Bogeumjari Loan, a Representative Policy-Based Financial Product for Ordinary Citizens, Keeps Rates Unchanged for Four Consecutive Months

With Market Rates Falling, Commercial Bank Mortgage Rates Become Cheaper, Creating a "Rate Reversal"

Base Rate Cut Expected to Increase Demand for Refinancing

Bogeumjari Loan, a representative policy-based financial product for ordinary citizens, has been found to be less competitive than commercial banks’ mortgage loan rates. While mortgage rates at commercial banks have dropped to the 3% range due to falling market interest rates, Bogeumjari Loan rates have remained unchanged for four consecutive months. As a result, in some cases, Bogeumjari Loan rates are now higher than those of commercial bank mortgage products, creating a “rate reversal” phenomenon. With the Bank of Korea lowering its base rate on May 29 and market interest rates expected to fall further, demand for refinancing from policy loans to commercial bank mortgage products is likely to increase.

According to the banking sector on May 30, as of May 28, the lowest mortgage rates at the four major commercial banks (KB Kookmin, Shinhan, Hana, and Woori) ranged from 3.38% to 3.56%. Including preferential rates, the lowest fixed (mixed/periodic, 5-year bank bond) rate at KB Kookmin Bank was 3.56%, Shinhan Bank (5-year bank bond) was 3.46%, Hana Bank (5-year fixed/mixed) was 3.459%, and Woori Bank (5-year variable) was 3.38%.

In contrast, the “Akkim-e Bogeumjari Loan” (fixed rate) from Korea Housing Finance Corporation, a flagship policy product, is at an annual rate of 3.65% to 3.95% (varying by loan term). The rates are 3.65% for a 10-year term, 3.75% for 15 years, 3.80% for 20 years, 3.85% for 25 years, and 3.90% for 30 years. Despite the recent downward trend in market interest rates, Korea Housing Finance Corporation has kept its rates unchanged for four consecutive months since February this year.

Notably, for the 30-year term, which is the most popular choice among borrowers, commercial banks tend to offer lower rates for longer repayment periods, while the Bogeumjari Loan remains at a fixed rate of 3.90%, which is higher than commercial bank offerings. Korea Housing Finance Corporation does offer up to a 1.0 percentage point preferential rate for victims of jeonse fraud, people with disabilities, single-parent families, and low-income youth, but it is not easy to meet these conditions.

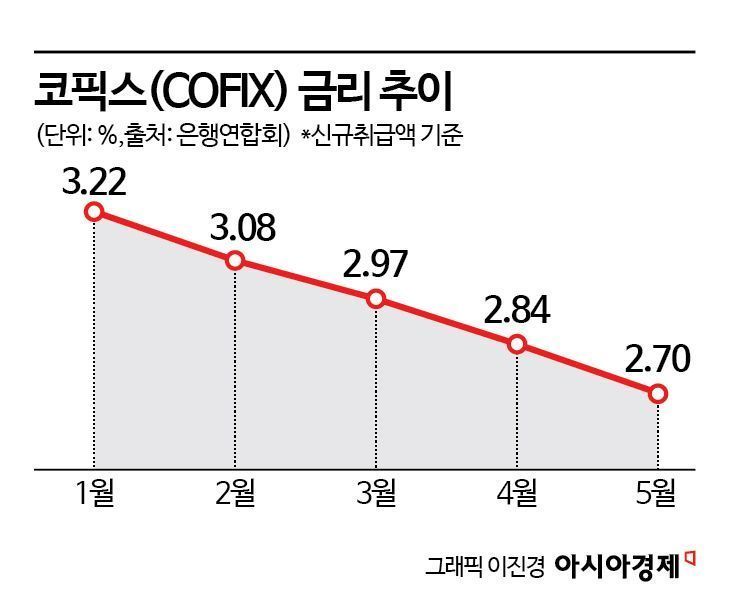

The “rate reversal” in which Bogeumjari Loan rates exceed those of commercial bank mortgages is due to the continued decline in the bank bond and COFIX (Cost of Funds Index) rates, which serve as the basis for commercial banks’ mortgage rates. The COFIX rate (based on new loans) has steadily fallen from 3.22% in January this year to 3.08% in February, 2.97% in March, 2.84% in April, and 2.70% in May.

Given the lack of rate competitiveness and the strict eligibility requirements, preference for commercial bank mortgage products over Bogeumjari Loan is expected to increase. To apply for Bogeumjari Loan, the combined annual income of a married couple must not exceed 70 million won, and the property value must be 600 million won or less. Compared to another policy mortgage, the Newborn Special Loan, which allows for an annual income of up to 200 million won and properties valued up to 900 million won, the requirements are much stricter. Furthermore, with the Bank of Korea having lowered the base rate by 0.25 percentage points to 2.50% the previous day and the possibility of one or two additional cuts in the second half of the year, demand for refinancing into commercial bank mortgage products is expected to rise even further.

A commercial bank official stated, “Recently, there has been a noticeable increase in inquiries about refinancing due to the recent decline in market rates. However, due to the continued policy of managing household loans, refinancing demand from other banks or policy loans is counted as new loans, making it difficult to accommodate all of the refinancing demand.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.