On May 20, Samil PwC stated in its report, "Global IPO Performance Analysis and Outlook," that "the global initial public offering (IPO) market is showing signs of recovery this year, while volatility is also increasing." The company emphasized that "flexible risk management and thorough preparation by companies are crucial."

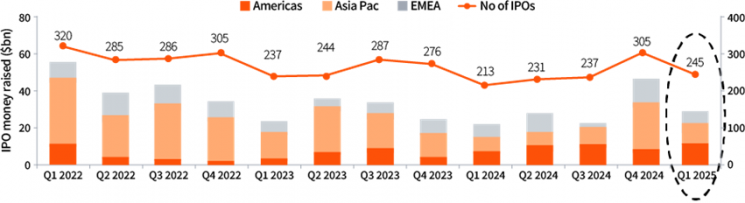

According to the report, the global IPO market recovered in the first quarter of 2025, with the total amount raised through IPOs increasing by 30% and the number of IPOs rising by 15% compared to the same period in 2024. In particular, the U.S. market saw its IPO offering amount rise by more than 20% year-on-year, marking the highest first-quarter level since 2021. India and the Middle East also delivered strong performances.

In the Korean market, a total of 28 IPOs were conducted from the beginning of this year through the end of last month, raising 1.9125 trillion won. Although the number of IPOs decreased by three compared to the same period last year, the overall offering amount surged by 196% to 1.2675 trillion won, driven by the large-scale listing of LG CNS (1.1994 trillion won).

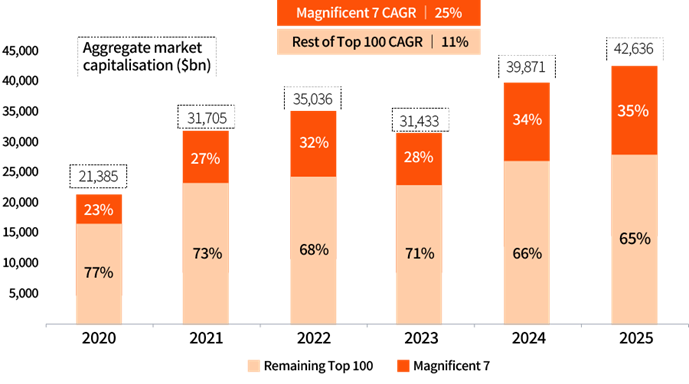

The combined value of the world’s top 100 companies by market capitalization reached an all-time high of $42.6 trillion. Although the growth of the "Magnificent 7" (Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia, and Tesla) has slowed, these companies still accounted for 35% of the total market capitalization of the top 100 firms.

In contrast, the VIX (Volatility Index), which measures market uncertainty, surpassed 50 last month, reaching its highest level since the COVID-19 pandemic. Market volatility was heightened by the Trump administration’s tariff policies, geopolitical uncertainties, and concerns over a macroeconomic downturn. Each of these factors contributed independently to the increased volatility.

Global stock exchanges are revising their regulations to support IPOs. The United Kingdom is integrating its listing markets and abolishing the three-year performance requirement. Hong Kong is shortening the lock-up period for cornerstone investors and easing listing requirements for technology companies. Singapore is unifying its review agencies and introducing a tax rebate system for IPO corporations. Taiwan is lifting investor restrictions for innovative companies. Japan is establishing a regular working group for IPO procedures.

Kim Girok, leader of the Global IPO Team at Samil PwC, stated, "The IPO market has been changing rapidly, and the approval windows for IPOs on different exchanges are opening and closing quickly." He stressed, "Companies preparing for IPOs must manage risks according to changing policies and the global economic environment, and establish long-term growth strategies." He added, "Thorough analysis and preparation at an early stage are essential for companies to respond flexibly to the choice of listing market and timing."

Further details of the report are available on the Samil PwC website.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.