Cumulative Investment of 4.7 Trillion Won in U.S. Investment Corporation

Expanding Investments Despite Cost Reduction Policy for Tariff Response

Investments in Robotics, Autonomous Driving, and Electrification Value Chain

Securing Future Mobility Technologies Through U.S. New Tech Investment

"Responding to Tariff Uncertainty" Inventory Increased to Record High

It has been revealed that Hyundai Motor Group invested 450 billion won in its U.S. investment corporation in just the first quarter of this year. The investment corporation is responsible for supporting future growth industries such as humanoids, autonomous driving, and strengthening the electrification value chain. On an annualized basis, this amounts to a massive 2 trillion won being poured into new businesses. After the launch of the Trump administration in the United States, Hyundai Motor Group emphasized cost reduction due to concerns over uncertainties such as tariffs. However, it is now being evaluated as taking a much more proactive approach to future investments. Hyundai Motor Group also significantly increased its inventory in the U.S. during January to March this year, responding to U.S. tariff policies by securing inventory.

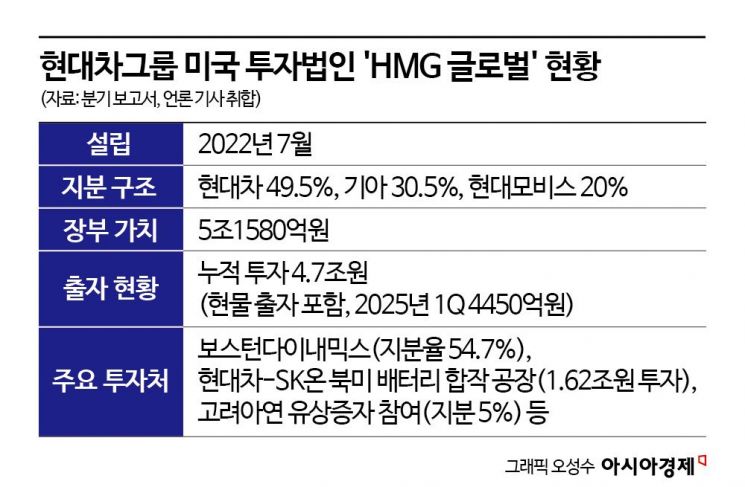

According to the first quarter 2025 reports of Hyundai Motor, Kia, and Hyundai Mobis released on May 21, the three companies made an additional capital injection of 445.255 billion won into their U.S. investment corporation, HMG Global, during this period. As a result, since the establishment of HMG Global in 2022, the cumulative amount invested by Hyundai Motor Group has exceeded 4.7 trillion won based on book value. The 445.2 billion won invested in the first quarter of this year is a figure that far surpasses the average quarterly investment amount of previous years (410 billion won in 2024, 290 billion won in 2023, 370 billion won in 2022). Considering that Hyundai Motor Group has established a company-wide cost reduction policy this year in response to U.S. tariffs, this can be seen as a highly aggressive investment.

HMG Global was established in July 2022 by Hyundai Motor Group to invest in and manage new businesses in the United States. Hyundai Motor and Kia hold 49.5% and 30.5% stakes, respectively, while Hyundai Mobis owns 20%. HMG Global has led major strategic investments for the group, including an in-kind contribution of its stake in Boston Dynamics, the establishment of a Hyundai Motor-SK On joint venture in the U.S., and the acquisition of a stake in Korea Zinc.

Securing Future Mobility Capabilities Through U.S. Investment in New Technologies

The reason Hyundai Motor Group continues to increase its investment in HMG Global is to expand new businesses such as robotics, autonomous driving, advanced air mobility (AAM), and strengthening the electric vehicle value chain. The plan is to effectively carry out strategic investments in the U.S., a technological powerhouse, and take the lead in future mobility technologies.

A significant portion of this capital injection is expected to be allocated to Boston Dynamics, a humanoid development company in which HMG Global has the largest investment share. Since being acquired by Hyundai Motor Group in the second quarter of 2021, Boston Dynamics has recorded quarterly losses of around 100 billion won, with cumulative net losses over the past four years estimated at more than 1 trillion won.

On the other hand, the company's future corporate value is rising sharply. As expectations for the humanoid industry as a whole increase, the valuation of global robotics companies has also risen. At the time of acquisition in 2021, Hyundai Motor Group valued Boston Dynamics at 1.1 billion dollars (about 1.25 trillion won). Since then, the group has increased capital through four capital increases each year. Currently, the minimum equity value in the unlisted market has risen to over 2.2 billion dollars (more than 3 trillion won).

"Responding to Tariff Uncertainty" Inventory Increased to Record High

In the first quarter of this year, Hyundai Motor and Kia increased their inventories in the U.S. to record levels in response to external uncertainties such as U.S. tariffs. Hyundai Motor's inventory assets in the first quarter reached 21.1426 trillion won, a 4.5% increase (917.3 billion won) compared to the end of last year (20.2253 trillion won). This is the largest amount ever recorded.

Even until the third quarter of last year, inventory remained in the 18 to 19 trillion won range, but began to increase from the fourth quarter onward. On a quarterly basis, inventory grew only 3.8% from 17.04 trillion won in 2023 to 18.0784 trillion won in 2024, but this year it surged by 16.9%. Kia also holds inventory of 13.0496 trillion won, a 3.7% increase from the end of last year (12.5774 trillion won), and a 12.7% increase compared to the same period last year (11.5775 trillion won).

It is interpreted that Hyundai Motor and Kia increased their inventory assets as a strategy to secure as much inventory as possible ahead of the U.S. auto tariffs that began last month. It is reported that a significant portion of the increased inventory is concentrated in the North American region. Hyundai Motor and Kia have chosen to prioritize the sale of pre-secured inventory in North America to minimize the impact of tariffs. Instead, they have frozen sales prices until June 2.

The 'inventory securing and price freeze' strategy is already showing results. Hyundai Motor's U.S. sales in April reached 81,503 units, a 19% increase compared to the same month last year (68,603 units). Kia's U.S. subsidiary also sold 74,805 units, a 14% increase from the same month last year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.