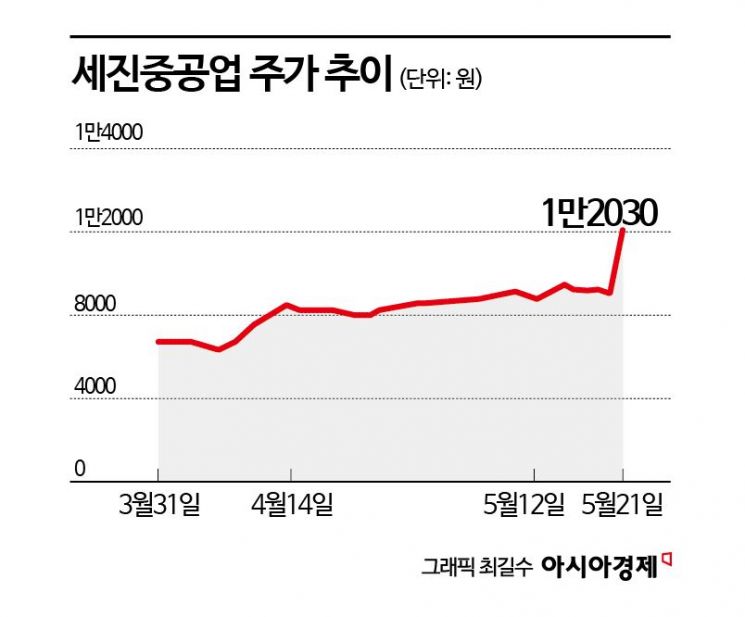

Share Price Up 83% Since End of March

Best Profitability Among Listed Shipbuilding Equipment Companies

Benefiting from Rising Demand for Liquefied Carbon Dioxide Carriers

The corporate value of Sejin Heavy Industries, a shipbuilding equipment supplier, is rapidly rising. The company has demonstrated profitability through its first-quarter results, strengthening optimism about its long-term growth prospects.

According to the financial investment industry on May 22, the share price of Sejin Heavy Industries increased by 82.8% compared to the end of March. Even considering the KOSPI's 5.8% rise during the same period, Sejin Heavy Industries' return exceeded the market by 77 percentage points (P). Its market capitalization grew to 684 billion KRW. During this period, foreign investors recorded a cumulative net purchase of 9.2 billion KRW, with an evaluated return of 27%.

In the first quarter of this year, Sejin Heavy Industries posted consolidated sales of 98.5 billion KRW and operating profit of 17.8 billion KRW. Compared to the same period last year, sales increased by 14.4%, and operating profit surged by 317.9%. On a separate basis, the company achieved sales of 90 billion KRW and operating profit of 17.1 billion KRW. The separate operating margin stood at 19.0%, the highest among listed shipbuilding equipment companies.

Oh Jihoon, a researcher at IBK Investment & Securities, explained, "We reflected some additional settlement payments out of the 20 billion KRW worth of Hanwha Ocean deckhouse and engine casing orders," and added, "The company achieved strong results by recognizing sales from the delivery of high-margin liquefied carbon dioxide carrier (LCO2C) tanks."

IBK Investment & Securities estimates that Sejin Heavy Industries will achieve consolidated sales of 430.7 billion KRW and operating profit of 68.4 billion KRW this year. These figures represent increases of 22.2% and 90.2%, respectively, compared to last year. The company is expected to see better-than-expected tank profitability this year, having successfully concluded price negotiations.

The outlook for Sejin Heavy Industries is bright, given the recent trend toward larger liquefied carbon dioxide carriers. Previously, when transporting liquefied petroleum gas (LPG) or ammonia from the United States to China, tanks would return empty after unloading at the destination, as LPG and ammonia have clearly defined export and import regions. Ships equipped with tanks capable of transporting liquefied natural gas can also carry LPG. China is the largest importer of US LPG and has the greatest potential to become a major exporter of liquefied carbon dioxide.

By transporting carbon dioxide on the return journey, rather than sailing empty after unloading LPG or ammonia, economic gains increase. As vessel size increases, the transportation cost per unit decreases, leading to rising demand for liquefied carbon dioxide tanks.

Researcher Oh stated, "Deliveries of high-margin tanks are increasing, and the profitability of deckhouse orders is also improving. We are raising our earnings per share (EPS) forecasts for Sejin Heavy Industries for this year and next year by 20.7% and 28.1%, respectively, compared to previous estimates."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)