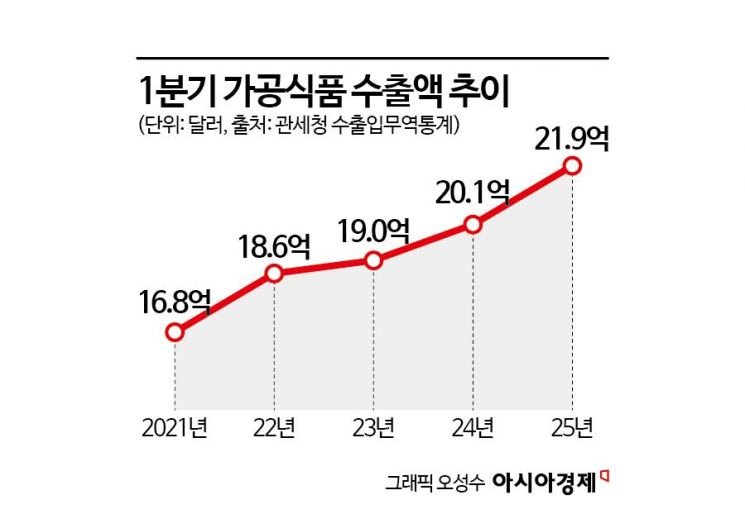

Processed Food Exports Reach $2.19 Billion in Q1, Up 8.8% Year-on-Year

K-Food Items Such as Ramen, Ginseng, and Gim Continue to Gain Global Popularity

Expectations for Economic Recovery Remain Limited

Amid growing uncertainty surrounding exports of Korean products due to the launch of a second Trump administration, exports of domestic processed foods reached a record high in the first quarter of this year, increasing by nearly 10% compared to the same period last year, driven by the global popularity of K-food items such as ramen.

According to export-import trade statistics from the Korea Customs Service on May 17, processed food exports amounted to $2.19 billion (approximately 3.05 trillion won) in the first quarter of this year, an 8.8% increase from $2.01 billion in the same period last year, marking the highest export performance ever recorded. Among major export items, cereal and cereal-based products accounted for the largest share at $620 million, followed by prepared foods ($430 million), tobacco and tobacco substitutes ($270 million), and beverages, alcohol, and vinegar ($260 million).

The item that recorded the highest export growth rate compared to last year was ramen products (25.4%). This was followed by processed ginseng products (23.8%), gim (8.3%), instant coffee products (6.6%), and processed rice products (2.5%). The continuous increase in ramen exports is attributed to the growing global preference for spicy flavors, which is driving steady growth in major overseas markets. For processed ginseng products, the expansion of fresh ginseng exports, as well as the diversification of product specifications and content?particularly in the Chinese and U.S. markets?are gradually expanding the export market.

The cumulative export value for "K-Food Plus," which includes agri-food and upstream and downstream agricultural industries, reached $3.18 billion (approximately 4.43 trillion won) in the first quarter, up 7.9% compared to the same period last year. Of this, agri-food (K-Food) accounted for $2.48 billion (approximately 3.45 trillion won), a 9.6% increase year-on-year. Exports from the agricultural industry sector (such as smart farms, agricultural machinery, and animal pharmaceuticals) also rose to $700 million, a 2.3% increase from the previous year.

By region, the United States, Japan, and China maintained their positions as the top three export destinations. The share of exports to the United States rose to 17.9%, up 2.2 percentage points from 15.7% last year, while the shares for Japan (13.5%) and China (12.9%) decreased by 1.2 and 1.1 percentage points, respectively, compared to the same period last year. The export concentration to these top three countries was 44.3%, a slight decrease from 44.5% in the same period last year, indicating a modest easing of export concentration.

While export values hit a record high, imports of processed foods in the first quarter stood at $4.12 billion (approximately 5.73 trillion won), a 1.3% decrease from $4.18 billion in the same period last year. Among major import items, prepared foods recorded the highest import value at $670 million (approximately 930 billion won), followed by edible oils ($570 million), prepared animal feeds ($540 million), and processed vegetables and fruits ($390 million).

In terms of year-on-year import growth, cocoa preparations showed the largest increase at 38.8%, followed by dairy products (31.9%) and edible oils (26.9%). On the other hand, imports of prepared animal feeds (-22.4%), tobacco and tobacco substitutes (-21.5%), and sugars (-11.7%) saw significant declines.

Additionally, the number of employees in the food manufacturing industry in the first quarter was 315,000, a 0.5% increase compared to the same period last year, marking the highest level in the past five years. Employment in the food manufacturing sector rose by 0.7% year-on-year to 295,700, while the beverage manufacturing sector saw a 1.9% decrease to 19,300 employees.

Meanwhile, according to the Food Industry Business Sentiment Index survey, the business outlook index for the second quarter of this year was recorded at 96.1, indicating that expectations for economic improvement remain low. The overall business conditions index for the first quarter was 86.3, the same as the previous quarter (86.2), remaining below the baseline (100). This suggests that many companies still perceive the business environment as deteriorating. Since the business outlook index for the second quarter is also 96.1, expectations for a recovery in the near future remain limited.

However, in a significant number of sectors?including non-alcoholic beverages, marine plants, fermented alcoholic beverages, and seasoning foods?there is an expectation of business recovery in the second quarter. In the first quarter, most sectors except for noodle-like products and marine plants reported a worsening business environment, which is attributed to external factors such as rising prices, interest rates, and exchange rates, as well as instability in the international situation. In contrast, for the second quarter, many sectors expect a recovery in business conditions due to factors such as improved raw material harvests, favorable climate and weather, new product launches, and business expansion through new market development, leading to increased transactions and consumption.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.