Delinquency Rate for Small Corporations at 0.80%

Delinquency Rate for Individual Business Owners at 0.71%

COVID-19 Loan Maturities Due in September... Fears of a Delinquency Bomb

Need for Bold Debt Relief Beyond Passive Support

As the maturity dates for low-interest loans issued during the COVID-19 period approach, concerns are mounting that a "delinquency bomb" could become a reality for small and medium-sized enterprises (SMEs) and small business owners who are unable to repay their debts. The repeated emergency measures at the time, such as repayment deferrals and maturity extensions, are now colliding with entrenched domestic demand stagnation and high interest rates, as well as other internal and external challenges, raising the risk to unsustainable levels.

The street near Seoul National University Hospital in Jongno-gu, Seoul, where pharmacies and restaurants are located, is quiet.

The street near Seoul National University Hospital in Jongno-gu, Seoul, where pharmacies and restaurants are located, is quiet.

According to the SME and small business sector and financial authorities as of March 2025, the delinquency rate for won-denominated loans at domestic banks stood at 0.62% at the end of March, up 0.14 percentage points from the same month a year earlier. The problems are particularly pronounced among SMEs and self-employed individuals. During the same period, the delinquency rate for small corporations was 0.80% and for individual business owners was 0.71%, representing increases of 0.19 percentage points and 0.17 percentage points, respectively, compared to the previous year.

Analysts note that this is closely related to the government's sweeping financial policies targeting SMEs and small business owners during the COVID-19 crisis. The intent was to compensate, at least in part, for the damage caused by strict lockdowns and widespread business shutdowns through measures such as low-interest loans, maturity extensions, and principal and interest repayment deferrals.

The assumption was that, once the pandemic ended and society returned to normal, much of the debt would be manageable. However, the rapid deterioration of liquidity, external shocks stemming from the Russia-Ukraine war, high interest rates and inflation, domestic demand stagnation and high exchange rates triggered by emergency measures, and a host of other simultaneous blows have put SMEs and small business owners?often described as the lifeblood of the economy?under unbearable pressure.

According to Korea Credit Data's "Q1 2025 Small Business Trends" report, the average sales per small business location in the first quarter of this year was about 41.79 million won, down 12.89% compared to the fourth quarter of last year. The number of self-employed individuals has also declined for four consecutive months since the beginning of the year, indicating that many are closing their businesses due to management difficulties. A business outlook survey by the Korea Federation of SMEs showed that the Small Business Health Index (SBHI) for May 2025 was 75.7, down 3.5 points from May 2024. The prevailing view is that adverse factors are becoming structural across the industry, casting a gloomy outlook for June and beyond.

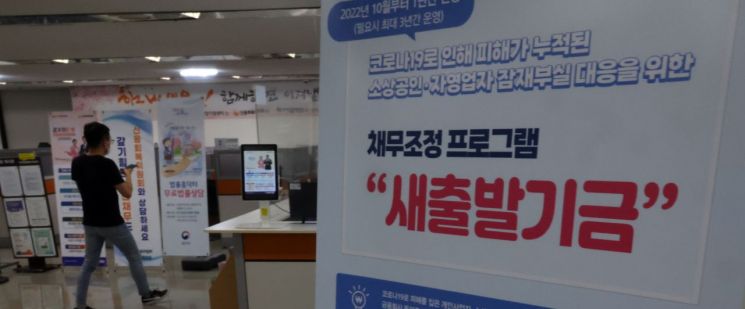

A New Start Fund information leaflet for small business owners and self-employed individuals is placed at the Seoul Citizen Financial Integrated Support Center.

A New Start Fund information leaflet for small business owners and self-employed individuals is placed at the Seoul Citizen Financial Integrated Support Center.

In this situation, where finding a breakthrough is increasingly difficult, there are concerns that the "delinquency bomb" could explode when the COVID-19 loan maturities for SMEs and small business owners come due in September. The government has extended the maturity of COVID-19 loans five times since April 2020, setting the final repayment deadline for September 2025.

While the government plans to manage the debts of vulnerable groups through policies such as the "New Start Fund," the strict eligibility requirements and limited coverage are seen as major limitations. The New Start Fund is a program that supports borrowers who have been delinquent on loan repayments for more than three months by extending repayment periods and partially reducing principal and interest. As of the end of last month, the cumulative amount of debt applied for under the New Start Fund reached 20.3173 trillion won, but the amount of debt that actually received principal or interest reduction was less than 30% of the total applications.

Given that normal debt management is realistically difficult, there are growing calls for more decisive and rapid policy action. Some experts argue that bold debt relief policies, tailored to the current crisis rather than small-scale welfare or charitable support, are necessary.

Jung Eunae, a research fellow at the Korea Small Business Institute, said, "Continuously extending loan maturities and providing welfare-type support payments of 10 to 20 million won are insufficient to resolve the current delinquency crisis among SMEs and small business owners," adding, "In fact, this approach is likely to require much larger budgets in the future." She further stated, "The debt accumulated by self-employed individuals since COVID-19 is an issue that must eventually be addressed, and the government should consider bold debt relief policies, even if it means taking on additional national debt."

Jung Seeun, a professor of economics at Chungnam National University, said, "We cannot continue to address this issue simply by extending loan maturities; at some point, a resolution is necessary." He urged, "The government should take more proactive measures to reduce actual debt by expanding the eligibility for New Start Fund benefits and applying more flexible principal reduction criteria for vulnerable borrowers."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)