"Construction investment lowered the growth forecast by 0.4%p"

"Export slowdown worsened by larger-than-expected US tariff impact"

If US-China conflict reignites, this year's growth rate could be limited to 0.7%... If mutual tariffs are blocked, growth could rise to 0.9%

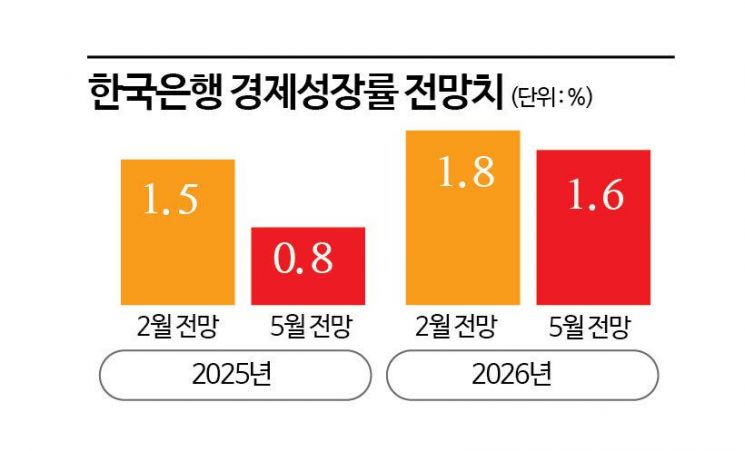

The fear of an 'R (Recession)' has descended upon the Korean economy. On May 29, the Bank of Korea sharply lowered its economic growth forecast for this year from 1.5% to 0.8%. This adjustment reflects the prolonged weakness in domestic demand, particularly in consumption and construction, as well as expectations that exports?a major pillar of the Korean economy?will be hit much harder than previously anticipated due to tariffs imposed by the United States. To address the dual challenges of shrinking domestic demand and slowing exports, the Monetary Policy Committee of the Bank of Korea cut the benchmark interest rate from 2.75% to 2.50% per annum.

Lee Changyong, Governor of the Bank of Korea, is answering questions at a press conference held after the Monetary Policy Committee meeting on the 29th. Bank of Korea

Lee Changyong, Governor of the Bank of Korea, is answering questions at a press conference held after the Monetary Policy Committee meeting on the 29th. Bank of Korea

"Construction investment lowered growth forecast by 0.4%p... Export slowdown worsened by larger-than-expected US tariff impact"

In its revised economic outlook released on this day, the Bank of Korea downgraded its real GDP growth forecast for Korea this year to 0.8%. This is a sharp reduction of 0.7 percentage points from the February forecast of 1.5%, effectively halving the outlook. It is the first time in five years that the Bank of Korea has adjusted its annual forecast by 0.7 percentage points or more, the last instance being in August 2020 during the COVID-19 pandemic, when the outlook was lowered by 1.1 percentage points from -0.2% to -1.3%.

This outcome is the result of a combination of worsening domestic demand, deteriorating global trade conditions due to the tariff war, and a slowdown in exports. The Monetary Policy Committee believes that while domestic demand will gradually recover, the pace will be slow. Lee Changyong, Governor of the Bank of Korea, explained at a press conference on this day, "Even though there has been progress in US-China trade negotiations and the government's supplementary budget has been finalized, the main reason for lowering the growth rate by 0.7 percentage points was the impact of construction. Although construction investment accounts for about 14% of total GDP, the deepening slump in the construction sector has led to a larger-than-expected decline, acting as a factor that lowered the growth forecast by about 0.4 percentage points." He also pointed out that private consumption, which performed poorly in the first quarter and is expected to recover more slowly than initially anticipated in the second quarter, was seen as a factor reducing the annual growth rate by about 0.15 percentage points.

Exports are also sluggish in non-IT sectors such as petrochemicals and steel due to structural factors like weakened global competitiveness. Above all, the impact of US tariffs has become larger than previously reflected in the outlook, which is expected to further slow exports. Governor Lee noted, "Exports have seen a much greater slowdown due to higher US tariff rates compared to the February baseline projection," adding, "This served as an additional factor lowering the growth rate by 0.2 percentage points."

If US-China conflict reignites, this year's growth rate could be limited to 0.7%... If mutual tariffs are blocked, growth could rise to 0.9%

The Bank of Korea's 0.8% growth forecast is lower than those of the Organisation for Economic Co-operation and Development (OECD·1.5%), the Asian Development Bank (ADB·1.5%), and the International Monetary Fund (IMF·1.0%). It matches the average forecast (0.8%) of eight major overseas investment banks as of the end of last month, as well as the forecast (0.8%) presented by the Korea Development Institute (KDI) this month.

The Bank of Korea projects private consumption to grow by 1.1% and facility investment by 1.8% this year. These are 0.3 percentage points and 0.8 percentage points lower, respectively, than the February forecasts. The construction investment outlook was sharply revised down from -2.8% to -6.1%. Goods exports were adjusted from 0.9% to -0.1%, and goods imports from 1.1% to 0.2%. The current account surplus is expected to reach $82 billion, surpassing the February forecast of $75 billion. While customs-cleared exports are expected to decrease due to the impact of US tariffs, imports are projected to decline even more sharply due to falling oil prices and weak domestic demand, resulting in a larger surplus than previously forecast.

The growth rate for next year was also revised downward from 1.8% to 1.6%. The outlook suggests that Korea will experience low growth of around 1% for two consecutive years, this year and next. The inflation rate is expected to move close to the target (2.0%). This year's inflation forecast remains at 1.9%, unchanged from February. For next year, the forecast was slightly lowered by 0.1 percentage points to 1.8% compared to the previous projection (1.9%).

In its May economic outlook, the Bank of Korea assumed that the US base tariff rate of 10% and item-specific tariffs of 25% would largely be maintained. It also assumed that some (10%) item-specific tariffs on semiconductors, pharmaceuticals, and other goods would be imposed in the second half of the year. If the situation turns more pessimistic, the Bank projected that if the US-China conflict reignites and US mutual tariffs are raised to about half their previous levels after the grace period, growth rates for this year and next could fall to 0.7% and 1.2%, respectively.

Conversely, if trade negotiations proceed smoothly and tariffs are significantly lowered by the end of this year, the growth rate could reach 0.9% this year and 1.8% next year. The Bank of Korea explained that if the US federal court's recent ruling blocks the implementation of President Donald Trump's mutual tariff policy, the growth rate this year could be similar to or slightly higher than the optimistic scenario (0.9% growth).

"There is a possibility of a larger rate cut"... Market expects year-end policy rate of 2.00% to be dominant

The Monetary Policy Committee of the Bank of Korea announced on this day that it had lowered the benchmark interest rate to 2.50% per annum. This is a 0.25 percentage point cut from the previous 2.75%, in line with market expectations. Since shifting to a rate-cutting cycle by lowering rates in October last year for the first time in three years and two months, the committee has now implemented a total of four rate cuts, including those in November last year, February this year, and this month.

Governor Lee said, "Although there are still significant concerns about the rising pace of household debt and increased volatility in the foreign exchange market, with inflation remaining stable and growth expected to decline sharply, we judged that an additional rate cut was appropriate to ease downward pressure on the economy." He added, "There is a possibility that the (final) rate cut could be somewhat larger going forward."

While not disclosing the specific level of the final rate, he explained, "Compared to the rate path that the Monetary Policy Committee members envisioned in February, it is now lower." After the February rate cut, Governor Lee had commented at a press conference, "The prevailing opinion in the market seems to be that the rate will be cut two to three times this year, including the February cut. The market outlook is not very different from the committee's assumptions." At that time, the year-end rate was expected to be in the range of 2.25% to 2.50%, suggesting that the cut could be even larger. Previously, a survey conducted by Asia Economy of 17 economic experts showed that a majority (64.7%) expected the year-end policy rate to be 2.00%.

Governor Lee also cautioned that the possibility of a rapid increase in household debt due to monetary easing should be watched closely. He said, "We will fully consider concerns that further rate cuts could lead to asset price increases when making future decisions," emphasizing, "The committee members also believe that the impact on Seoul real estate prices and household debt should be considered when deciding on rates." He viewed a 'big cut' (a 0.50 percentage point reduction) in the same context. Governor Lee pointed out, "If rates are lowered quickly through a big cut, there is a risk of repeating the mistakes made during COVID-19, such as capital flowing into real estate and driving up housing prices."

He stated, "I hope the new government and we can share a mutual understanding that adjusting the household debt-to-GDP ratio is necessary, and that monetary policy should not supply liquidity to the extent that it stimulates real estate prices in specific regions."

Regarding the burden of the Korea-US interest rate gap, he explained, "If the gap becomes too large, we cannot help but worry about capital flows and other issues. However, compared to two to three years ago when the US made a giant step (0.75 percentage point hike), the speed and impact on the exchange rate are different now, so we have more room to act independently."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.