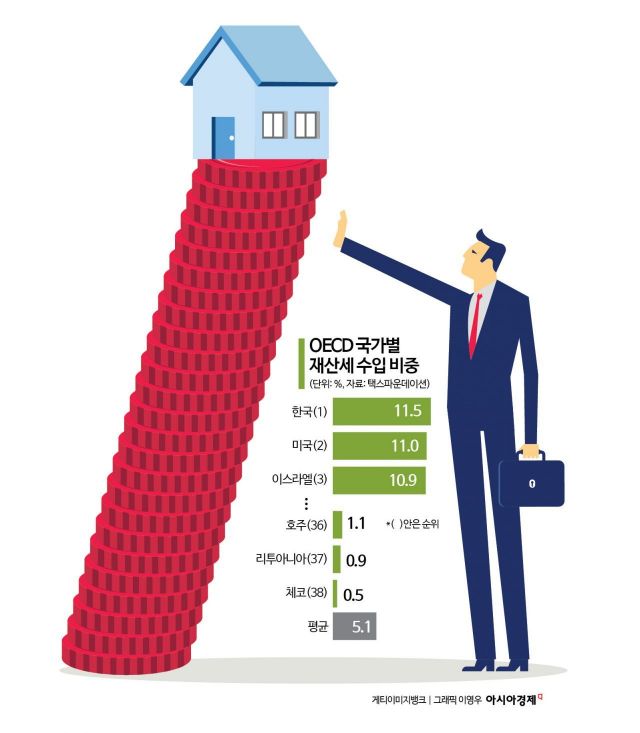

11.5% of South Korea's Tax Revenue Comes from Property Taxes

More Than Twice the OECD Average of 5.1%

Consumption and Income Taxes Below Average

"Universal Taxation Becoming Increasingly Difficult"

The proportion of property tax revenue in the South Korean government's total income is the highest among member countries of the Organisation for Economic Co-operation and Development (OECD). This means that taxes collected from those who own assets such as land or buildings have accounted for a significant portion of government revenue.

According to the "2025 OECD Government Revenue Sources" report recently released by the U.S.-based international research think tank Tax Foundation, the South Korean government collected 11.5% of its total revenue from property taxes in 2023. This is the highest share among the 38 OECD countries and is more than double the OECD average of 5.1%. Ten years ago, South Korea's property tax revenue accounted for 10.6% of total government income, ranking third, but it has steadily increased since then.

The only other country where property tax revenue accounted for more than 11% of total government income was the United States (11%), which is home to many high-wealth individuals. This was followed by Israel (10.9%), the United Kingdom (10.5%), Canada (9.9%), and Australia (9.3%). In contrast, Nordic countries known for high tax rates and robust welfare systems, such as Sweden (2%), Norway (2.9%), and Denmark (3.8%), had property tax shares below the OECD average. In neighboring Japan, the figure was around 7.9%.

The high property tax burden in South Korea is closely linked to the real estate market. Since the introduction of the comprehensive real estate holding tax in 2005, property tax revenue has surged, especially as housing prices in the Seoul metropolitan area have rapidly increased. The total amount collected from the comprehensive real estate holding tax, which includes both residential and land properties, was only 1.7 trillion won in 2017, but soared to 7.3 trillion won in 2021?more than tripling in just four years. Although revenue decreased to 6.7 trillion won in 2022 and 4.7 trillion won in 2023, property taxes still account for a significant portion of total tax income.

In contrast, South Korea's consumption tax share was only 22.6%, ranking 35th among OECD countries. Excluding countries like the United States, which does not have a value-added tax (16.8%), South Korea is effectively at the bottom of the list. On average, OECD countries collect 31.1% of their revenue from consumption taxes. After the 2008 global financial crisis, 25 OECD countries raised their value-added tax rates to address fiscal deficits, but South Korea has maintained its 10% rate for 48 years since its introduction in 1977.

The share of personal income tax in South Korea was 19.8%, lower than the OECD average of 23.7%, ranking 25th. Countries with a lower share of income tax than South Korea include Japan (18.8%), where wages have stagnated for a long period, as well as developing countries such as Chile (9.3%), Colombia (7.4%), and Costa Rica (5.7%).

The fact that property tax burdens are high while the shares of income and consumption taxes are low means that South Korea's tax revenue sources are concentrated among the wealthy. Rather than all citizens paying a small amount of tax, those with more wealth are shouldering a disproportionately heavy tax burden. An official from the Ministry of Economy and Finance said, "Although South Korea has rapidly expanded its welfare programs, we have not implemented measures such as increasing the proportion of wage earners who pay income tax or raising the value-added tax rate," adding, "It is true that the principle of broad-based taxation?where all citizens pay at least a small amount of tax?is becoming increasingly difficult to achieve."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.