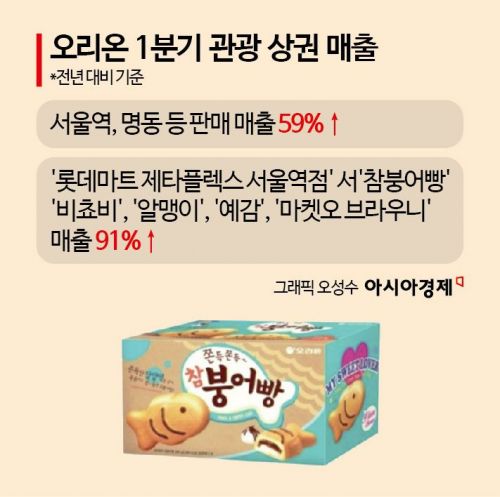

Sales in Tourist Districts Like Seoul Station and Myeong-dong Rise 59% in Q1

Lotte Mart Zeta Plex Seoul Station Sees Soaring Sales

Chambungobang, a Symbol of Wealth in China, Popular as a Gift for Returning Tourists

As the number of foreign tourists visiting Korea increases, Korean snacks are selling rapidly in major tourist shopping districts. Foreign tourists are posting photos of the snacks they purchase during their trip to Korea on social networking services (SNS), and some products have gained a reputation as “must-buy items” for travelers, leading to bulk purchases through word of mouth.

According to the food industry on May 25, Orion saw its sales revenue in tourist areas such as Seoul Station and Myeong-dong rise by 59% year-on-year in the first quarter of this year. In particular, at Lotte Mart Zeta Plex Seoul Station, combined sales of five brands?'Chambungobang', 'Bichobi', 'Almaengi', 'Yegam', and 'Market O Brownie'?jumped by 91% over the same period.

Lotte Mart Zeta Plex Seoul Station is considered a must-visit shopping destination for foreign tourists because it is connected to the airport railroad that links downtown Seoul with Incheon International Airport. The number of store visitors has increased as more foreign tourists come to Korea, and the introduction of K-snacks on overseas SNS appears to have led to a rise in related snack sales. According to the Korea Tourism Organization, 3.87 million foreign tourists visited Korea in the first quarter of this year, an increase of 13.7% compared to the previous year.

A representative snack is Orion's 'Chambungobang', launched in Korea in 2011. The product name uses the Chinese word for fish '魚 (yu)' and the word for abundance '余 (yu)', which are pronounced the same, and in China, fish are considered symbols of wealth. As a result, it is reported that Chinese tourists have recently been buying this snack in bulk as gifts for family and friends upon returning home.

An Orion official stated, "Foreigners are intrigued by the fact that Korea's representative street food, Bungobang, which is typically enjoyed on cold winter streets, has been turned into a mass-produced snack that can be enjoyed year-round. Korean products also rank high in the direct purchase category on Chinese online shopping malls such as JD.com. Since the end of 2019, Orion's Chinese subsidiary has started local production under the name 'Xiaoyu Nuonuo', and since 2024, the Vietnamese subsidiary has launched it as 'Bong Bang', where it is also enjoying strong sales."

'Chambungobang' is also popular in the United States. After entering Costco, an American warehouse retailer, in January this year, export sales of this product in the first quarter grew approximately tenfold compared to the same period last year.

The domestic food industry is expecting a "viral effect" that will raise awareness of K-snacks through word of mouth among foreign tourists visiting Korea. Foreigners are naturally increasing brand awareness and favorability by posting photos of snacks and ramen purchased in Korea on SNS platforms like YouTube and Instagram. This can open the way for exports through local buyers, and serves as a foundation for targeting overseas markets.

In fact, in the case of 'Choco Pie Jeong', a buying craze among Chinese and Russian traders in the early 1990s led Orion to directly enter these markets. Orion completed its Langfang plant in China in 1997, which resulted in explosive growth in overseas sales. In Russia, the company began direct exports in 1993 and established a plant in Tver in 2006, launching a full-scale market strategy. As a result, Orion now produces and sells locally in overseas subsidiaries in China, Vietnam, Russia, and India, selling more than 4 billion units annually worldwide. Last year, global sales of Choco Pie exceeded 580 billion won as a single brand.

In response, Orion is targeting foreign tourists by releasing limited editions that can only be purchased in tourist districts, such as 'Bichobi Korea Edition', 'Market O Brownie Jeju Matcha', and 'Market O Brownie Cream Cheese'.

An industry official explained, "Before pursuing localization strategies through overseas subsidiaries and production plants for global market entry, it is essential to have differentiated product quality and brand awareness that can capture the tastes of local consumers. As SNS develops and overseas direct purchasing becomes more active, national barriers to consumer purchases are lowering. Therefore, we expect that K-food will continue to spread worldwide through word of mouth among foreign tourists visiting Korea."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.