Cargo Surge from China Drives SCFI Back Above 1,400 Points

Shipping Companies Raise Rates and Add More Vessels on US Routes

As cargo volumes between the United States and China surge, shipping companies have responded by not only raising freight rates but also adding more vessels. Concerns have been raised that freight rates could overheat in line with the 90-day high-tariff grace period.

According to the shipping industry on May 23, the Premier Alliance, a shipping alliance, will begin its Pacific Southwest (PS5) service?previously suspended due to the US-China tariff war?starting June 5. Alliance members Ocean Network Express, HMM, and Yang Ming will deploy the 'YM Mobility,' a 6,589 TEU vessel built in 2011.

Among mid-sized carriers, Korea Marine Transport Company (KMTC) is re-entering the trans-Pacific trade for the first time in 40 years. Starting June 18, KMTC will deploy a 6,655 TEU-class container ship on the China?US West Coast route. Together with TS Lines and Sea Lead Shipping, a total of six vessels ranging from 3,000 to 11,100 TEU will be deployed.

An industry official said, "Cargo volumes from China, which had been suppressed by the tariff war, are increasing," and added, "Shipping companies are seeking to capitalize on special market conditions as volatility grows due to uncertainty."

According to shipping information provider Vizion, after the US-China tariff agreement, container bookings on China?US routes reached 21,530 TEU (1 TEU = one 20-foot container), a surge of about 277% compared to the previous week.

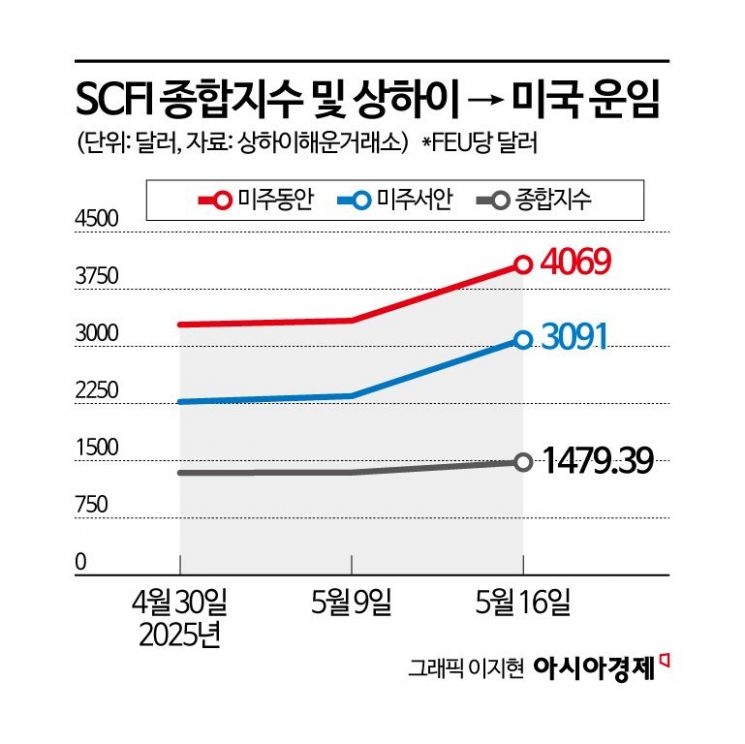

Recently, shipping rates have soared following the tariff truce. The Shanghai Containerized Freight Index (SCFI) stood at 1,479.39 points as of May 16, up 9.98% from the previous week. This is the first time in two months since March that the SCFI has recovered to the 1,400-point range. The SCFI is a composite index of freight rates on 15 export container routes from Shanghai, reflecting global ocean freight rate levels.

The increase in rates on US-bound routes was particularly notable. The eastbound trans-Pacific rate reached $4,069 per FEU (one 40-foot container), up $734 (about 18%) from the previous week. The westbound trans-Pacific rate rose even more sharply, climbing $744 (31.7%) to $3,091 compared to the previous week.

Freight rates are expected to rise even further, coinciding with the traditional summer peak season. Global carriers have decided to implement an additional $3,000 rate hike on US routes starting in June, which is nearly double the recent rate based on the SCFI. The peak season surcharge, typically imposed from July, will also be applied one month earlier.

The global freight rate increase is also affecting the domestic market. The Korea Containerized Freight Index (KCCI), published by the Korea Ocean Business Corporation (KOBC), stood at 1,849 as of May 19, up 5.54% from the previous week. Both eastbound and westbound US routes saw increases of more than 10%.

As a result, small and medium-sized shippers, who mainly rely on short-term contracts, are facing increased burdens. An industry official explained, "As volumes from China increase, vessel space is being concentrated on China routes. Naturally, space available for Korea-bound shipments is decreasing, so Korean shippers are scrambling to secure vessel space."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)