Expansion of the Saechulbal Fund's Role

New Loan Measures for Small Businesses

No Mention of Funding Scale by Either Candidate

Similar to Current Policies... Lacking in Detail

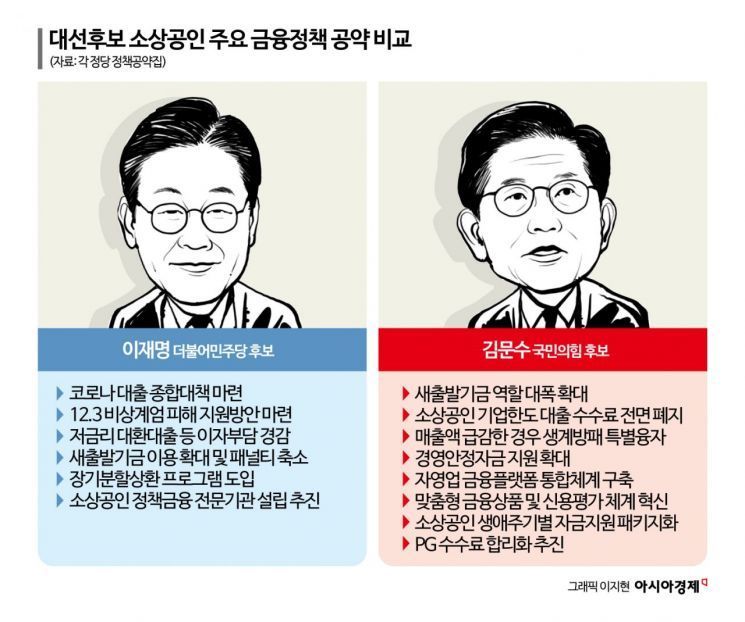

Lee Jaemyung, the Democratic Party candidate for president, and Kim Moonsu, the People Power Party candidate, both actively proposed measures to ease the financial burden on small business owners. Coincidentally, both candidates pledged to expand the role of the “Saechulbal Fund,” a debt adjustment program for small business owners. They also mentioned the need to establish new loan policies for small businesses. However, there is criticism that the details are insufficient and that neither candidate specified the budget for the Saechulbal Fund or the loan policies.

Lee Jaemyung: "Drastically Easing the Financial Burden on Small Businesses"... Support for Victims of the 12·3 Martial Law

According to the Democratic Party’s presidential policy pledge book released on the 28th, Lee Jaemyung stated, “We will establish a comprehensive COVID-19 loan countermeasure.” He made it clear that he would implement special measures for COVID-19 loans in stages, ranging from debt adjustment to debt forgiveness.

He also promised to prepare support measures for small business owners affected by the 12·3 Martial Law last year. This is the only significant difference in small business financial policy between the candidates. This move appears to be a strategy to remind the public of the martial law crisis, which triggered the early presidential election, and to gain the support of small business owners who suffered losses at that time.

He also mentioned expanding low-interest refinancing loans and interest support programs. The “low-interest refinancing program” to reduce interest burdens for small business owners has been in place since 2022. In 2023, the eligibility and limits were expanded so that more individual business owners could benefit as they recovered from COVID-19. In addition, household credit loans used for business purposes were also included in the low-interest refinancing program.

He further stated that he would relax the eligibility criteria for the Saechulbal Fund and reduce penalties. The Saechulbal Fund is a debt adjustment program for small business owners. It was launched in 2022 to help small business owners and self-employed people who suffered unavoidable losses during the COVID-19 recovery process. This year, the program expanded its coverage and simplified the application process.

Additionally, he specified plans to introduce a customized long-term installment repayment program for small business owners and the self-employed, as well as to establish a specialized policy finance institution for small businesses.

Lee Jaemyung Separately Mentions 'Easing Loan Interest Burdens'

Lee also separately pledged to significantly reduce the burden of principal and interest repayments for small business loans. He said he would amend the Banking Act to ensure that statutory costs, such as various contributions, are not unfairly passed on to financial consumers when banks calculate additional interest rates.

He also addressed the restructuring of the “education tax burden structure,” which had been criticized by some. The education tax is a special-purpose tax collected to secure funds for expanding educational facilities and improving teacher treatment. According to the Korea Federation of Banks’ “Best Practices for Enhancing the Rationality of Loan Interest Rate Systems,” banks may include the education tax in statutory costs when calculating additional interest rates. The Democratic Party explained that restructuring the education tax burden could help ease financial consumers’ interest burdens.

To slow down the increase in household loans, commercial banks are consecutively raising mortgage loan interest rates. On the 3rd, a loan information board was posted at a commercial bank branch in Euljiro, Jung-gu, Seoul. Photo by Jo Yongjun

To slow down the increase in household loans, commercial banks are consecutively raising mortgage loan interest rates. On the 3rd, a loan information board was posted at a commercial bank branch in Euljiro, Jung-gu, Seoul. Photo by Jo Yongjun

He also promised to develop measures to promote refinancing loans for small business owners and the self-employed. However, he did not specify how this would differ from the “low-interest refinancing program.” In addition, he pledged to consider gradually exempting prepayment penalties, starting with policy mortgages and policy financial institutions.

Kim Moonsu: "Providing Financial Support That Empowers Small Businesses"

According to the People Power Party’s presidential policy pledge book, Kim Moonsu stated, “We will greatly expand the role of the Saechulbal Fund to reduce the financial burden on small business owners.” This is the same pledge as Lee’s, and Kim also did not mention specific details.

For small business corporate limit loans, he pledged to abolish all types of fees, just as with household loans.

The outcry from self-employed business owners is severe. Many shops are closing down, saying "It's harder than during COVID," but no one is starting new businesses, so a virtuous cycle is not happening. Even after cleaning up and tightening regulations to make it proper, Hwanghakdong Kitchen Street remains deserted with no one coming to start businesses. Photo by Jo Yongjun

The outcry from self-employed business owners is severe. Many shops are closing down, saying "It's harder than during COVID," but no one is starting new businesses, so a virtuous cycle is not happening. Even after cleaning up and tightening regulations to make it proper, Hwanghakdong Kitchen Street remains deserted with no one coming to start businesses. Photo by Jo Yongjun

For small business owners whose sales have plummeted, he proposed creating a “Livelihood Shield Special Loan” program. He also plans to expand management stabilization fund support to help overcome crises and support business recovery.

Instead of establishing a new financial institution, Kim stated that he would build an integrated platform system for self-employed finance. However, he did not mention specific details such as the cost and time required for integrating financial platforms.

He also pledged to develop customized financial products for small businesses and to innovate the credit evaluation system. In addition, he plans to package financial support for small businesses according to their business life cycle and to rationalize PG (payment gateway) fees.

A business administration professor who participated in the policy planning for the presidential campaign commented, “Due to the early presidential election, there was not enough time to develop detailed and concrete pledges. Both candidates’ economic and financial pledges lack detail, and it is disappointing that there are no specific figures or budget information.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)