal of Japan's Toray from the market could present an opportunity for Korean separator companies.

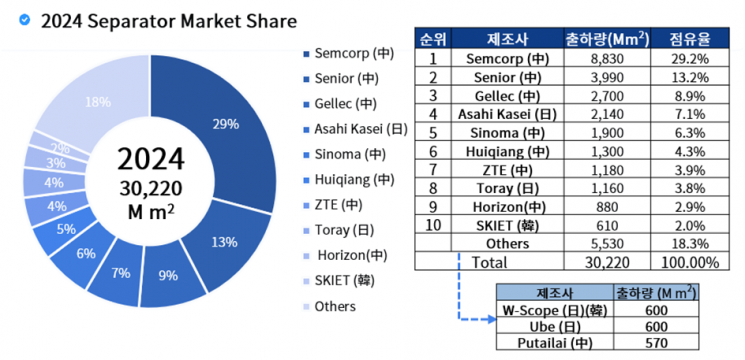

According to the report "Q1 2025 Lithium-ion Battery Four Major Materials Supply Chain Management (SCM) Analysis and Mid- to Long-term Market Outlook" published by SNE Research on May 30, 2024, the demand for lithium-ion battery separators in 2024 reached 23.2 billion square meters, while shipments totaled 30.2 billion square meters. Compared to the previous year, demand increased by 30% and shipments by 22%.

SNE Research explained, "Excessive shipments compared to demand were recorded due to a combination of factors, including proactive inventory buildup, overcapacity, and strategic efforts to expand market share." The firm added, "As a result, the profitability of many separator companies has deteriorated."

By application, separators for electric vehicles accounted for the largest share at 20.8 billion square meters, followed by energy storage systems (ESS) at 7.7 billion square meters, and consumer electronics at 1.8 billion square meters. It was analyzed that Chinese companies accounted for more than 80% of the total shipments.

By company, SEMCORP maintained its top position with a 29% market share, while Senior held onto second place. Gellec also saw a sharp increase in shipments, entering the top three with an 8.9% share.

In contrast, Japanese company Asahi Kasei (4th place), Korea's SK IE Technology (SKIET, 10th place), WCP, and other Korean and Japanese separator manufacturers saw their shipments stagnate due to inventory adjustments by customers and a slowdown in European demand.

Meanwhile, Japan's chemical giant Toray officially mentioned the possibility of withdrawing from the lithium-ion battery separator business due to the slump in the electric vehicle market. On May 26, Toray President Mitsuo Oya stated at a press conference, "Given the stagnation of the electric vehicle market and rising costs, we are keeping all options open, including downsizing or withdrawing from the lithium-ion battery separator business." He also announced plans to sell Toray's 20% stake in the separator joint venture in Hungary, co-invested with LG Chem, to LG Chem.

This is expected to create new opportunities for domestic separator companies. SNE Research stated, "SKIET, the leading player in the separator industry, is well positioned to quickly fill the market gap left by Toray's withdrawal." With production bases in Poland and China, SKIET supplies products suitable for high-power and high-safety electric vehicles through its high-performance ceramic coated separator (CCS) technology.

In addition, the recent preliminary decision by the U.S. Department of Commerce to impose countervailing duties on Chinese-made separators is also expected to be a positive development for Korean separator companies such as SKIET. SNE Research forecast, "Toray's withdrawal signals a global restructuring of the battery materials supply chain and could serve as an opportunity for Korean materials companies to expand their market presence based on technological competitiveness."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)