Some Banks, Including KB Kookmin Bank and KakaoBank, See Mortgage Loan "Open Runs"

Last-Minute Loan Demand Surges Ahead of July's Phase 3 DSR Implementation

Banking Sector on Alert Over Potential Rise in Household Loans

With the implementation of the third phase of the Stress Debt Service Ratio (DSR) scheduled for July, a surge in last-minute loan demand has led to a phenomenon where housing mortgage loans (jumdandae) are quickly snapped up via some banks' mobile applications. Additionally, as some banks have begun to lower loan interest rates, concerns are growing that this could further stimulate loan demand. In response, banks are adjusting product limits and the number of loans handled to control supply and demand. The banking sector appears tense, as household loans could increase further.

According to the banking industry on the 23rd, when applying for a housing mortgage loan through KB Kookmin Bank's Star Banking app, a notice appears before 9 a.m. stating that "all daily loan applications have been exhausted," indicating a jumdandae open-run phenomenon. This is because Kookmin Bank's non-face-to-face jumdandae interest rates are 0.2 to 0.7 percentage points lower than those of other banks, attracting a surge in demand, while the bank has limited the number of non-face-to-face jumdandae applications to 150 per day. A Kookmin Bank official said, "Recently, it has become known that our rates are cheaper than those of other banks, which has led to a surge in demand," adding, "We have now increased the daily application limit."

KakaoBank and K Bank, where jumdandae interest rates range from 3.84% to 3.98%?lower than the average rates at major commercial banks?are also experiencing open-run situations, with loan limits being exhausted as soon as business begins.

There are also concerns that commercial banks' moves to lower jumdandae rates and expand preferential rates could further stimulate loan demand. NH Nonghyup Bank decided to expand the preferential rate for face-to-face variable-rate jumdandae by 0.45 percentage points starting on the 22nd. Previously, Kookmin Bank reduced the additional rate for face-to-face five-year cycle jumdandae by 0.08 percentage points, and Shinhan Bank introduced a new 0.10 percentage point preferential rate for non-face-to-face jumdandae and jeonse loans.

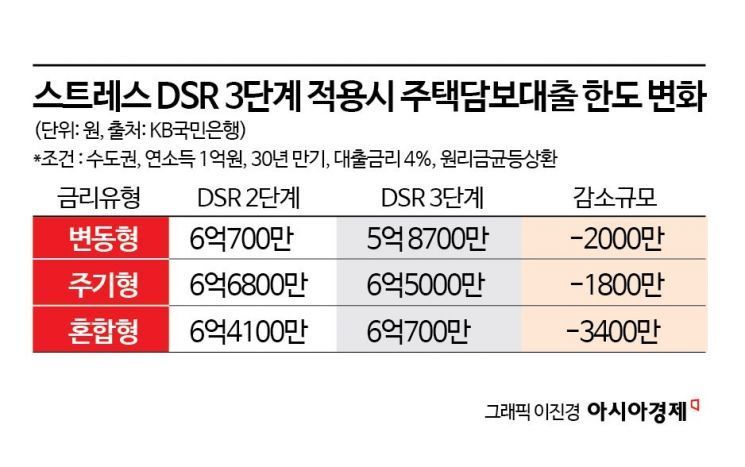

Furthermore, with the third phase of the DSR set to take effect on July 1?applying a 1.5% stress rate to jumdandae, unsecured loans, and other loans in the Seoul metropolitan area?there is a rush of borrowers seeking to secure loans before the new rules take effect. According to a simulation conducted by this newspaper in cooperation with Kookmin Bank, if a salaried worker with an annual income of 100 million won takes out a jumdandae (30-year term, equal principal and interest repayment, 4% variable interest rate), the loan limit would decrease by 20 million won. Under the same conditions, choosing a cyclical rate would reduce the limit by 18 million won, and choosing a mixed rate would reduce it by 34 million won. For unsecured loans, the reduction ranges from 1 million to 4 million won.

Given this situation, some banks are taking steps to control supply and demand out of concern that household loans may increase further. Measures include raising interest rates for certain products or reducing product limits. Following Kookmin Bank, Woori Bank has also abolished preferential rates for some unsecured loan products. Eliminating preferential rates effectively increases loan interest rates. Kookmin Bank also raised its non-face-to-face jumdandae rate by 0.25 percentage points in response to surging demand.

In fact, as of the 19th of this month, the outstanding household loans at the five major banks (Kookmin, Shinhan, Hana, Woori, and Nonghyup) stood at 746.1276 trillion won, already surpassing last month's figure of 743.0848 trillion won, meaning household loans increased by 3 trillion won in just half a month. If this trend continues, it is expected that household loans will increase by about 5 trillion won by the end of the month compared to the previous month.

An official from a major commercial bank said, "With the third phase of the DSR approaching, last-minute demand is surging. Banks with higher jumdandae rates are lowering them to improve competitiveness, while those experiencing a concentration of loan applications are slightly raising rates to manage household lending. However, due to the authorities' policy of managing household debt, it is difficult to engage in competitive rate cuts, so banks are responding by reducing product limits instead."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)