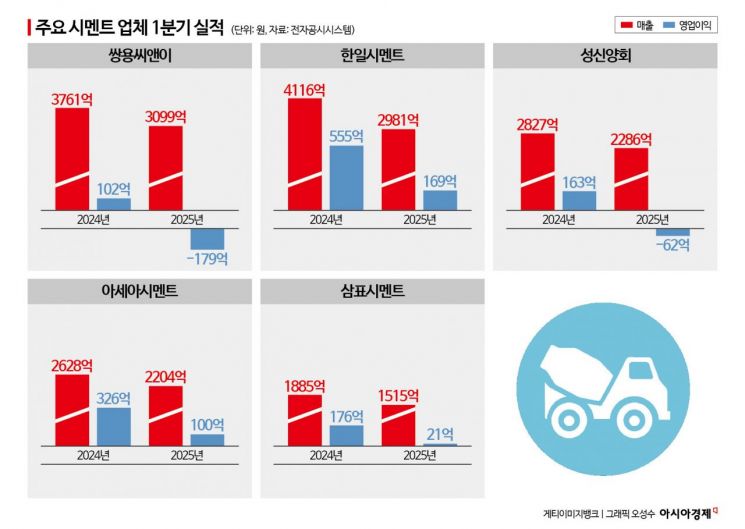

Combined Operating Profit of Five Companies Drops 96%

Ssangyong C&E and Sungshin Cement Turn to Losses

"No Clear Solution... Endurance Is the Only Option"

The cement industry has failed to overcome the prolonged slump in the construction sector and recorded its worst performance in the first quarter. Companies are making every effort to cut costs, such as suspending factory operations and improving equipment efficiency, but they have yet to find a clear breakthrough.

According to industry sources on May 16, the combined operating profit of the five major domestic cement companies (Ssangyong C&E, Hanil Cement, Sungshin Cement, Asia Cement, and Sampyo Cement) in the first quarter of this year totaled 4.9 billion KRW, down more than 96% from 132.2 billion KRW in the same period last year. Ssangyong C&E and Sungshin Cement turned to losses, while Sampyo Cement (-88.0%), Asia Cement (-72.3%), and Hanil Cement (-69.9%) also saw declines of over 70.0%.

As overall cement shipments decreased, sales also declined. The combined sales of these five companies in the first quarter of this year amounted to 1.2085 trillion KRW, down 20.6% from 1.5217 trillion KRW last year. An industry official explained, "We knew the industry was in trouble as demand fell off a cliff starting in the second half of last year, but honestly, some are saying they didn't expect it to be this bad. The fundamental cause is the slump in the construction sector, but the fact that there were many days of heavy rain and wind this year, and the weather was worse than usual, is also being analyzed as one of the reasons for the poor performance."

The domestic cement industry is experiencing an unprecedented recession due to a combination of adverse factors, including the construction downturn, rising labor costs, and environmental regulations. According to the Korea Cement Association, cement shipments?a key indicator of industry performance?are expected to fall short of 40 million tons this year. Since domestic cement shipments first surpassed 40 million tons in 1991, they have never dropped below that level in the past 35 years. If the association's forecast proves accurate, the industry will record an unprecedented performance this year, worse than even during the IMF financial crisis.

Within the industry, there is a prevailing view that it will be difficult to change the overall trend in the near future. For the construction sector, which is an upstream industry, to recover, structural issues such as private consumption and investment must be resolved. However, there are currently few factors that could trigger a turnaround. As a result, companies are focusing on cost reduction by suspending factory operations and reducing unnecessary inventory. Although it costs several hundred million KRW to restart cement production facilities, the domestic cement industry has decided to halt operations at 8 out of 35 production lines this year. This is truly a desperate measure.

An industry official said, "The reason cement companies are recently venturing into new businesses is because there is a shared sense of crisis that 'if things continue like this, everyone will go under.' At present, it is difficult to find any solution, and we believe that the only option is to endure this long tunnel in silence."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)