Korea Zinc Receives Strong Demand as Sole Domestic Antimony Producer

Steelmakers Diversify Supply Chains to Reduce Reliance on China

As China strengthens export controls on strategic minerals such as antimony in the wake of the US-China tariff war, domestic steel and non-ferrous metal industries in Korea are solidifying their cooperation. Major steelmakers are signing consecutive mineral procurement contracts with Korea Zinc to reduce their dependence on China and secure stable supplies. The government is also responding by monitoring import volumes of strategic minerals in real time.

Lee Jejung, Vice Chairman and Chief Technology Officer (CTO) of Korea Zinc, is visiting the indium plant within the Korea Zinc Onsan Smelter to inspect the products being produced. Photo by Korea Zinc

Lee Jejung, Vice Chairman and Chief Technology Officer (CTO) of Korea Zinc, is visiting the indium plant within the Korea Zinc Onsan Smelter to inspect the products being produced. Photo by Korea Zinc

According to industry sources on May 23, since China began controlling exports of strategic minerals such as antimony in September last year, Korean steel companies have recently been contacting Korea Zinc directly to sign alternative supply contracts or conduct spot transactions (one-time purchases). At the beginning of this year, raw material procurement managers from Hyundai Steel visited Korea Zinc in person to secure spot quantities of antimony. They are also working to diversify their supply chains by sourcing from third countries such as Europe and Turkey.

POSCO also visited Korea Zinc earlier this year to discuss antimony procurement measures and reportedly finalized a contract in the first half of the year. A POSCO representative stated, "We are comprehensively reviewing both domestic and overseas alternative supply chains for strategic metals whose exports have been restricted by China."

The reason steelmakers are signing contracts with Korea Zinc is that it is the only domestic producer of antimony. Last year, its annual production reached 3,604 tons. Of this amount, 70% was supplied to the domestic market and 30% was exported to regions including Europe and Japan. The production target for this year is between 3,800 and 4,000 tons.

Antimony is a key additive that increases the hardness and corrosion resistance of steel alloys. It is widely used in automotive electronic components and high-performance steel products, making it a material that directly affects the cost and quality competitiveness of major steelmakers. It is also an essential strategic material for the production of military supplies such as ammunition, missiles, and shells. Its applications are expanding in heat-resistant materials for car dashboards, tents, and advanced industries, driving strong global demand. China accounts for more than half of the world's antimony production.

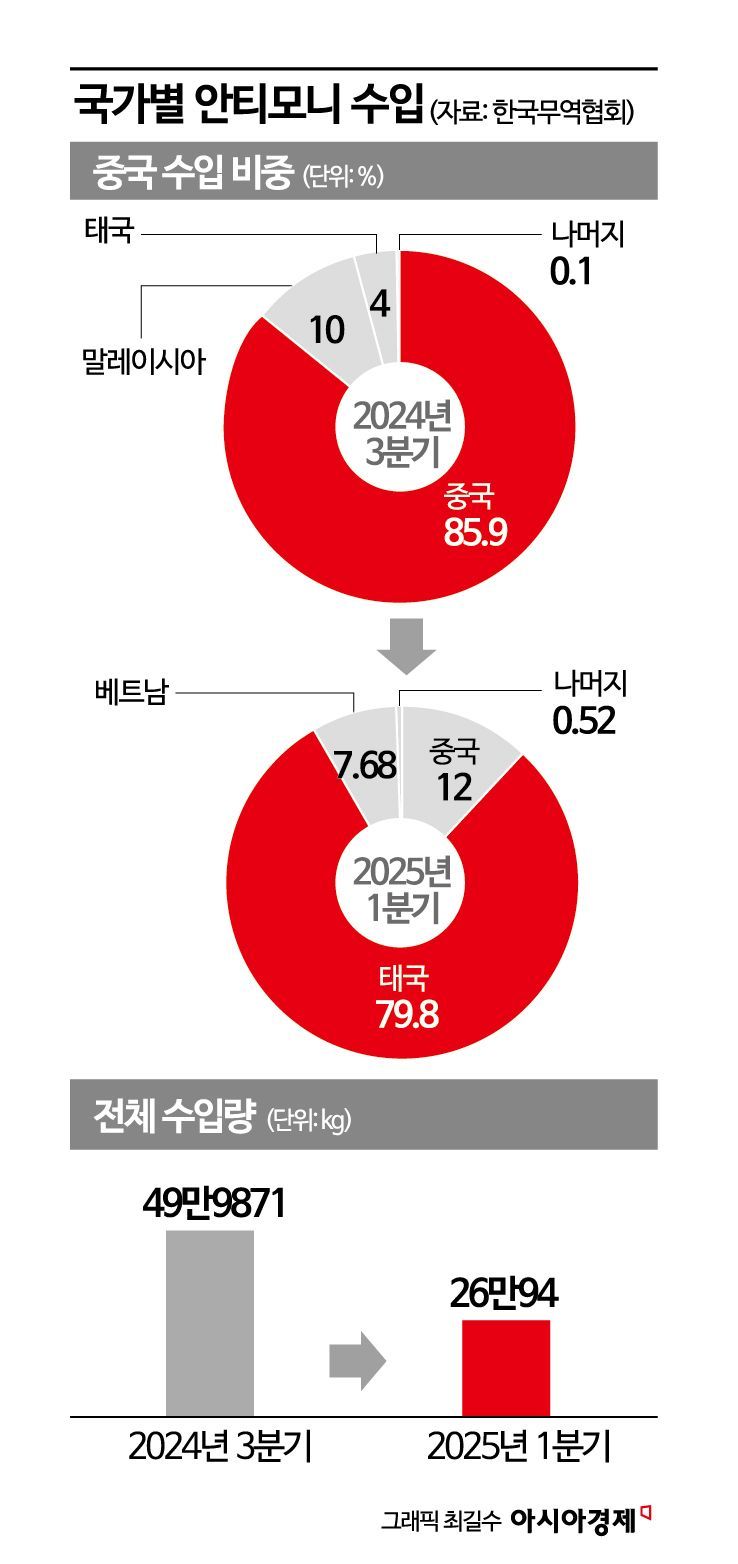

Due to China's controls, dependence on Chinese antimony in Korea's import statistics has clearly decreased. According to the Korea International Trade Association, the share of Chinese antimony in Korea's total imports, which stood at 85.9% in the third quarter of last year, dropped sharply to 12% in the first quarter of this year. During the same period, total import volumes were halved from 499,871 kg to 260,094 kg.

As global supply chain instability intensifies, prices are soaring. The price of antimony, which was at $13,650 per ton (about 20.27 million won) as of February last year, surged to $62,000 per ton by the end of February this year, more than quadrupling in just one year.

The Ministry of Trade, Industry and Energy, as well as related organizations such as the Korea Mine Rehabilitation and Mineral Resources Corporation, are closely monitoring supply and demand trends. An official from the Ministry of Trade, Industry and Energy stated, "Given the uncertainty over how long the US-China conflict will last, we are monitoring logistics trends to prepare for potential supply crises," and added, "There are many inquiries from domestic companies, especially regarding resources entering through China that are experiencing export delays or have effectively been suspended."

Following antimony, China implemented additional export controls in February on five strategic minerals: tungsten, molybdenum, indium, bismuth, and tellurium. Korea Zinc produces three of these: indium, bismuth, and tellurium. Indium is widely used in semiconductor substrates, aircraft engines, and solar panels, and Korea Zinc supplies about 150 tons to the global market annually. The company also produces 900 to 1,000 tons of bismuth each year, which is used in high-temperature superconducting materials and automotive transmission parts. Annual production of tellurium, used in the manufacture of solar cells and thermoelectric materials, is about 100 to 200 tons.

A Korea Zinc representative stated, "China's export controls on key minerals have made Korea Zinc's role in the global supply chain even more important," and added, "We will focus on stabilizing the production of strategic minerals."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)