Solid Chip Demand Keeps Growth Strong... But Pace Is Slowing

China Export Controls Halve Market Share... Uncertainty Remains

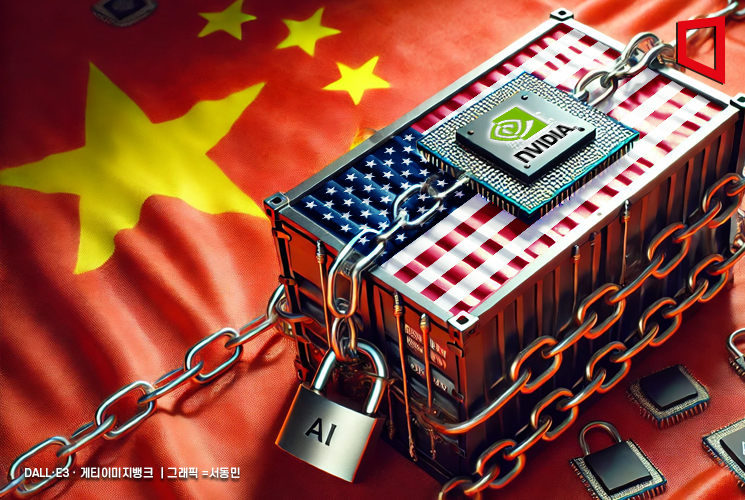

On the 27th, CNBC reported that ahead of Nvidia's earnings announcement on the 28th (local time), market attention is focused on the impact of export control measures to China. This is because the Donald Trump administration effectively blocked Nvidia's exports to China by implementing export controls on artificial intelligence (AI) chips in an effort to curb China's rise in advanced industries. While demand for semiconductor chips remains steady and Nvidia's performance is still robust, the market views the company's growth rate as slowing.

Solid Chip Demand Keeps Growth Strong... But Pace Is Slowing

According to CNBC, Nvidia, the world's largest AI semiconductor company, will announce its results for the first quarter of fiscal year 2026 (February to April this year) on the 28th. The market is anticipating an "earnings surprise" from Nvidia. According to market research firm LSEG, Nvidia is expected to post revenue of $43.28 billion for the quarter (up 66% year-on-year) and adjusted earnings per share (EPS) of $0.88. This represents a 66% and 44% increase, respectively, compared to the same period last year.

Although strong AI server demand is driving high growth, there are concerns that the growth rate is slowing. CNBC analyzed, "While this is still a high growth rate compared to other big tech companies, it marks a sharp slowdown considering Nvidia had posted growth of over 250% year-on-year in previous quarters."

The key issue for the market is the China risk. Recently, Nvidia wrote down $5.5 billion worth of inventory for its H20 AI chips, which were specially designed for the Chinese market. This is the largest write-down in the history of the semiconductor industry.

David O'Connor, an analyst at BNP Paribas, stated in a report, "This inventory write-down suggests that annual revenue related to the H20 chip could decrease by $15 billion in the future."

This situation stems from the Trump administration's notification to Nvidia in April that a separate export license would be required for H20 chip exports. Although the chip was specifically designed to comply with existing U.S. export restrictions, the new regulations have effectively made it impossible to export these chips to China.

China Export Controls Halve Market Share... Uncertainty Remains

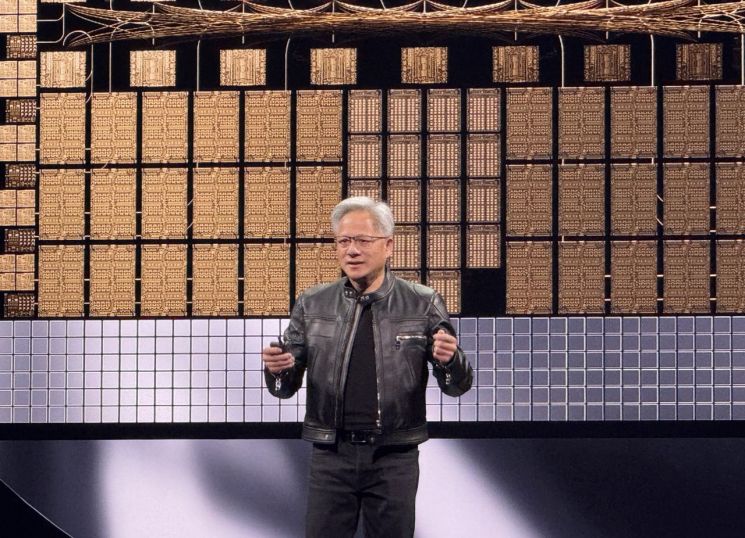

Due to these AI regulations, Nvidia's market share in China has been cut in half. At a press conference in Taiwan earlier this month, Nvidia CEO Jensen Huang admitted to the aftermath of export controls, stating, "Our market share in the Chinese GPU market has plummeted from 95% in the past to 50% now."

According to the U.S. Securities and Exchange Commission (SEC), Nvidia recorded $17.1 billion in revenue from China (including Hong Kong) in fiscal year 2024, making it the company's fourth-largest market by revenue.

Jensen Huang, CEO, has warned that "U.S. export restrictions may actually spur China's self-sufficiency in AI semiconductors and, in the long run, threaten U.S. technological leadership." As calls for easing export regulations grow, the Trump administration recently decided to withdraw its plan to further restrict AI chip exports to China. However, uncertainty persists, as the U.S. government has not fully stepped back and has indicated it still intends to establish "simpler alternative regulations."

In a recent report, Morgan Stanley stated, "Questions about Nvidia's H20 replacement product strategy and its plans for the Chinese market will persist even after the earnings announcement," adding that "Nvidia is actively lobbying to secure export licenses."

As a result, market attention is now focused on the second-quarter guidance that will be provided after the earnings announcement. Analysts have already revised down their second-quarter revenue forecasts from $48 billion to $46.4 billion. However, there remains some optimism, and it is expected that the stock price will move according to how conservatively the actual guidance is presented.

Meanwhile, Nvidia will release its earnings after the close of the New York Stock Exchange on the 28th local time. In Korea, a conference call will be held by Chief Financial Officer (CFO) Colette Kress at 7 a.m. on the 29th, during which she will share the company's business outlook.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)