KB Kookmin Bank Retains Top Spot in Won-Denominated Deposits

Shinhan Bank Rises in Market Share, Reshuffling 2nd to 5th Place Rankings

Total Won-Denominated Deposits Among Six Major Banks Up 5.58% Year-on-Year

In the ranking of market share for Korean won-denominated deposits among the six major banks (KB Kookmin, Shinhan, Hana, Woori, NH Nonghyup, and IBK Industrial Bank), KB Kookmin Bank has maintained its unchallenged position as number one, while there has been competition for the 2nd to 5th places. While Shinhan Bank has shown a particularly notable increase, some banks have experienced negative growth in market share, indicating changes in their positions within the market.

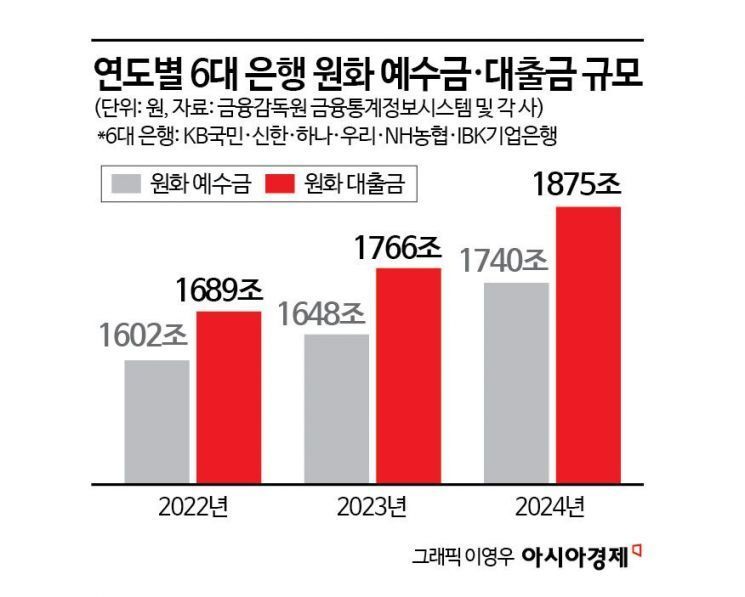

According to the financial sector on May 21, as of the end of last year, the total Korean won-denominated deposits of the six major banks amounted to 1,740 trillion won, a 5.58% increase compared to the previous year (2023). This is nearly double the growth rate of the previous year (2022?2023), which was 2.87%. Korean won-denominated deposits include demand deposits, savings deposits, and housing installment savings.

By bank, KB Kookmin Bank held the top spot with a market share of 21.1%. Last year, KB Kookmin Bank also ranked first with a 20.8% share. It was followed by Shinhan Bank (18.8%), NH Nonghyup Bank (17.7%), Hana Bank (17.5%), and Woori Bank (17.3%). The bank with the largest increase in market share compared to the previous year was Shinhan Bank, which rose by 1.1 percentage points. All others saw a decline in market share: NH Nonghyup Bank (-0.6 percentage points), Woori Bank (-0.4 percentage points), Hana Bank (-0.3 percentage points), and IBK Industrial Bank (-0.1 percentage points). As a result, the market share ranking for Korean won-denominated deposits changed from KB Kookmin > NH Nonghyup > Hana > Shinhan = Woori > IBK in 2023 to KB Kookmin > Shinhan > NH Nonghyup > Hana > Woori > IBK in 2024. While KB Kookmin Bank maintained its unchallenged lead, there was considerable movement among the banks ranked 2nd through 5th.

In terms of market share based on Korean won-denominated loans, KB Kookmin Bank also maintained its top position this year, following last year, while there was fierce competition for the 3rd to 6th places. Last year, the total Korean won-denominated loans of the six major banks reached 1,875 trillion won, a 6.17% increase compared to the previous year (2023). This is higher than the previous year's (2022?2023) growth rate of 4.55%.

By bank, KB Kookmin Bank's market share increased by 0.1 percentage points from the previous year's 19.3% to 19.4%, securing the top position. In 2023, Shinhan Bank and Hana Bank shared second place (16.4%), but in 2024, Shinhan Bank saw the largest increase in market share among the six major banks (up 0.7 percentage points), solidifying its hold on second place. In contrast, Hana Bank's market share decreased by 0.3 percentage points from the previous year, dropping from joint second to third place. In 2023, IBK Industrial Bank (16.1%) ranked fourth, followed by Woori Bank (16%) and NH Nonghyup Bank (15.7%). In 2024, there was a shift in the 4th and 5th places, with Woori Bank (16%) moving ahead of IBK Industrial Bank (15.9%), followed by NH Nonghyup Bank (15.5%).

An official from a commercial bank commented, "As we enter a full-fledged interest rate cut cycle, it is expected to be difficult for Korean won-denominated deposits to grow significantly this year overall." The official added, "Although these are not profitability indicators, the market share of Korean won-denominated deposits and loans is meaningful as it reflects the influence of each bank in the market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.