Settlement Risk Down... Favorable Interest Rates and Enhanced Profitability

Mandatory Central Clearing for Private Sector RP Transactions in the U.S. Treasury Market from 2027

"A Leading Example of Proactive Adaptation... Expected to Encourage Participation from Private Financial Institutions"

The Bank of Korea has become the first institution in Korea to acquire associate membership in the U.S. Fixed Income Clearing Corporation (FICC). As a result, starting from May 23, it will be able to conduct sponsored repurchase agreement (Sponsored RP) transactions with FICC clearing members (dealers).

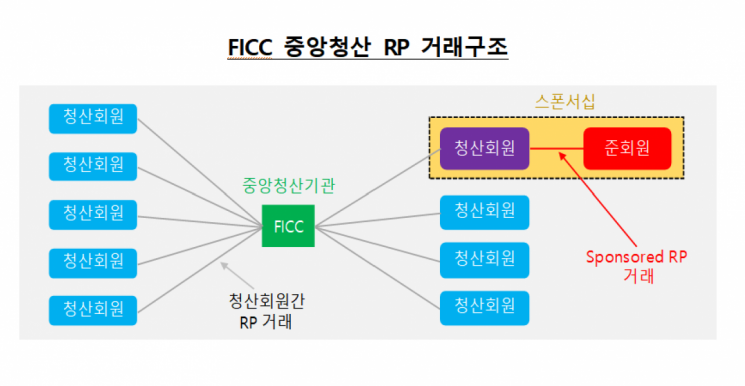

FICC is a subsidiary of the U.S. Depository Trust & Clearing Corporation (DTCC) and provides clearing services for U.S. Treasury securities, government agency bonds, and mortgage-backed securities (MBS) for its members. Unlike general RP transactions, sponsored RP transactions can reduce settlement risk through central clearing, while also improving profitability by offering more favorable interest rates and expanding transaction volumes. Associate members of FICC can utilize central clearing services when conducting sponsored RP transactions with full clearing members.

An official from the Bank of Korea stated, "We joined the sponsored RP program to achieve excess returns and reduce settlement risk in the process of managing foreign currency assets." The official added, "To join, an existing RP trading relationship with a clearing member is required, as well as final approval from FICC. We completed the preparations and membership process over approximately eight months, starting in the second half of last year."

The U.S. Treasury RP market is dominated by bilateral transactions, making it difficult for regulatory authorities to monitor trading activity and manage risks. To address this, the U.S. Securities and Exchange Commission (SEC) plans to mandate central clearing of RP transactions by private sector participants in the U.S. Treasury market starting in June 2027 to enhance market transparency. The Bank of Korea official stated, "Currently, most U.S. Treasury RP transactions do not go through central clearing, but after the new regulations take effect, the majority of RP transactions between clearing members and associate members are expected to shift to sponsored RP." The official added, "The Bank of Korea's acquisition of FICC associate membership is a leading example of proactive adaptation to changes in the U.S. Treasury market, and it is expected to encourage greater interest and participation from private financial institutions in this market."

Sponsored RP transactions in the U.S. Treasury market have been steadily increasing. As of the end of 2024, the daily transaction volume reached approximately $2 trillion. The Bank of Korea official stated, "Once central clearing becomes mandatory for U.S. Treasury cash and RP transactions, the transaction volume is expected to grow even further." The official added, "We plan to proceed with additional steps such as system integration and test transactions before commencing actual trading."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.