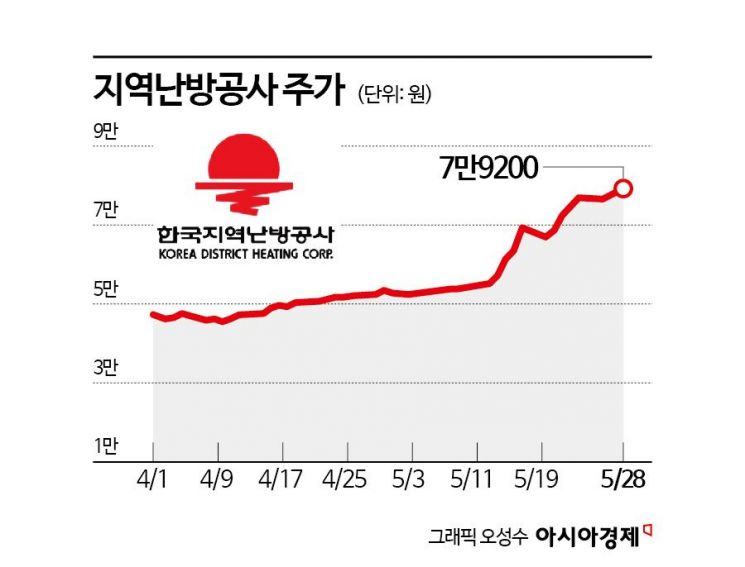

Stock Price Up 59.8% Since End of March

Q1 Operating Profit Rises 55.3% Year-on-Year to 323.8 Billion Won

Falling LNG Prices Have Positive Impact on Overall Performance

Korea District Heating Corporation achieved its highest-ever quarterly performance in the first quarter of this year. As operating profit increased and accounts receivable decreased, there are expectations that the company will raise its dividend payout ratio. The stock price also surged significantly, pushing the market capitalization up to 910 billion won.

According to the financial investment industry on May 29, the stock price of Korea District Heating Corporation rose by 59.8% compared to the end of March. Even considering that the KOSPI increased by 7.6% during the same period, the company's return exceeded the market by 52.2 percentage points (P). Foreign investors recorded a cumulative net purchase of 8.8 billion won from April to May.

Korea District Heating Corporation operates in the district energy business, electricity business, and new and renewable energy business. As of the end of March this year, the company supplied heating and cooling to 1,887,000 apartment units and 2,985 buildings across a total of 19 business sites. It owns power plants with a combined capacity of 2,982 MW, including mid- to large-scale power plants of 500 MW or more and renewable energy facilities.

The district energy business refers to the centralized supply of energy (heat or heat and electricity) produced at concentrated energy facilities to a large number of customers in densely populated residential or commercial areas. The electricity business involves selling electricity produced from combined heat and power plants, solar power, and other renewable energy sources directly to the electricity market or to customers in district heating supply areas.

The main products are heat, chilled water, and electricity. On a consolidated basis, the sales composition in the first quarter of this year was 53.4% heat, 0.2% chilled water, and 45.5% electricity. The company uses liquefied natural gas (LNG), water source heat, and low-sulfur fuel oil (LSFO) as its main raw materials.

In the first quarter of this year, Korea District Heating Corporation recorded sales of 1.5768 trillion won and operating profit of 323.8 billion won. Compared to the same period last year, these figures increased by 14.7% and 55.2%, respectively. Heat sales volume rose by 6.1%, while electricity sales volume increased by 29.5%. The unit price of heat increased by 10.0%, but the unit price of electricity fell by 13.1%.

Lee Sangheon, a researcher at iM Securities, explained, "The drop in LNG prices led to an improvement in the cost ratio, which had a positive impact on overall performance. In the first quarter of this year, the average LNG price was 826 won per normal cubic meter (Nm³), down about 14% from 962 won in the same period last year." He added, "This year, profitability in the heat business segment is expected to improve due to lower costs and higher selling prices, while the electricity business segment will see improved results thanks to higher utilization rates."

Korea District Heating Corporation's dividend policy follows the Ministry of Economy and Finance's medium-term dividend payout ratio targets for government-invested institutions. In December 2014, the Ministry announced a plan to gradually raise the medium-term dividend payout ratio target for government-invested institutions from 21.5% in 2014 to 40% by 2020. The company's payout ratio reached 40.0% in 2020 and 43.0% in 2021. However, due to poor performance, no dividends were paid in 2022 and 2023. Last year, the payout ratio was only 21.4%, as the company lowered it due to the occurrence of accounts receivable.

This year, as accounts receivable decrease, there are expectations that the payout ratio will be raised to 25-30%. At the end of the first quarter, Korea District Heating Corporation's accumulated accounts receivable stood at 536.5 billion won, down 23 billion won from the previous quarter. If net profit increases this year and the payout ratio is raised, the dividend per share could rise significantly.

Yoo Jaeseon, a researcher at Hana Securities, analyzed, "Given the downward trend in gas prices for power generation, accounts receivable are expected to continue to decline. The reduction in accounts receivable can lead to an expansion of dividend resources and an increase in the payout ratio."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.