HPSP Sale Delayed... Shift to Recapitalization

CJ Selecta and Kakao VX Sales Halted

Tariff Risks Widen Price Disagreements

Difficulties Expected for Upcoming Bids to Gain Transaction Momentum

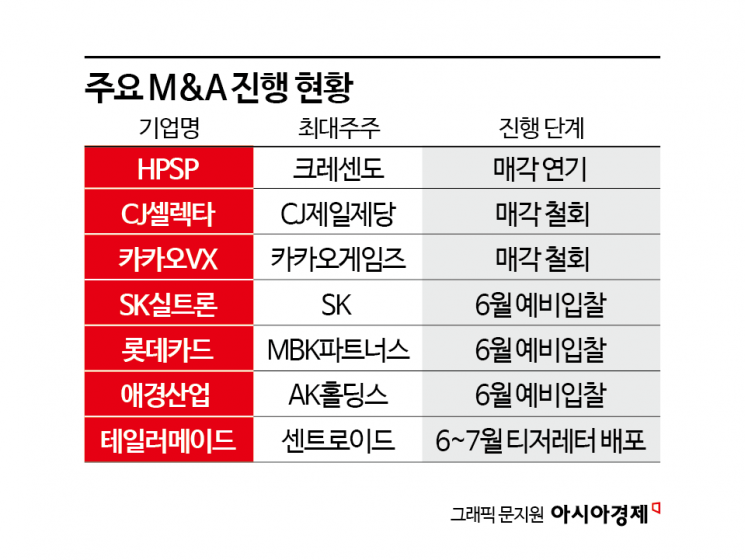

As uncertainty grows due to U.S. President Donald Trump’s tariff policies, assets that had been put up for sale in the mergers and acquisitions (M&A) market are gradually disappearing.

According to the investment banking (IB) industry on May 26, there has been a recent increase in cases where companies have postponed or canceled plans to sell management control. In addition, companies that were expected to be put on the market are now taking a wait-and-see approach, signaling a chill in the market.

Recently, Crescendo Equity Partners decided to delay the sale of HPSP, a semiconductor equipment company. Earlier this year, Crescendo conducted a preliminary bidding process for the sale of HPSP. The stake up for sale is the 40.8% held by Crescendo. It is known that global private equity (PE) firms such as MBK Partners, Blackstone, and Bain Capital participated in the process.

However, as uncertainty has increased due to the impact of tariff risks on the semiconductor industry, buyer interest has cooled. Although Crescendo reportedly intended to sell HPSP for up to 2 trillion won, the recent drop in share price has caused its market capitalization to fall below this level. As a result, Crescendo shifted its strategy to partially recover its fund investment by raising acquisition financing loans secured by HPSP shares, through recapitalization (recap).

Last month, CJ CheilJedang announced that it was withdrawing from the agreement to sell its stake in its Brazilian subsidiary, CJ Selecta. Had the sale proceeded as planned, CJ CheilJedang would have secured approximately 480 billion won in cash, which was intended to be used for business restructuring. CJ CheilJedang explained, "We notified the cancellation of the contract because the likelihood of meeting the deal’s preconditions was unclear."

Since last year, CJ CheilJedang’s bio division has also been rumored to be on the market. Although CJ CheilJedang officially denied any plans to sell, it is known that MBK Partners and others approached the company and even conducted due diligence. However, the deal fell through due to differences over price and other factors.

In addition, Kakao Games recently halted the sale of its subsidiary Kakao VX, which operates a golf-related business. The sale of Kakao VX had been in the works since last year and was formalized earlier this year, but was called off after only a few months.

Ultimately, price has been the main obstacle in these transactions. As macroeconomic uncertainty has increased due to U.S.-driven tariff risks, the price gap between sellers and buyers has widened. An IB industry insider said, "Sellers set prices based on when business conditions were favorable, but buyers are negotiating based on the current difficult situation, so the gap between the two sides has become too wide."

As a result, it now appears difficult for assets currently on the market to gain transaction momentum.

SK Siltron, SK Group’s semiconductor wafer manufacturer, is set to begin preliminary bidding in early June. In addition to Hahn & Company, the most likely acquisition candidate, Stick Investment and others are expected to participate. The main issue is that, due to the unpredictable impact of U.S. tariff policies, it is difficult to assess the company’s performance and value, making price a major point of contention.

In addition, Lotte Card, Aekyung Industrial, and TaylorMade are also expected to begin preliminary bidding as early as next month. However, even before the bidding process begins, there are already debates over overvaluation, so these transactions are expected to face challenges.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.