Musk's Return to Hands-On Management and Influx of Bargain Buyers a Boon

Reduction of U.S. EV Purchase Subsidies and Aggressive Chinese Price Competition Remain Challenges

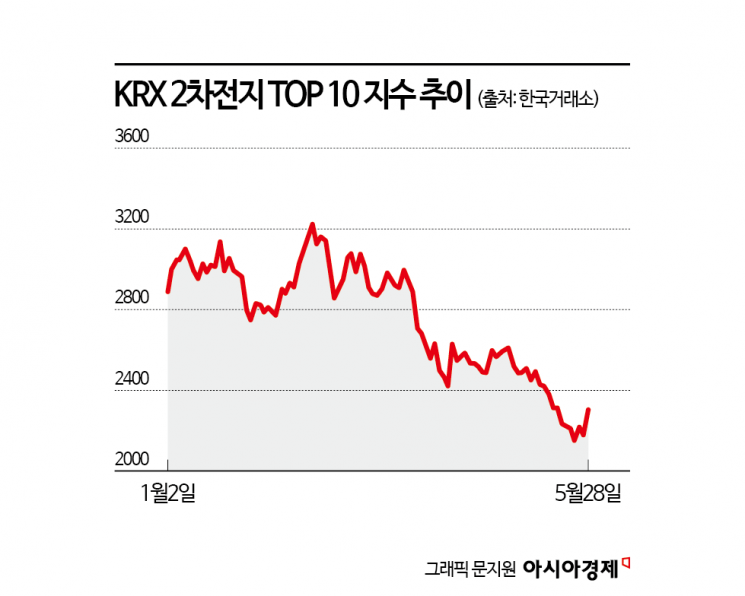

After nearly two years of sluggish performance, secondary battery stocks have finally shown signs of recovery. News that Elon Musk, CEO of Tesla, is returning to hands-on management has sparked renewed investor sentiment. However, there are still doubts about the possibility of a sustained rebound in the sector, as the industry continues to face challenges such as slowing electric vehicle demand and aggressive price competition from Chinese battery manufacturers.

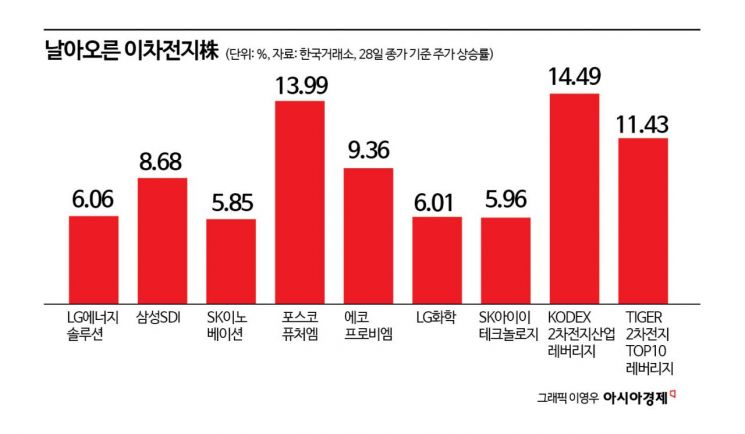

According to the Korea Exchange on May 29, LG Energy Solution, the leading secondary battery stock, closed at 289,000 won on the previous day, up 6.06%. Samsung SDI and SK Innovation also surged by 8.68% and 5.85%, respectively. Material companies such as POSCO Future M (13.99%), Ecopro BM (9.36%), LG Chem (6.01%), and SK IE Technology (5.96%) also rose in tandem. As a result, KODEX Secondary Battery Industry Leverage (14.49%) and TIGER Secondary Battery TOP10 Leverage (11.43%) ranked first and second, respectively, in ETF (Exchange Traded Fund) returns for the day.

The news of Musk’s return to hands-on management has brought a glimmer of hope to secondary battery stocks, which have been on a downward trend since peaking in the second half of 2023. Musk, who had been criticized for neglecting company management due to his involvement in U.S. politics, recently posted on X (formerly Twitter) that he had "returned to the routine of working all day and sleeping at the company," and emphasized that he must be "super focused" on X, xAI, and Tesla as important technological releases are imminent. Following this news, Tesla shares soared nearly 7% on May 27 (local time).

Individual investors have also contributed to the rally by buying undervalued stocks in sectors such as semiconductors, secondary batteries, and automobiles. So far this month, individuals have purchased about 358 billion won worth of LG Energy Solution shares, making it the second most net-bought stock by individuals after Samsung Electronics (about 1.236 trillion won). LG Chem (213 billion won), Samsung SDI (177 billion won), and SK Innovation (107 billion won) also ranked high in net purchases by individuals.

However, there is skepticism about whether this rebound will lead to a sustained upward trend. While the tax cut bill passed by the U.S. House of Representatives last week spared production subsidies for battery cells and modules from cuts, and the end date for the Advanced Manufacturing Production Credit (AMPC) was only moved up by one year from 2033 to 2032, the overall direction remains unchanged: eco-friendly incentives such as the electric vehicle purchase subsidy, which can be as much as $7,500, are being reduced across the board.

Joo Minwoo, a researcher at NH Investment & Securities, stated, "The U.S. electric vehicle market is inevitably facing a slowdown in demand until 2026 due to the abolition of the purchase tax credit and the resulting increase in real purchase prices from tariffs," and added, "Weak demand will inevitably lead to reduced production, so a slowdown in the AMPC is also expected."

Another source of concern is that the European market is increasingly adopting cheaper lithium iron phosphate (LFP) batteries instead of the ternary batteries in which Korea has a competitive edge. Jang Junghoon, a researcher at Samsung Securities, pointed out, "Volkswagen Group is expanding the use of LFP batteries in order to lower the prices of its main models," and warned, "This could lead to a decline in demand for Korean ternary batteries." According to SNE Research, the top six Chinese battery companies accounted for 74% of global shipments last year, widening the gap with the three major Korean battery companies, whose share stood at 14%.

Ha Inhwan, a researcher at KB Securities, commented, "Although President Trump's anti-environmental stance remains a concern, the main targets of the Trump administration's sanctions are China, not Korea." He added, "If the launch of low-cost models and robotaxis leads to an increase in (secondary battery) penetration, there will be a renewed need to pay attention to secondary battery stocks, which have been extremely neglected."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.