Demand Plummets Due to Delayed Housing Pre-sales

Factory Utilization and Operating Profits Fall Together

Cement Shipments Drop, Impact Spreads Downstream

Cement shipments have dropped to their lowest level since the Asian financial crisis, and the factory operating rates of major construction materials companies have fallen to their lowest point in five years. The delay in housing pre-sales due to high interest rates and rising construction costs, which has led to a decrease in housing starts, is now spreading throughout the industry. As the housing market has shown little sign of recovery in the first half of the year, the outlook for the construction materials industry has become even gloomier.

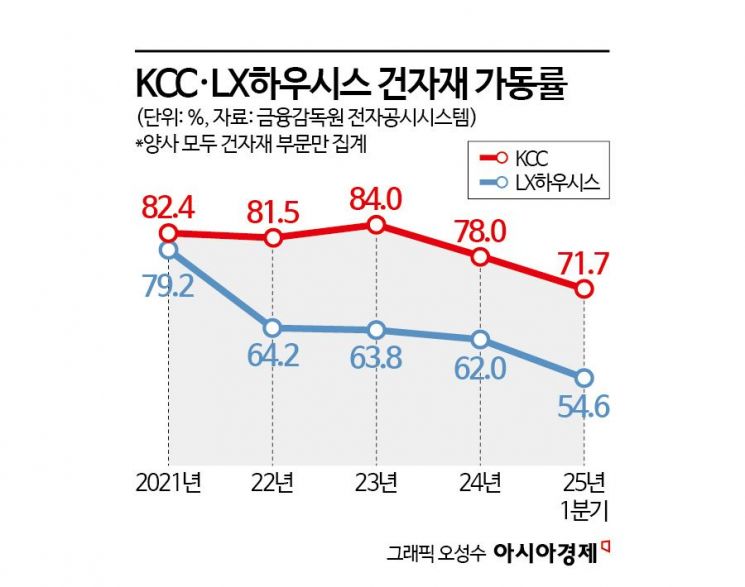

According to electronic disclosures from the Financial Supervisory Service on May 20, the factory operating rates for the construction materials divisions of the two leading companies, KCC and LX Hausys, were recorded at 71.7% and 54.5%, respectively, in the first quarter of this year. Compared to the end of last year, these figures represent declines of 6.3 percentage points and 7.4 percentage points, respectively, marking the lowest levels for both companies in the past five years. As demand has weakened and performance has deteriorated, factory operating rates have naturally declined as well.

The poor performance is also evident in the numbers. While KCC's total sales in the first quarter increased slightly to 1.5993 trillion won, sales in the construction materials division fell by 12.2% during the same period, reaching only 232.3 billion won. The securities industry estimates that operating profit in this division decreased by more than 36% year-on-year. LX Hausys also saw its construction materials sales drop by 13% year-on-year to 538.1 billion won, and it posted an operating loss of 5.2 billion won, turning to a deficit. Hana Securities analyzed, "In the construction materials sector, both volume and prices declined due to weakened downstream demand and a decrease in the number of business days."

The situation is similar in the paint industry. Noroo Paint's first-quarter operating profit decreased by 47% compared to the same period last year, while Samhwa Paint turned to a deficit. In particular, since the paint sector is highly dependent on imported raw materials, the burden of rising raw material costs due to the high exchange rate has also played a significant role.

The problem is that this trend may not be a temporary adjustment but rather a sign of structural stagnation. Materials such as windows, paint, and furniture are used in the later stages of construction, so when housing starts decrease, the impact is felt with a lag of several months to several years.

The cement industry, considered a leading indicator of the construction materials sector, has already entered a serious contraction phase. In the first quarter of this year, domestic cement shipments decreased by more than 20% year-on-year, reaching their lowest level since 1998, immediately after the Asian financial crisis. Cement is the first material used in foundation and framework construction, so a decrease in housing starts leads directly to reduced cement demand. The shock then spreads sequentially to downstream industries such as ready-mixed concrete, windows, and paint.

Industry insiders are concerned that if the current construction market slump continues, the profitability of the entire construction materials industry could deteriorate for several years. The Korea Institute of Construction Industry recently reported that "construction orders, a leading indicator of the construction market, fell by 16.6% year-on-year last year, a steeper decline than during the global financial crisis in 2008," and diagnosed that "the recent downturn in the construction market is showing signs of an even faster contraction."

The industry agrees that, for now, the only solution is to diversify portfolios and improve operational efficiency. Each company is planning strategies such as developing high value-added products in new growth areas like the defense industry and secondary batteries, or increasing the proportion of industrial products such as industrial paints that are not affected by the construction market. An industry official said, "This is an industry dependent on the construction market, but there are currently no clear factors for a rebound," adding, "Enduring the current downturn will be the biggest challenge for companies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.