Hanwha Asset Management stated on May 29 that the 'PLUS Global Nuclear Value Chain' ETF could benefit from U.S. President Donald Trump signing an executive order aimed at revitalizing the nuclear industry.

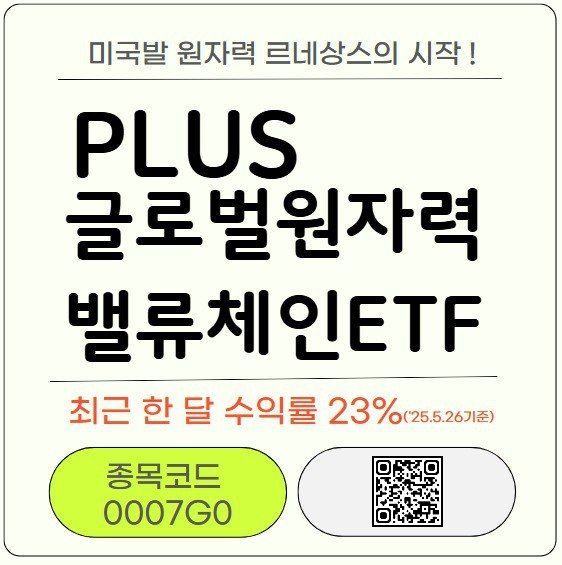

The PLUS Global Nuclear Value Chain ETF surged by approximately 15% over the past two trading days, rising 6.37% on the 23rd and 8.52% on the 26th. The ETF's one-month return stands at 23.51%.

The ETF has delivered strong returns as President Trump recently signed an executive order to quadruple the United States' nuclear power capacity by 2050, which is expected to benefit related industries. The executive order includes provisions such as starting construction on 10 large nuclear reactors by 2030, reforming (reducing the authority of) the Nuclear Regulatory Commission (NRC), shortening the approval process for new nuclear power plants to within 18 months, considering the installation of reactors on federal land and military bases, and expanding uranium mining and enrichment in the United States.

The background of the executive order lies in the 'global energy hegemony war.' The order is interpreted as an intention to respond to the surge in electricity demand driven by the development of the artificial intelligence (AI) industry and to reorganize the global nuclear market around the United States in opposition to China's aggressive expansion of nuclear power. The United States previously imported uranium from Russia, but is now focusing on reducing foreign dependence and strengthening its own nuclear value chain competitiveness.

The PLUS Global Nuclear Value Chain ETF is a product that enables comprehensive investment across the global nuclear industry, which is regarded as a key element of the global energy hegemony competition and a core power source in the AI era. The ETF portfolio covers both upstream and downstream sectors of the nuclear value chain, including uranium mining and concentrate production (Cameco, Uranium Energy), uranium conversion and enrichment (Centrus Energy), nuclear plant design and construction (BWX Technologies, NuScale Power), small modular reactors (SMRs) (Fluor, NuScale Power), and physical uranium investment funds (Sprott Physical Uranium Trust), and can even invest in physical uranium itself.

Kim Jeongseop, Head of the ETF Business Division at Hanwha Asset Management, said, "Amid the global energy hegemony war, the United States will continue to strengthen its value chain with domestic and allied nuclear-related companies." He added, "We expect nuclear power to emerge as a major energy source in the United States over the medium to long term, and now is the time to invest in the PLUS Global Nuclear Value Chain ETF, which covers the entire nuclear industry, including uranium mining/concentrate production, conversion/enrichment, and design/construction."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.