Series of Acquisitions in Japan... Quiet at Home

Criticism Intensifies over Homeplus Controversy

New Strategy Targeting Third-Generation Chaebol Shareholdings Falters

Potential Shift to a More Stable Path in Japan

MBK Partners, the largest private equity fund (PEF) manager in Northeast Asia, is shifting its investment focus from Korea to Japan. Amid growing public criticism stemming from the Homeplus controversy and as its strategy of targeting the weak shareholdings of third-generation chaebols such as Korea Zinc and Hankook & Company has stalled, the firm appears to be adopting a more stable investment approach for the time being.

Series of Investments in Japan... Quiet on the Domestic Front

According to the investment banking (IB) industry on May 30, MBK Partners recently secured exclusive negotiating rights to acquire Makino Milling Machine, a Japanese machine tool manufacturer. The acquisition price is expected to exceed 2 trillion won. MBK has recently shown little interest in acquiring the bio division of CJ CheilJedang in Korea and did not participate in the acquisition of SK Siltron, which was the largest deal in the first half of this year.

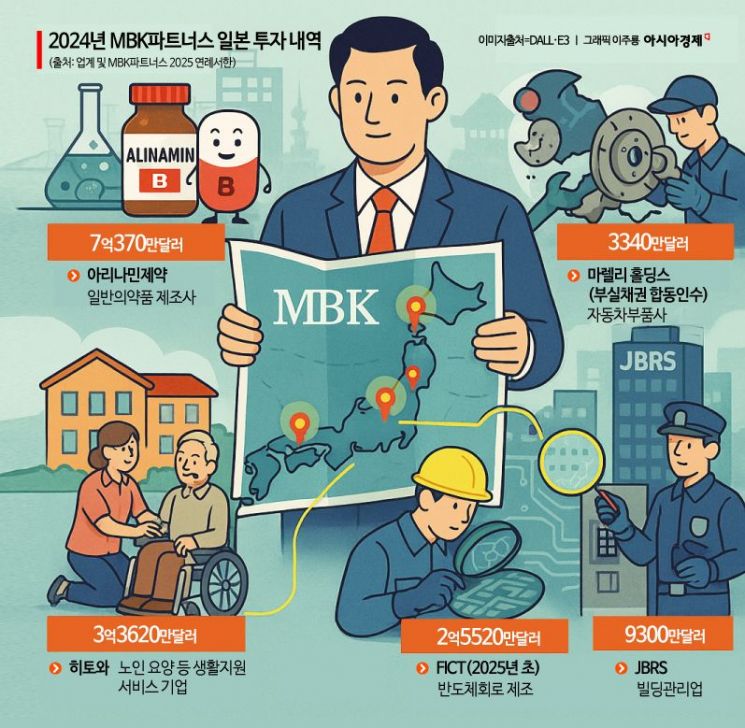

In fact, since the acquisition of GeoYoung in April last year, MBK has not completed any management control acquisitions in Korea. The 1 trillion won invested in ConnectWave was a follow-up investment to a previous deal. In contrast, MBK has remained active in Japan. According to the annual letter sent by Chairman Byungjoo Kim to investors earlier this year, MBK invested $336.2 million (about 462 billion won) in the acquisition of Hitowa Holdings, a healthcare company providing elderly care services, at the beginning of last year. Subsequently, the firm made active investments in Arinamin Pharmaceutical, a manufacturer of over-the-counter drugs ($703.7 million), FICT, a semiconductor circuit manufacturer ($255.2 million), Marelli Holdings, an auto parts company ($33.4 million, joint acquisition of distressed assets), and JBRS, a building management company ($93 million), among others. This has led to interpretations that MBK's main stage of activity may shift entirely to Japan.

A Whale Too Large... Blocked in China, Facing Limits in Korea

MBK has long maintained a strategy of focusing investments in the Northeast Asian region. However, it has virtually halted new buyout (management control acquisition) deals in China, and has concentrated its activities mainly in Korea and Japan.

In the Korean market, MBK has found itself with increasingly limited room to maneuver. Its growth, achieved through past successes, has ironically become a burden. MBK's assets under management (AUM) stand at $31 billion, with a single buyout fund reaching as much as 10 trillion won. Typically, each fund makes around 10 investments. To fully deploy its funds, MBK must participate in trillion-won-scale deals. Given that PEFs usually invest with leverage, MBK must find multiple investment targets worth several trillion won each. Like the National Pension Service in the domestic stock market, MBK has become a 'whale' too large for the market to easily absorb. An IB industry insider explained, "For any sizable deal, MBK is the first firm people approach, which is a reflection of this situation. However, it is becoming increasingly difficult to distinguish quality assets at fair value, while sellers only demand higher prices, so MBK's position is not easy."

A 'New Strategy' Targeting Third-Generation Chaebol Shareholdings

In response, MBK recently adopted a new strategy of targeting the weak shareholdings of third-generation chaebols in Korea. Its involvement in the 2023 management control dispute between brothers at Hankook & Company is seen as a kind of rehearsal. Because the shareholding gap between the brothers was not large, MBK could play the role of a kingmaker. At the time, Chairman Cho Hyunbum, who held management control, was embroiled in various embezzlement and breach of trust lawsuits, which MBK judged would give it an advantage in the legitimacy battle. The various conditions MBK attached during the public tender offer were also seen as both a safeguard and a simulation.

Having gained experience from this mock evaluation, MBK set its sights on Korea Zinc last year. Noting that Chairman Choi Yoonbum, the second-largest shareholder with management control, held only about a 17% stake, MBK teamed up with Young Poong, the largest shareholder, to try to secure management control. Although it failed to gain control of the board due to controversies over circular shareholding, it did secure a larger stake than its rival. However, after the Homeplus controversy erupted, everything came to a halt. Public criticism of MBK intensified to the point where the firm was regarded as a social evil, and Chairman Byungjoo Kim was subjected to an unprecedented search and seizure as well as a travel ban.

An executive at another private equity firm commented, "As many large Korean conglomerates transition to third-generation management, there are quite a few companies with vulnerable shareholdings. If MBK had succeeded in the Korea Zinc case, it would have had a great opportunity to pitch a new Korean profit model to global mega-LPs. But as the situation unexpectedly faltered, it seems MBK decided to shift its focus to Japan for now, despite the various cumbersome regulations there."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.