Household loan delinquency rate hits 0.5% in February, highest since July 2015

Corporate loan delinquency rate also on the rise

More borrowers unable to repay debts as economic downturn continues

The delinquency rate on household loans at domestic banks has reached its highest level in about nine years. The delinquency rate for corporate loans has also hit its highest point in six years. As the economic downturn continues, the number of people borrowing money and failing to repay it is steadily increasing.

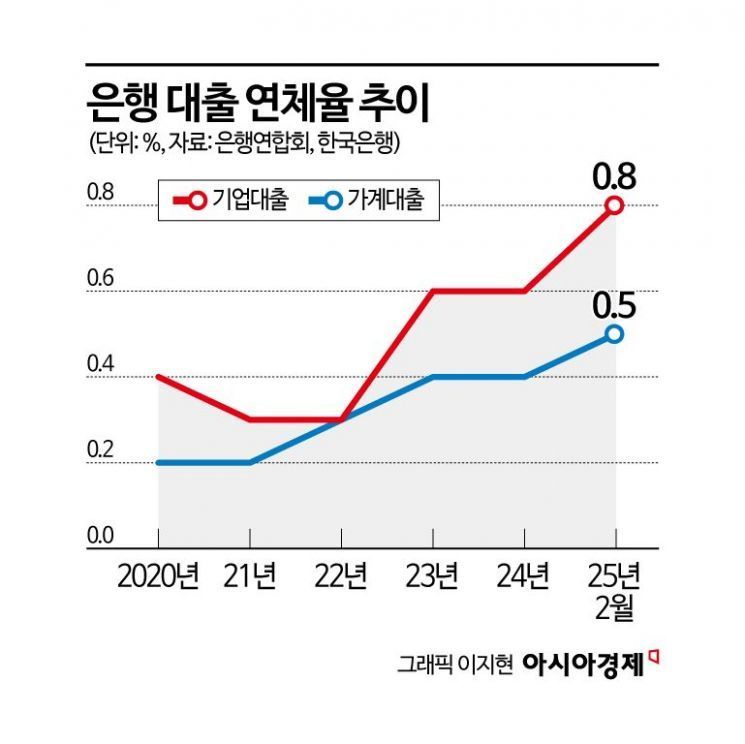

According to statistics from the Korea Federation of Banks and the Bank of Korea on May 27, the delinquency rate on household loans at domestic banks stood at 0.5% as of February. On a monthly basis, this is the highest level in nine years and seven months since July 2015, when it was also 0.5%. The household loan delinquency rate, which is based on loans with principal overdue by at least one day, rose from an average of 0.3% in 2022 to 0.4% in 2024, and has continued to climb further this year.

Not only household loans but also corporate loans and credit card loans have seen rising delinquency rates at most major banks. In February, the delinquency rate for corporate loans was 0.8%, the highest in six years and three months since November 2018, when it was 0.9%. The corporate loan delinquency rate, which averaged 0.3% in 2022, increased to 0.6% in 2024 and surged to 0.8% this year. The delinquency rate for credit card loans has also soared. For general banks, excluding those that have spun off their card businesses, the delinquency rate for credit card loans was 2.3% as of February, the highest in ten years and three months since November 2014, when it was also 2.3%.

The rise in loan delinquency rates is closely linked to the overall economic downturn. In the first quarter of this year, South Korea's economic growth rate was just -0.2%. Since the second quarter of last year, the Korean economy has recorded a sluggish growth rate of 0.1% or less quarter-on-quarter for four consecutive quarters. South Korea's economic slump is severe even compared to other countries. Among the member countries of the Organisation for Economic Co-operation and Development (OECD) that have announced their first-quarter economic growth rates so far, South Korea's growth rate was the lowest.

As the economic slump persists, the number of people unable to repay their debts continues to rise. In particular, there is a clear trend of increasing delinquency rates among vulnerable borrowers, such as self-employed individuals, low-income groups, and small and medium-sized enterprises (SMEs). According to the Financial Supervisory Service, as of February, the delinquency rate on bank loans for individual business owners was 0.76%, more than double the rate from two years ago. Over the same period, the delinquency rate for small and medium-sized corporations also nearly doubled to 0.9%. In contrast, the delinquency rate for large corporations has remained largely unchanged at around 0.1% over the past two years. The polarization between the rich and poor in the loan market is becoming increasingly apparent.

Despite the benchmark interest rate being lowered, the delinquency rate has risen because income recovery for self-employed individuals has been delayed due to sluggish conditions in the service sector. For SMEs, the delinquency rate has increased, particularly in industries heavily affected by domestic demand, such as construction, real estate, and services.

Experts point out that economic recovery is the most important factor in improving loan delinquency rates. There are calls for a range of policy efforts, including a more active reduction of the benchmark interest rate by the Bank of Korea, swift implementation of additional government budgets, and direct financial support to stimulate domestic demand. Joo Won, head of economic research at Hyundai Research Institute, emphasized, "More aggressive economic stimulus policies are needed to improve the economy," adding, "In addition to lowering the benchmark interest rate, it is necessary to maintain active fiscal policies and a growth-friendly economic policy stance."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.